Back to: Trading with Smart Money

Volume Analysis in Trading

In this article, I will discuss 3 Rules for Stock Volume Analysis in Trading. Please read our previous article, in which we discussed the Opening Range Breakout Trading Strategy in detail. At the end of this article, you will understand the following pointers related to Volume Analysis in Trading.

- What is Volume in Trading?

- What is Stock Volume Analysis in Trading?

- Understanding Volume Analysis in Trading.

- 3 Fundamental Rules of Volume Analysis.

What Does Volume Mean in Trading?

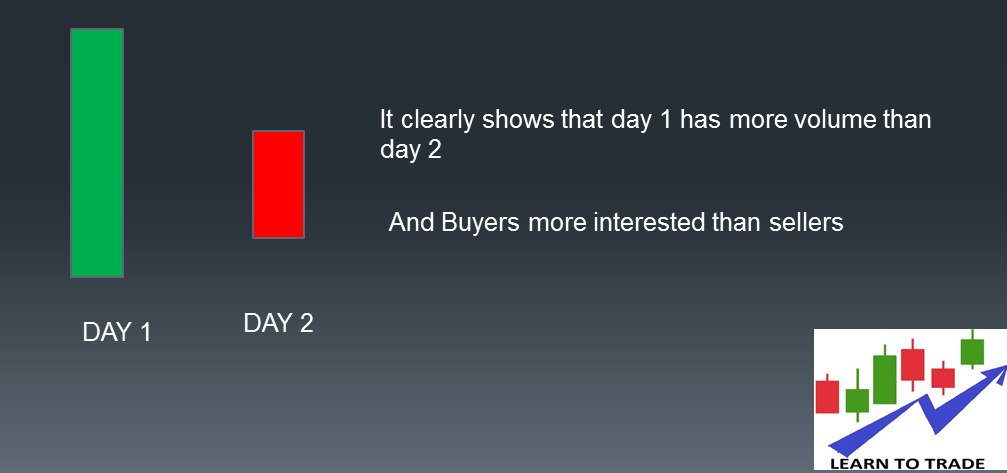

Volume, or trading volume, is the amount (total number) of shares or contracts traded during a given period. Generally, the volume shows the interest of buyers and sellers. In the above example, volume clearly shows buyers are more interested than sellers. Let me explain to you

3 rules for Volume Analysis in Trading

These are the 3 rules that, based on our volume analysis

- THE LAW OF SUPPLY AND DEMAND

- THE LAW OF CAUSE AND EFFECT

- THE LAW OF EFFORT VS RESULT

These rules are popularly known as WYCKOFF BASIC LAW. Now let’s understand the 3 fundamental rules of RD Wyckoff.

THE LAW OF SUPPLY AND DEMAND

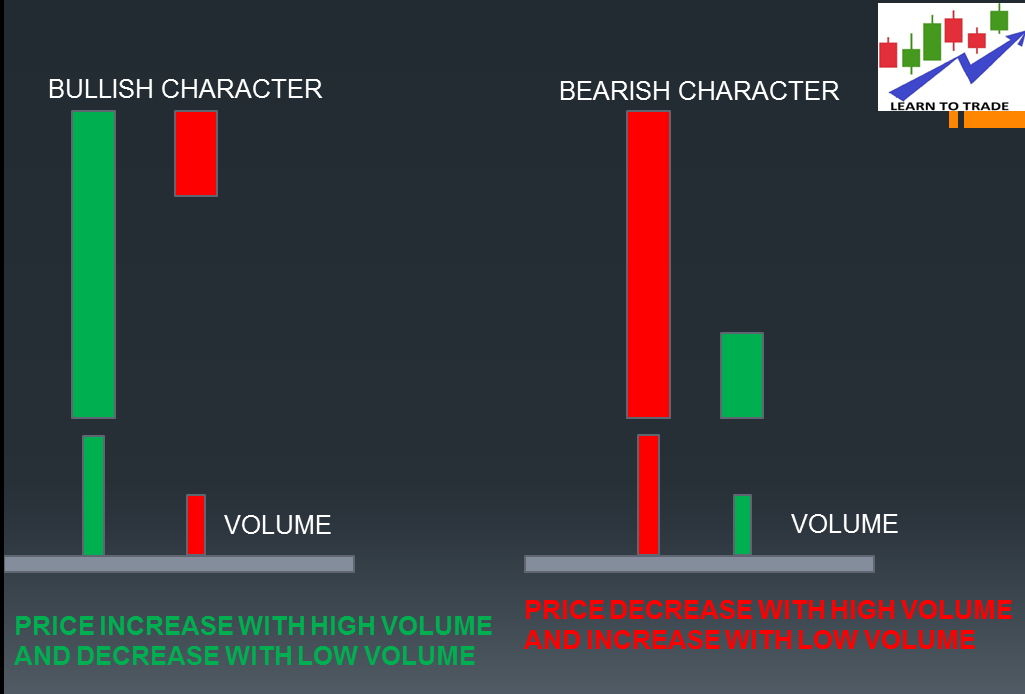

When demand is greater than supply, the price will rise to meet this demand, and conversely, when supply is greater than demand, the price will fall. 4 fundamental principles of supply and demand

- Price = direction of the trend

- Volume =strength of the trend

- Price and volume confirm the market direction

- Divergence leads to market weakness

THE LAW OF CAUSE AND EFFECT

The law of cause and effect basically tells us that we cannot get something from anything. When the market enters a period where demand exceeds supply or excess of supply over demand, it is not just a freak occurrence. Each of these comes out of a period of preparation, and the extent of that preparation has a direct and inseparable effect on the final result. If there is no preparation, there will be no move.

THE LAW OF CAUSE AND EFFECT: The effect will be directly proportional to the cause; in other words, a small amount of volume action will only result in a small amount of price action. If the cause is large, the effect will be large, and vice versa.

Different types of causes that occur are

- Trading range(accumulation/distribution)

- Chart pattern

THE LAW OF EFFORT VS RESULT

The market, or a stock, continually attempts to go one way or the other. These attempts may be very short in duration or quite lengthy. Either way, they represent an effort generally expressed in terms of volume. An important price movement is likely when the price responds to the effort. When the effort and result are contrary(divergence) in nature, there is likely to be an important change in the direction of the price.

THE LAW OF EFFORT VS RESULT: Similar to Newton’s third law. Every action must have an equal and opposite reaction; in other words, the price action on the chart must reflect the volume action below. Effort (volume) is seen as the result (price), where validated and divergence come to consider

How to trade with price and volume

- As discussed in multiple time frame analyses. define the nearest supply and demand zone

- Let the price come to the zone and analyze the candle associated with volume at the zone.

- See either reversal or continuous volume and price action

In the next article, I will discuss Volume Price Action Analysis in detail. In this article, I explain the 3 Rules for Volume Analysis in Intraday Trading in detail. I hope you enjoy this Volume Analysis in the Trading article. Please join my Telegram Channel, YouTube Channel, and Facebook Group to learn more and clear your doubts.

Have some doubts how to contact you pls

Sir does colour of volume affect the price action ..Cause effect… demand supply behaviour plz answer