Back to: Trading with Smart Money

WRB (Wide Range Bar) Trading Strategy

In this article, I will discuss the WRB (Wide Range Bar) Trading Strategy in detail. Please read our previous article, in which we discussed the Trendline Trading Strategy. The WRB stands for Wide Range Bar. As part of this article, we will discuss the following pointers in detail.

- What is the WRB Trading Strategy?

- Criteria for finding a Wide Range Bar (WRB).

- What Does a Wide Range Bar Mean

- Uses of Wide Range Bar in Trading

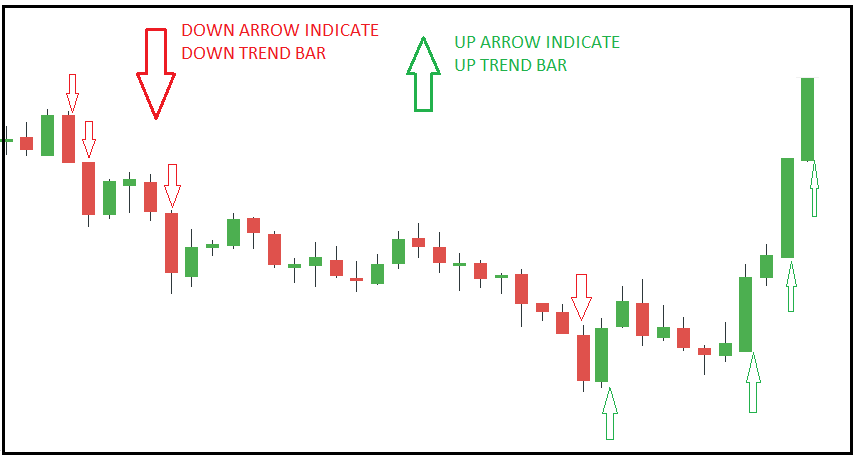

Note: Don’t confuse this with a Wide Range Bar or Trend Bar. Both are the same. In the following paragraph and image, I used both the Wide Range Bar and Trend Bar.

What is the WRB (Wide Range Bar) Trading Strategy?

A Wide Range Bar represents a trend within a smaller time frame. A bull Wide Range Bar opens near its low and closes near its high. A bear wide range bar opens near its high and closes near its low.

Criteria for WRB Trading

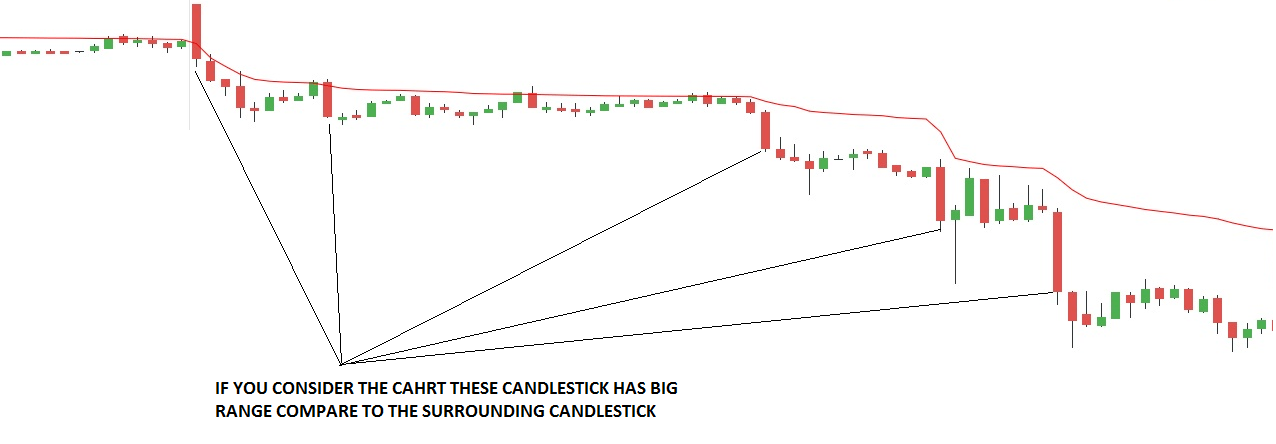

It’s basically a candlestick that has a longer body than the surrounding candlesticks.

What Does a Wide Range Bar (WRB) Trading Mean?

Remember that in every bar, the same number of contracts are sold and bought.

- The only reason for a bar to end up with a higher price is that the buyers were committed to one direction and more aggressive than the sellers. The reverse is true for a bear WRB.

- The importance of Wide Range candles is that they are one of the few places on a chart where supply and demand can be both identified and measured, i.e., Wide Range bars occur from the supply and demand zone. I mean, you can easily identify supply and demand zones by observing trend candle

Let me explain to you.

Did you know that a single candlestick (on its own) is, by its nature, an area of supply/demand (support/resistance)?

Let’s take the example of a bull Wide Range Candle: A bullish candle tells us there is a larger volume of buyers than sellers (nothing new here). But this information is based on something that had already happened. How does this help us make trading decisions in the future?

Answer

A bull candle tells us at what price there is a pool of sellers in the future (long exit). Does this make sense?

Let’s imagine you’ve just entered a BUY trade, and prices start moving up. Your trade is making money. Soon, however, you notice that prices are starting to move back down close to your trade entry point. What would you do? You’ll hang on to the trade. And wait for it to move back up again. But what happens next when prices continue to move down and down even closer to your entry point?

They will think of getting out of the trade at breakeven, or most traders will have already moved their stop loss to breakeven. If not, they will manually get out of their BUY trades as soon as the market moves towards the breakeven price.

So, all the traders who entered a BUY trade along this Wide-Range bull candle are now looking to SELL to close the trade. A wide range of bull candles thus represents the range of prices at which the previous buyers are now looking to sell to close their previous (buy) trade. Reverse for Wide Range Bar Candle.

How to Use WRB in Your Trading?

- BREAKOUT

- CLIMAX

- ChCo candle (change of character candle )

Breakout

A trend candlestick occurs as a breakout candle in a sideways market or as the beginning of a new trend. It represents strength. Here, I will explain the breakout trading strategy in depth.

CLIMAX PATTERN

Whenever it occurs at the end of an established trend, it is a sign of climax. It represents the end of the move, a possible trend change in the near future, or the trend becoming a trading range.

ChCo candle (CHANGE OF CHARACTER CANDLE)

Use of ChCo candle

- For identifying swing (The distance between the highest and lowest points is a swing)

- For placement of stop loss

Identifying swing using ChCo candle

Identify the last Wide Range Bar. Look for a reversal bar that closes below/above the last Wide Range Bar.

For placing stop-loss using CHCO Candle

This is a very rare situation where prices will reverse without forming a clear reversal pattern. Then, how do we know whether a counter-trend move will be a temporary retracement or reversal? Here’s the trick.

You’ll first have to identify what I call a wide range of candlesticks. When a candlestick closes past the opening price of the Wide Range Candle, a reversal is likely to happen. If not, it’s just a retracement.

Why?

When traders don’t consider profit-taking behavior, they’ll often be tricked into placing low winning-probability trades. Here’s what I mean:

If you noticed, the close price of the last bull candle did not go above the open price of the last Wide Range bear candle. This means it’s entirely possible for most of the buying activity to be coming from the sellers who are exiting their positions. We’ll need to see more buyer commitment before we can say that prices will likely reverse. Let’s see what happens next.

.Here’s an example:

The market increased with a strong Wide Range Candle and then dropped again. This looks like a reversal… but is it really? Let’s see what happened next:

If you look closely, prices did not close past the opening price of the Wide Range candlestick. So, it was a strong retracement. Here is another example.

You already have the idea of placing a stop loss below or above the wide-range candle to avoid unexpected reversal. Let me show you an example.

The WRB strategy is another tool in a trader’s arsenal, and, like all strategies, it’s not foolproof. Market conditions can change, and what works in one market environment may not work in another. Continuous learning and strategy refinement are key to long-term success in trading.

In the next article, I will discuss 5 Candlestick Patterns Every Trader Should Know. In this article, I try to explain the WRB (Wide Range Bar) Trading Strategy in detail. I hope you enjoy this WRB (Wide Range Bar) Trading Strategy article. Please join my Telegram Channel and YouTube Channel as well as my Facebook Group to learn more and clear your doubts.

Thank you sir for this useful information

Nice article. When drawing Support and resistance, I see sometimes people take middle of the WRB, is this recommended? OR do we need to consider the top and bottom of WRB as Support and resistance?

good information………thank you….

Never seen such an excellent training whether in paid course or free. Kudos to Teacher

excellent

great teacher thank you sir ji paid courses main bhi itni information nahi dete details main, may god bless you great effort

in which time frame we need to see , trend candle

for swing trading

and weekly trading or intraday