Back to: Trading with Smart Money

Momentum Trading Strategy

In this article, I will explain the Momentum Trading Strategy. Please read our previous article discussing Mastering Market Dynamics: Industry Rotation and Its Impact on Swing and Positional Trading Strategies.

Introduction to Industry Momentum Trading Strategy

Because institutions invest in themes, stocks move in groupings. Industry-wide moves last longer and deliver bigger returns than most expect. The leading industries are changing throughout the year. You are going to have a great year if you can figure out how to capture them. If you are able to figure out which industries are currently hot and focus your trading efforts on them, you will realize that trading can be a pleasurable and lucrative experience.

Money never sleeps. It always rotates somewhere. Every year, there’s a hot industry theme that dominates price action. It could last only a few weeks or multiple months and provide incredible opportunities for swing and position traders.

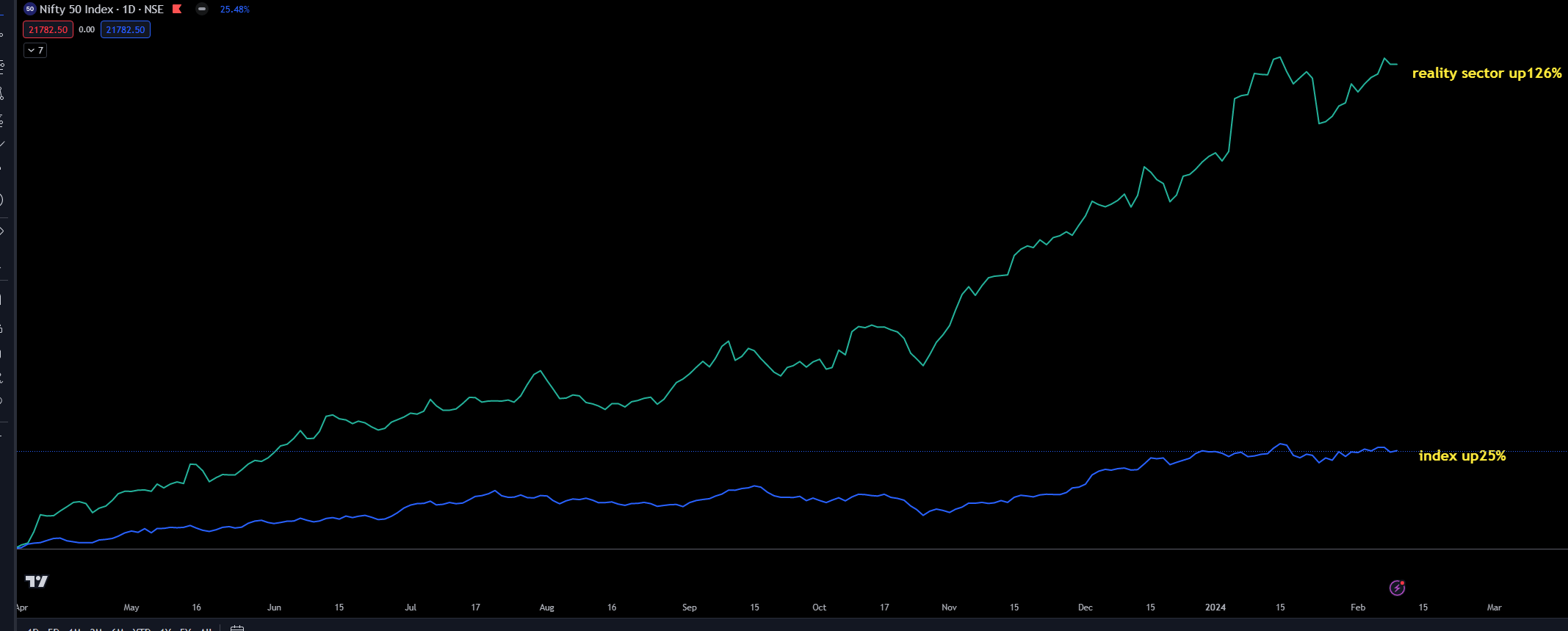

In the above image, we compare the reality sector with the index(nifty). As you can see, nifty is up 25%, while the reality sector up 126% from the anchor point.

How Industry Momentum Trading Strategy Works

Stocks move in groups because the players that move markets think and invest in themes. When a large hedge, pension, or mutual fund starts accumulating a position, they do so for days, weeks, and months. Their intention is not to buy today and sell tomorrow. They are buying with the goal to hold for multiple weeks and months.

If money is going to a specific industry, sooner rather than later, it is likely to lift all stocks (even weak stocks) inside that industry. By focusing on stocks that have not broken out yet from good technical bases, we may allocate money to that setup.

Strategies for Swing Setups and Industry Selection

When looking for swing setups, traders should prioritize recent technical setups and the identification of stocks from hot industry groups. Stocks within these groups tend to move more, and being in the right setup within the right group can significantly impact the outcome of a trade. The right technical setup in the right industry could mean the difference between a small move and a large move.

- This will increase your probability of success. It does not matter how perfect the technical setup you are trading. If you are not in the right industry, you may not get a good result.

- Technical setups define the risk-to-reward and the probability of a breakout (breakdown) happening. Still, they don’t tell you the probability of following- through after a breakout and the likely size of the move.

How to Identifying Industry Momentum for Trading

4% momentum stocks industry wise

How do we recognize the industry in momentum for swing trades?

- number of stocks from the same industry that are up >4% for the day and clearing new 20-day highs or giving breakout. If more numbers of stocks from the same industry are gaining momentum and experiencing short-term breakouts at the same time, money is most likely flowing into that industry.

- When a momentum trader sees an industry gaining momentum, his (her) instinct is to look for the next stocks in the same industry to break out. By focusing on stocks that have not broken out yet from good technical bases, we may allocate money to that setup.

Manually Sector/Index Timing

We select industry momentum setups the same way we trade breakouts and pullbacks in strong stocks. The only difference here is the way to find those setups. We check manually to find which industry/sector is in momentum

- leading sector and breaking resistance from proper base breakout

- or giving pullback to key moving average or key level

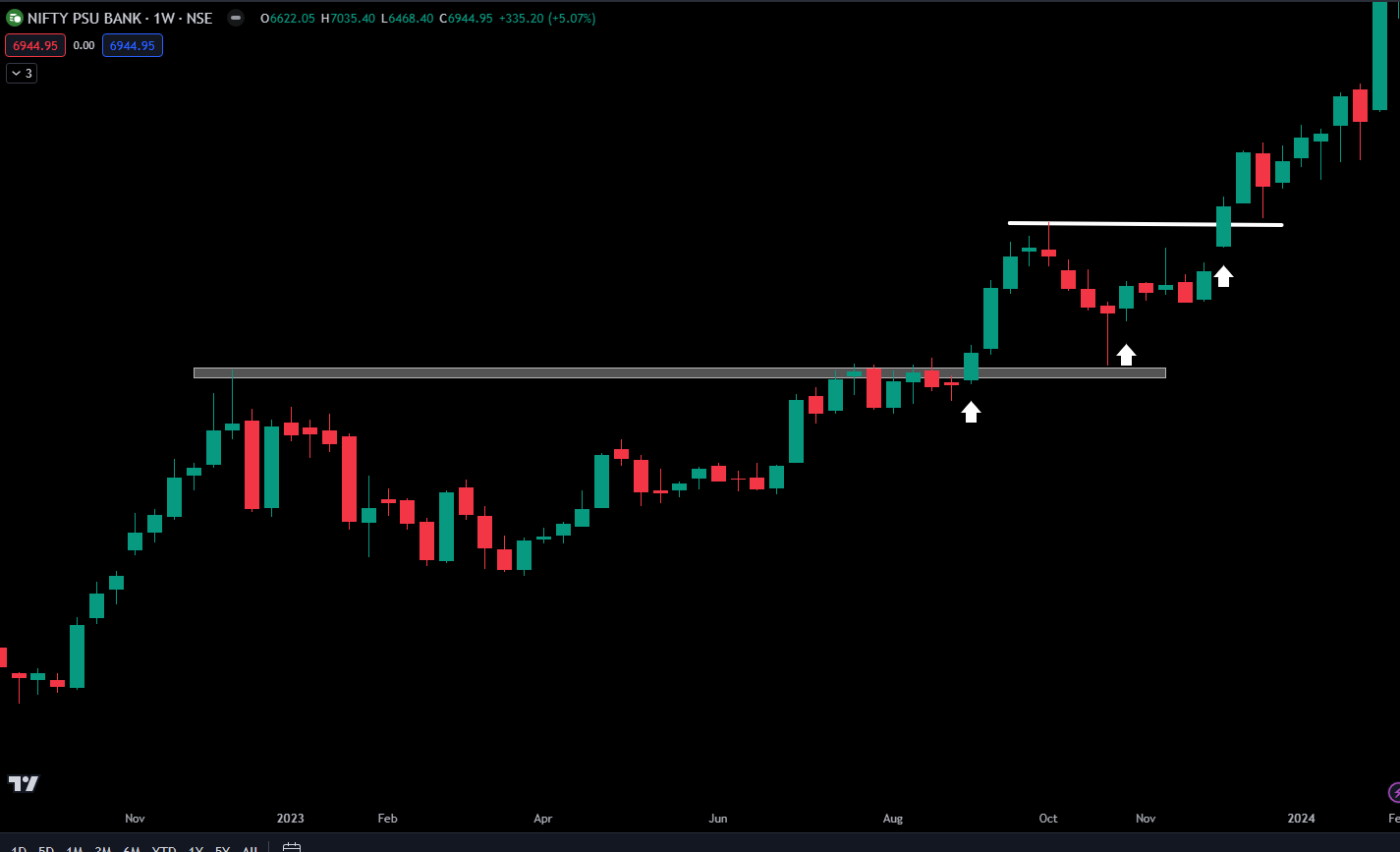

The above image is an example of the PSU bank sector and weekly time frame. The white arrow shows the possible entry location. First entry opportunity in breakout move, then 2nd opportunity pullback after breakout. Again, 3rd opportunity is a fresh new breakout. Below is the image of the reality sector price breaking a large range and making a new high, then giving superb returns.

How to trade industry momentum setup

We trade industry momentum setups the same way we trade breakouts and pullbacks in strong stocks. The only difference here is the way to find those setups. We use a top-down analysis. Below is the step-by-step process

- We first identify the industries in momentum

- then zoom in to find the leading stocks and great setups from that industry. Within the current industry in momentum, find stocks that are setting up for a potential breakout. You can buy them in anticipation of a breakout during strong markets or wait for the actual breakout.

- We can either buy

-

- find stocks that are setting up for a potential breakout

- or we can buy them in anticipation of a breakout .

- Or we can buy pullbacks to rising 10 and 20- day EMAs in stocks

Example 1: Pharma Sector

pharma sector has given a breakout from base a few days later, gls gave a base breakout

Example 2: PSU Bank

As you can see, stock moves similarly with the sector

In this article, I explain the Momentum Trading Strategy. I hope you enjoy this article on Momentum Trading Strategy. For more details, you can check the video.