Back to: Trading with Smart Money

How to Trade with Smart Money

In this article, I will discuss How to Trade with Smart Money with Examples. Please read our previous article, where we discussed Thrust Pullback and Measuring Move Analysis in detail. As part of this article, we will discuss the following three important pointers in detail.

- 3 Signs of Smart Money Activity

- How to Trade with Them?

- Odd Enhancer of Trading

How to trade with Smart Money?

We can spot three main signs of Smart Money activity with Price Action and volume and trade with them.

- Sideways Price Action Area

- Aggressive Initiation Activity

- Strong Rejection (of Higher or Lower Prices)

Sideways Price Action Area

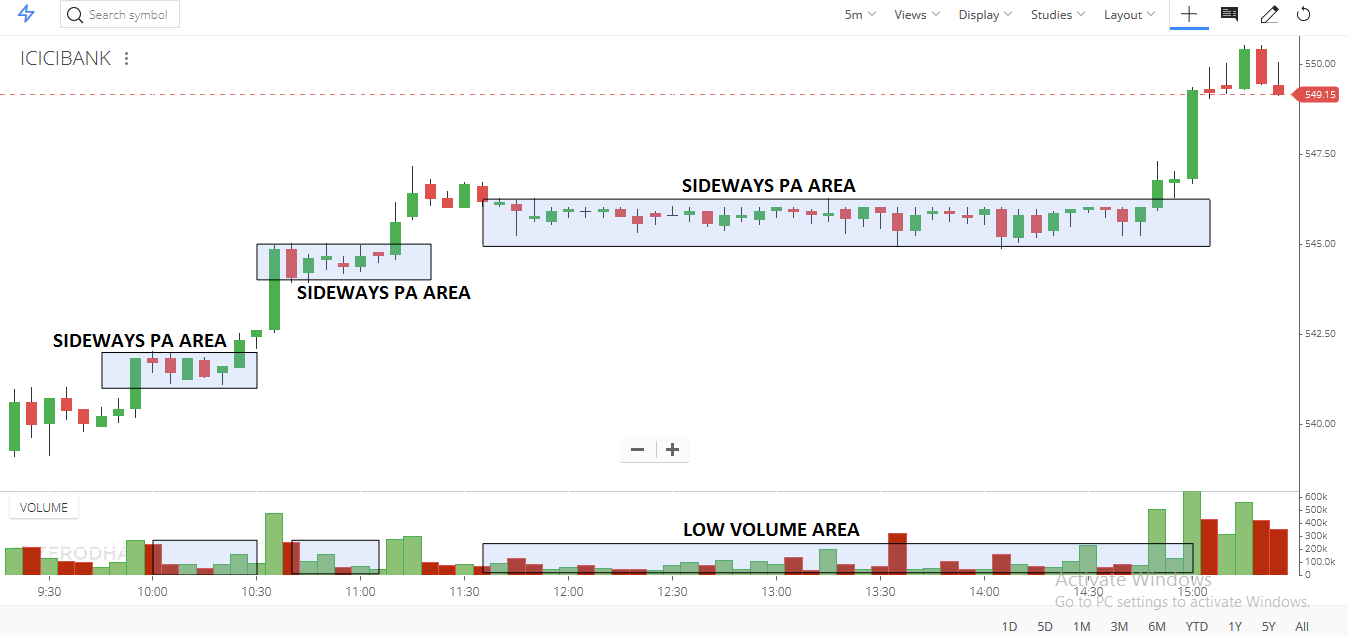

Look for sideways price action areas. These are very significant places because Smart Money is accumulating its positions there. Always watch for such areas, no matter which timeframe you use. These sideways price action areas should be low-volume to continue an existing trend.

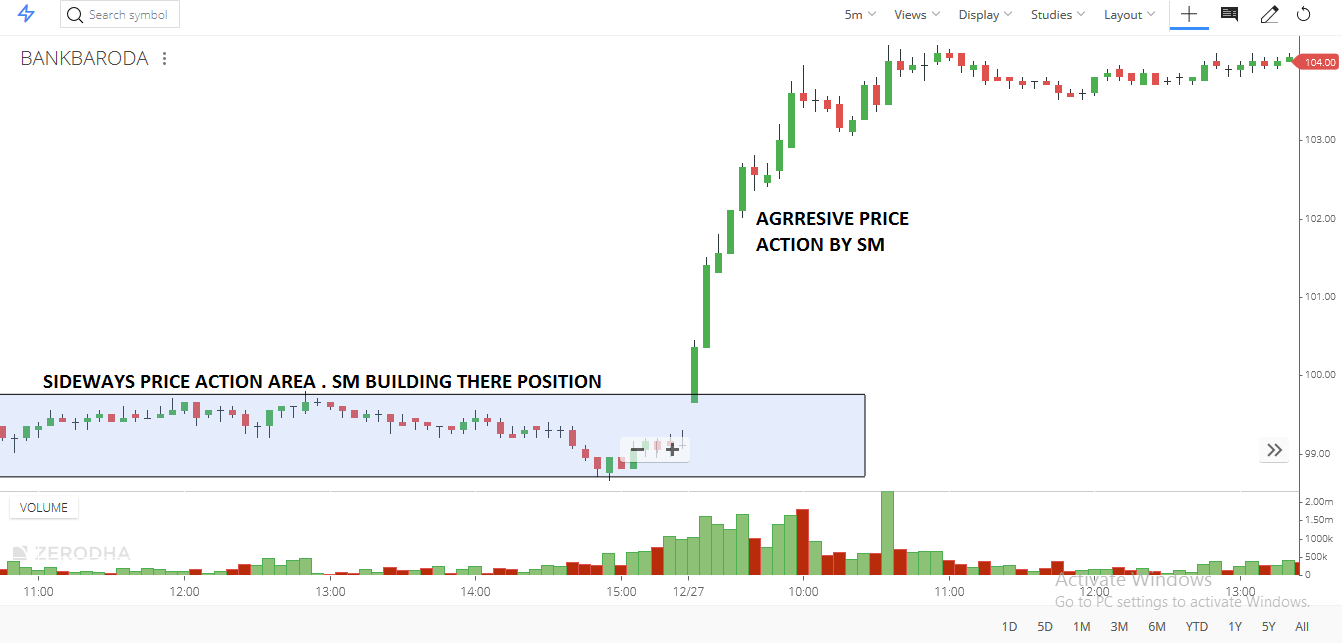

Aggressive Initiation Activity

Aggressive activity is basically a significant price movement. It is caused by aggressive buyers(SM) pushing the price higher or by aggressive sellers(SM) pushing the price lower. This sort of aggressive buying or selling often takes place after a sideways price action activity. What happens is that Smart Money builds up its positions (in sideways areas), and when they are done with that, it starts aggressive buying or selling to manipulate and move the price in any direction they want. This is how they make money. They build up their positions slowly and unnoticed, then start a trend to make those positions profitable.

When the price is moving quickly, there isn’t much time to place any more big positions. For this reason, Smart Money needs to accumulate its positions before the move. Below is an example of sideways price action areas followed by aggressive initiation activity:

Strong Rejection (of higher or lower prices)

Strong rejection means sudden price reversal from either higher or lower price levels. This pattern is made when the price goes one way aggressively and then turns quickly, with the same aggression and speed going the other way. An example would be a type of candle called the pin bar. But the pin bar isn’t the only visual form of strong rejection. There are many ways a strong rejection can look like. A common sign of all strong rejections is aggression and sudden reversal (2 bar reversal)

One side of the market (for example, buyers) is aggressive and moves the price in one way. Then, it clashes with the other side (for example, strong sellers), suddenly becoming stronger and more aggressive. So, the price turns quickly, and the stronger side takes over. The area where the other side took over is significant because it marks a place where strong market participants aggressively rejected the current course of action and started a strong countermove. This place is significant for us because it will most likely be defended again if the price gets near again. It becomes a new support/resistance zone.

Here are some examples of strong rejections:

Remember, places where the price suddenly turned and changed direction are significant. We should always watch out for them in our price action analysis

Odd enhancer for trading

- Trading with the trend

- Trading from supply and demand or support resistance level

- Trading with the dominant pressure

TASK

Open the chart, find these three Smart Money activities, and analyze the behavior. This strategy works on all time frames, from day traders to swing traders.

Trading with smart money is not a foolproof strategy and can be risky. It’s based on the assumption that institutional investors are always right, which is not the case. Furthermore, it might be too late to profit when retail traders identify smart money moves. Therefore, it’s essential to conduct a thorough analysis and not rely solely on the perceived actions of smart money.

In the next article, I will discuss How to Trade with the Supply and Demand Zone in detail. In this article, I will try to explain how to trade with smart money using some examples. I hope you enjoy this article on how to trade with smart money. Please join my Telegram Channel, YouTube Channel, and Facebook Group to learn more and clear your doubts.

Excellent work done by you god bless you and your family

Never seen such excellent training whether paid course or free. Kudos to Teacher

sayğılar ve sevgilerimle muhtesem siniz

Good explanation

Thank you very much for sharing such in-depth knowledge! This is worth gold!