Back to: Trading with Smart Money

Intraday Breakout Trading Strategy

In this article, I will discuss the Intraday Breakout Trading Strategy in detail. Please read our previous article, in which we discussed the Pullback Trading Strategy in detail. As part of this article, the following pointers will be discussed in detail.

- What is the Intraday Breakout Trading Strategy?

- Merit and demerit of breakout trading

- When should void breakout trade?

- How to find high-probability breakout trading?

- Price action for the breakout bar

- How to enter a breakout?

What is an Intraday Breakout Trading Strategy?

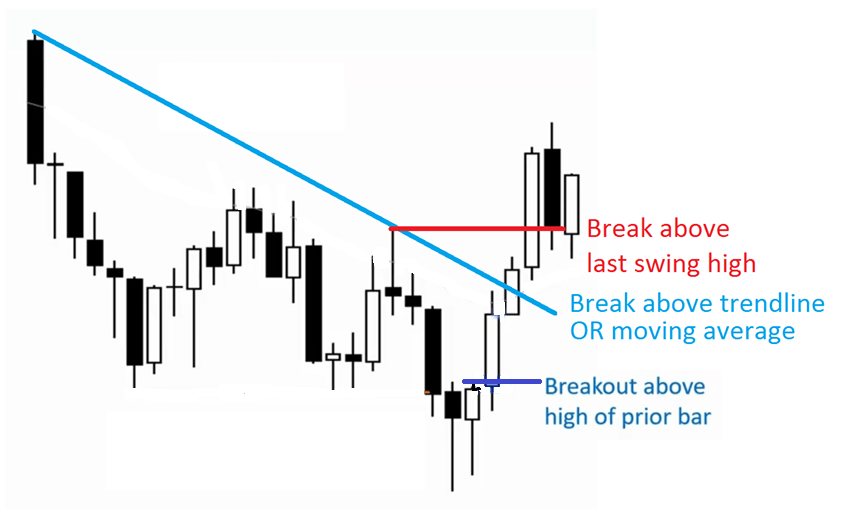

Break out means moving below any support or above any resistance. Price breakout from

- First support and resistance is a break of the previous candle high or low

- Last swing high or low (shorter-term support and resistance)

- Major support and resistance

- Trend line or moving average

Benefits of Intraday Breakout Trading Strategy:

There are several benefits to trading breakouts. For example

- Momentum is with you – Trading breakouts allow you to enter your trade with momentum at your back

- Catch big trends – If you were to trade pullbacks, sometimes it may never come. But with breakouts, you never have to worry about missing another move in the markets

The demerit of Breakout Trading Strategy:

False breakout or trap

When should we avoid trading breakouts?

- Don’t trade breakouts when the market is far from Support/Resistance (S/R). Are there obstacles overhead or underfoot that could possibly obstruct an advance or decline?

- Don’t trade breakouts without a TIGHT TRADING RANGE (consolidation) before the breakout.

- Don’t trade breakout when the break is set against the dominant pressure

Don’t trade breakouts when the market is far from Support or Resistance (S/R). Why?

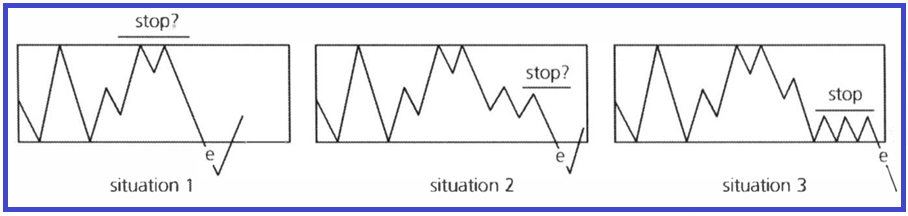

Because you don’t have a logical level to place your stop loss, even if you do, it usually results in a poor risk-to-reward profile. Based on the stop loss placement, we can divide the breakout into three types.

False Breaks, Tease Breaks, and Proper Breaks

Whether to take a position or not on a break is always a function of how well the chart’s technical credentials back up the prospects for follow-through.

The difference in consolidation before a breakout affects not only the likelihood of follow-through but the level of protection as well. An excellent way to play a break is shown in Situation 3. Now, we can truly see the virtues of proper consolidation. The breakout may still fail soon after, but technically, this is the more favorable scenario.

Don’t Trade Breakouts Without Consolidation

Why is this so?

Traders in profit will exit their positions at the nearest swing high (to protect their profits). Traders looking too short will do so at the swing high. So here’s what happens…

You get a double dose of selling pressure from traders exiting their long trades (by selling) and traders looking to short the markets. With so much selling pressure in the same area, chances are the breakout would fail if it happened without consolidation.

DON’T TRADE AGAINST THE Higher Time Frame Support and Resistance

How to find high-probability breakout trades

How to find high-probability breakout trades

Based on my experience, these are the best times to trade breakout:

- When the market is trending strongly

- When there’s no Support/Resistance nearby

- When the market is forming consolidation in the Support and Resistance area

- When there are higher lows in Resistance or lower highs in Support

Let me explain to you the above four points in detail

1. When the market is trending strongly

If the market is trending strongly, you’re unlikely to catch the trend on a pullback. So, what can you do? Well… you can trade the breakout, right?

You can get long when the price trades above the swing high and place your stops below the last swing low

2. When there’s no Support/Resistance nearby

Think about this. If you’re short of the market, where would buyers come in? If you’re long the market, where would sellers come in? Support and Resistance, right?

3. When the market is forming consolidation at the Support and Resistance area

Why do you want to trade breakouts with consolidation?

Here’s why: A consolidation would attract stops in the market as traders place their stop-loss beyond the highs/lows of the consolidation. It could be to protect their existing positions or to trade the breakout in either direction. So, when the market breaks out of consolidation, you get a double dose of pressure. And it’s caused by traders looking to protect their positions and traders looking to trade the breakout. An example:

CONSOLIDATION

4. When there are higher lows in Resistance or lower highs in Support

Higher lows into Resistance are a sign of strength by the buyers, and there’s a good chance the market will break out higher. Why? Because if there were strong selling pressure at resistance, the price should have fallen quickly. The fact is that it didn’t tell you that buyers are willing to buy at higher prices, thus forming higher lows into Resistance. Visually, it looks like an ascending triangle. Here’s an example:

And when you get lower highs into Support, it’s a sign of strength by the sellers. If there had been strong buying pressure at Support, the price would have risen quickly. The fact is that it didn’t tell you that sellers are willing to sell at lower prices, thus forming lower highs. Visually, it looks like a descending triangle. An example:

Breakout bars for upside

- The bar that breaks the structure (resistance line)

- Volume should dramatically increase

- If the follow-through bar is large, the odds of the trend continuing are greater

- The first pullback occurs after 3 or more bars of a breakout with low volume and lower tail

Breakout and breakout bar

The bar has a full-trend body and small or no tails. The larger the body, the more likely the breakout will succeed. A wide-spread up bar closing on the highs pushing up and through an old top to the left is an effort to go up as it is showing demand. After this event, the market usually rests or starts to react. You are now looking for indications of strength to confirm the strength.

Breakout and Volume

If you observe a wide spread up, on high volume, punching through the top of a resistance (supply line), and the next day is level or even higher, then you would now be expecting higher prices. Any low volume down-day (potential test) will confirm this view.

BREAK OUT BAR NEEDS FOLLOWTHROUGH

Traders would like to see confirmation after the breakout. One more trend bar after the breakout bar. A bull break followed by a bull break is a sign of follow-through and, thus, an indication of bullish enthusiasm for as long as it lasts. Should we see the market respond to a bull break with a bearish bar, which then gets broken at the bottom by another that gives us valuable information: technically, we are dealing with a false break. It shows false as the bull break failed to follow through and was followed by a bear break-in turn.

BREAKOUT AND PULLBACK

Any low-volume pullback shows a successful breakout

How do I enter breakout trades?

Well, there are usually 3 ways you can trade a breakout.

You wait for a candle to close:

- It’s easier to execute the trade psychologically as the candle has closed in your favor

- You may get a poorer risk-to-reward (as the market has already moved in your favor)

You trade breakout using a stop order:

- It’s harder to execute the trade psychologically because there are no signs of “confirmation.”

- You usually get a better risk-to-reward (as you’re entering near the breakout level)

You trade test of the breakout.

After the breakout, any low-volume test is a high-probability entry with low risk and high reward.

In the next article, I will discuss the Wide Range Bar (WRB) Trading Strategy in detail. In this article, I try to explain the Intraday Breakout Trading Strategy in detail. I hope you enjoy this article. Please join my Telegram Channel, YouTube Channel, and Facebook Group to learn more and clear your doubts.

Registration Open – Microservices with ASP.NET Core Web API

Session Time: 6:30 AM – 8:00 AM IST

Advance your career with our expert-led, hands-on live training program. Get complete course details, the syllabus, registration, and Zoom credentials for demo sessions via the links below.

Thank u sir

Wonderful may God bless u

really helpful. thank u

Never seen such an excellent training whether in paid course or free. Kudos to Teacher

You are a great trader having a good heart to us. Teaching most valuable topics in simple way for free. May God always bless you !!

Can you pls tell which software to use for drawing support and resistance? Also what time frame to use.. Like 5 minutes or 10 minutes etc?

Thanks

Ravi

sir aap great ho

Awesome explanation sir.

This is very easy to understand and thank you for helping god bless you 🙏🙏🙏

THANK YOU S0 MUCH

This is very helpful and so easy to understand. thank you for the provider

GOOD VIEW. THANKS