Back to: Trading with Smart Money

PIN BAR Trading Strategy

In this article, I will discuss the PIN BAR Trading Strategy in Detail. Please read our previous article, which discusses the Intraday Open High Open Low Trading Strategy in detail. At the end of this article, you will understand the points related to bullish pin bar and bearish pin bar trading strategies in detail.

- What is a pin bar?

- Structure of pin bar

- The psychology behind pin bar

- How do we use the pin bar in our trading?

- One-day trading strategy based on the pin bar

Pin Bar Structure

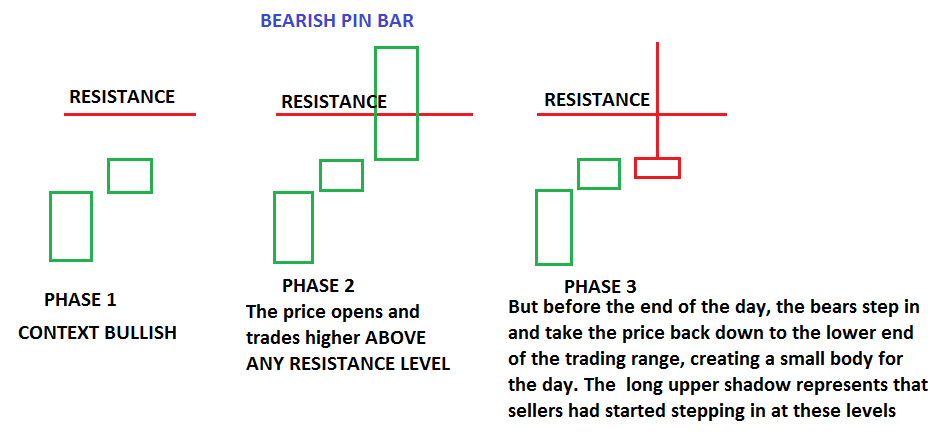

Let’s understand a bearish pin bar. How was it formed?

Phase 1: After a strong extended up-trend has been in effect, the atmosphere is bullish.

Phase 2: The price opens and trades higher. The bulls are in control.

Phase 3: But before the end of the day, the bears step in and take the price back down to the lower end of the trading range, creating a small body for the day. The long upper wick represents that sellers had started coming in at these levels. A lower open or a red candle the next day reinforces the fact that selling is going on and sellers have now taken control.

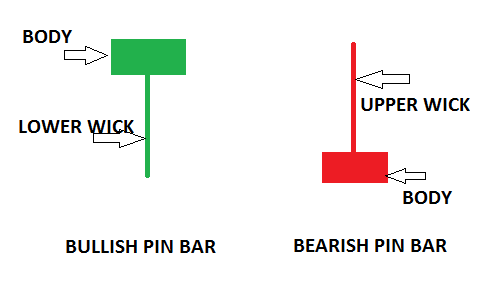

So, basically, the pin bar is a reversal pattern. There are two types of pin: (1) bearish pin bar, explained above, and (2) bullish pin bar.

Criteria to Identify Pin Bars

- First, it Requires old support or resistance in the background.

- The price rallies above resistance only to fall back below. It closes below resistance and on or near its lows. Reverse for support.

- The “wick” (or tail) should be at least 2 – 3 times the length of the body.

- The body should be completely contained within the previous day’s range. The body is either red or black.

- The body should be present towards either the upper or lower extreme of the Pin Bar.

- The wick should stand out when compared to surrounding bars. The wick of the Pin Bar should be larger than the previous day’s trading range.

- The following day needs to be confirmed.

- The volume can be either low ( no demand above the resistance ) or high (supply overcoming the demand above resistance ), reverse for support.

THE CONTINUOUS PIN BAR Trading Strategy

A pin bar does not always signal a reversal, so you’ll need to know how to tell when a pin bar has failed and how to react accordingly. The significance of the pin bar trading strategy depends on (1) the location, where it appears in the trend, and (2) the length of the wick. If the Pin Bar wick is more than 4 times larger than the average trading range of the preceding bars. Then, it will most likely become a (1)continuation pattern, or (2) the wick will be tested again for reversal.

When presented with a massive Pin Bar, my advice is to stay on the sidelines and wait for a better opportunity to present itself. You have to risk too much capital in hopes of being profitable. Let me explain this through an example.

PSYCHOLOGY OF PIN BAR Trading Strategy

Let me tell you very important information.

Smart Money only targets places with higher Volumes, and he collects them. Generally, the places (reference points) are

- Support and resistance

- The area on consolidation/accumulations on yesterday’s high/low, weekly high/low, etc.

- At the beginning of the day

- At the end of the day

- Daily High and low.

Why do they do it?

The main objectives are:

- To get volume

- Avoid Slippage due to big order

- Smart money testing demand above old resistance before moving down or testing supply below support before moving up

How did they do?

They move the price above or below any reference point, hitting the stop losses of either buyers or sellers while Encouraging traders to commit to positions in the wrong direction. Smart money induces traders to take the wrong direction by using sharp and aggressive moves near the high or low of the day.

Let me explain when the price reverses from resistance. As the early price is marked up,

- Premature short traders are liable to panic and cover with buy orders. (stop hunts)

- However, those traders looking for breakouts will buy, but their stop-loss orders are usually triggered as the price moves back down.

- All those traders who are not in the market may feel they are missing out and will feel pressured to start buying.

Let’s understand through an example.

What happens next? Does price move down words? After trapping breakout long trader

Pin bars act as support and resistance.

The low of the bullish acts as support, and the high of the bearish pin bar acts as resistance

Pin Bar and Market Context

To be able to trade pin bars effectively, you need to gauge the direction of the trend and trade with it. Here are some key principles for trading pin bar

Pin Bar Works Best in Trending Conditions.

Ideally, a Pin Bar should close in favor of the prevailing trend. For example, if the trend is up, then the Pin Bar should have a close higher than the open and should be a bullish Pin Bar. The opposite applies to a downtrend.

A retracement to a prior resistance support area is a typically excellent trade.

A retracement to a prior resistance support area is a typically excellent trade.

A choppy, range-bound market should not be traded.

Pin Bars are in heavy traffic or are choppy, so range-bound markets should not be traded. There is no clear trend, and there are too many areas of interest for the price to stall.

A pin bar should immediately follow through.

A pin bar should immediately follow through.

If a bullish pin bar fails to rally away from the danger point and the price hangs near the bullish pin bar low, then something is likely wrong.

Opening Pin Bar Trading Strategy

- Price gap up above previous day’s high(PDH)

- Opening candle close above PDH. (bullish pin bar)

- If the candle’s low touches PDH and leaves a wick below, then there is a very high probability of a trade.

- Entry above the high of the bullish pin bar candle

- Ensure that there is no resistance overhead like big support/resistance

- SL below PDH or below entry candle

NOTE:- REVERSE FOR BEARISH PIN BAR

Stop-Loss Placements

The simplest and most likely method that you will profit from is to place your stop a certain distance beyond the high/low of the Pin Bar.

What next

For better understanding, read the support and resistance article. As we explained above, the Pin bar best works from support and resistance level

The best way to learn about pin bars is to open up some charts and try to find some for yourself. Once you have found a selection of pin bars, try to figure out whether or not they are good or bad with respect to their form and the candles that precede them.

The Pin Bar strategy, like any trading strategy, does not guarantee success and should be used with a thorough understanding of market conditions, along with sound risk management practices. It’s often recommended to backtest any strategy and gain experience through a demo account before trading with real money.

In the next article, I will discuss Trading with Sideways Price Action Area in detail. Here, In this article, I try to explain the PIN BAR Trading Strategy in Detail, and I Hope you enjoy this PIN BAR Trading Strategy article. Please join my Telegram Channel, YouTube Channel, and Facebook Group to learn more and clear your doubts.

please write article about Fibonacci retracement and how to use, which time frame is best

Never seen such an excellent training whether in paid course or free. Kudos to Teacher for sharing

Plz make a pin bar video for us. Many many thanks to u sir. God bless u

Such an honest and clear explanation have never been shared…hats off to you sir..I have reading your articles and they have improved my trading psychology.it is only the greatest and pure minds really share knowledge…. someone like you sir.. thank you so much..god bless you and your family..

sevgier saygılar ALLAH Aemanet olun

VERY NICE EXPLANATION ..I REALY THANKS U. I AM WAITING FOR YOUR FURTHER ARTICLE..

Sir You are a G.O.A.T please make analysis for Index