Trading with Smart Money(SM) Tutorials

In this Trading with Smart Money tutorial series, we will cover all the features of Trading and Smart Money. As we progress in this tutorial series, you will learn from the basic to advanced-level features of trading and smart money. You can also access our Premium Videos for Free from our YouTube channel: https://www.youtube.com/c/LearnToTradeLTT.

Trading with Smart Money

Trading with “Smart Money” is a concept often discussed in financial markets. Smart Money refers to institutional investors, professional traders, and other well-informed market participants who are believed to have a deep understanding of the market and the ability to make informed trading decisions. These entities typically have access to significant resources, research, and information that individual retail traders often lack.

How Does the Market Work?

All financial markets operate according to the universal law of Supply and Demand.

- Law of Demand– The higher the price of an item, the less the demand (buyers don’t want to buy at a higher price), and the lower the price, the higher the demand (buyers want to buy at a low price).

- Law of Supply– The higher the price of an item, the higher the supply (sellers want to sell at a higher price), and the lower the price, the lower the supply (sellers don’t want to supply at a lower price.

So prices go up to find sellers and then go down to find buyers

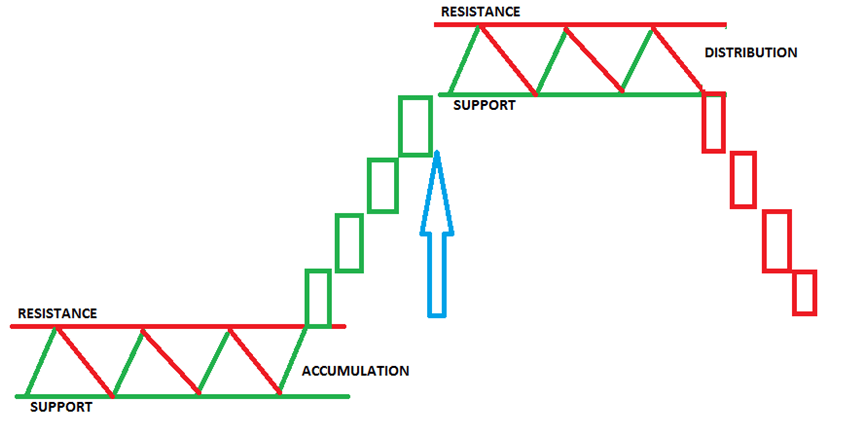

Let’s think from a big player/smart money(SM) perspective. Smart Money (SM) removes the floating supply of stock by buying. This process is called accumulation. Now, they have the power to move the stock up or down.

Smart Money can mark the stock’s price when general market conditions appear favorable. At some point in the future, a time will come when the SM will capitalize on the higher prices achieved during the rally to generate profits by reselling the stock to uninformed traders and investors. This is now referred to as the distribution phase.

Why Does the Price Move?

What truly moves the price is AGGRESSION. If the price increases, buyers become more aggressive. If it goes down, then sellers are more aggressive.

If you are aggressive, you want to buy or sell NOW. If you want something now and want to be 100% sure you will get it, you must use a market order. This type of order ensures that your order will be filled regardless of the price. In other words, you place a MARKET ORDER to buy or sell immediately at the best available current price.

The aggressive market participants drive the price up or down with their market orders. This is the actual reason why the price moves. After accumulation or distribution, the smart money AGGRESSIVELY moves the price higher or lower.

Who are they?

- They move the market, and they have the power.

- They can influence values and direction.

- They can bet against the trend or bet on the top or bottom.

- They usually move the price at a very low volume.

How to Spot Smart Money (SM)?

Through analyzing

- The Spread (i.e., the range of the price bar)

- The Close (i.e., the point where the price closes on the current bar)

- The Volume (i.e., activity),

How to Trade With Smart Money?

So, TRADING WITH Smart Money IS ABOUT TO GO WITH Smart Money. IF THEY BUY, WE WILL BUY. We will discuss all topics in greater detail in a step-by-step process.

About Me:

I am Pranaya Rout, a day trader trading stocks and futures since 2015. I am a student of the stock market, continually learning and updating my skills. I have decided to help aspiring traders by sharing what I have learned, reducing their learning curve. Please join my Telegram Channel, YouTube Channel, and Facebook Group to learn more and clear your doubts.

Disclaimer:

Trading involves the risk of financial loss. The information provided here is for educational purposes only.

Note: If we’ve missed any topics or if you’d like to learn about a specific topic, please let us know by commenting in the comment box. We will create a video and publish an article on it as soon as possible.

Swing and Positional Stock Trading Course

This section does not have any lessons.

Any chance to ask doubts on telegram sir beside channel u have

If you become a Premium Member, then you can ask your doubt in our private telegram group.

How can I download all the content for taking print copy

how can we become the Premium Member of you channel

Please provide email ID sir

I have one doubt

learntotrade@dotnettutorials.net

Good work.

Wish you can develop & share Trading strategy Python programs on Zerodha Kite api, helpful to retail traders for algo based day trading

macd of E 9 12 26

one more E 85 10 70

what about your opinion about macd indicator

Hi sir please design a strategy which u rely most and give training with small amount so that we can learn from u as u have great knowledge.

Sir ,

Your are grt, i learned a lot by your videos

Thank you very much , Keep guiding us

Could you do a topic of wyckoff methodology in-depth with VSA?

Hello

I have gone through most of the course, but I didn’t finish, starting again today from scratch since it has been a while. My only wish is that you get to translate or narrate the videos in English, Videos give much more clarity as it is a practical activity being done, besides besides, I love your work sir, its wort alot yet its free from you, thank you for presenting us with an opportunity to learn

Which are paid courses?

Everything is free. But you can take other advantages if you become a premium member.

Pls link Provaiding

My name Satish

City pune

Sir i already have account on fyers.. zerodha upstox and angel ..aliceblue….then how can I join ur premium group pls guide me

No one can define your great work sir just what I can say is deadly cool and hats of to you

Sir apka much online course ya program hai kya online classes waisa much mai app me course me join jobs charum

Sir ,your work is absolutely great. I have learnt a great deal from you. Thank you so much Sir. Pl provide us a strategy step by step, related with Vsa and Vpa,for day trading only.

Sir if you provide any online course I am keen to join.You are next to God for me.Thank You so much Sir. I am from Kolkata and my mobile no is 9325504212.Sir how can I talk to you,pl provide any contact number if possible.

With warm regards

Sir if you provide any online course I am keen to join.You are next to God for me.Thank You so much Sir. I am from Kolkata .Sir how can I talk to you,pl provide any contact number if possible.

With warm regards

what are other benefits for Premium Members?

Sir

I have opened account with Angel base on your link given in your website. Also I want to know how to add to your premium group

Greetings…

Ur teaching and videos are excellent

Thanks

Thank you so much for the great tutorial. I tried to watch your YouTube videos and although the text is in English, it seems that the language may be perhaps one from India which I am unable to understand. English is my only language. Is there a way to listen to the video audio in the English language? Thanks!

Sir, already i am having Zerodha Account , then how i can be your member ,

I thoroughly enjoyed reading your insightful blog post. Your perspectives and ideas were incredibly helpful.

I found great pleasure in reading your thoughtful blog article. The views and concepts you expressed were tremendously useful.