Back to: Trading with Smart Money

2 Pullback Trading Strategies You Must Know

In this article, I am going to discuss 2 Pullback Trading Strategies You Must Know as a Trader. Please read our previous article where we discussed Pullback or Reversal in Trading: How to Spot the Difference?

What are Pullbacks and the Psychology Behind Pullbacks?

A pullback is a temporary reversal of the current dominating trend in the price, followed by a return to the primary current market direction. For example, an uptrend-down move takes into account the short uptrend pullback. In existing trends, pullbacks are sometimes referred to as price corrections or retracements. Pullbacks can offer traders better opportunities to enter positions at more advantageous levels because they are frequently viewed as healthy corrections within an overall trend. Understanding the various types of pullbacks in a trend is essential for success when using the pullback trading strategy.

In any financial market, the price never moves in a straight line; instead, it is frequently described in terms of bullish (rising) and bearish (falling) waves. For example, the price falls during an uptrend pullback (against the dominating up waves, CALLED impulse waves), then rises once again in the direction of the main trend. The corrective waves are what traders look for when trading pullbacks in order to time trade entries during these corrective waves.

As you know price move is a zig-zag form

- Movements with the trend are called “impulses/extensions”.

- Movements against the trend are called “correction/retracement/pullback”.

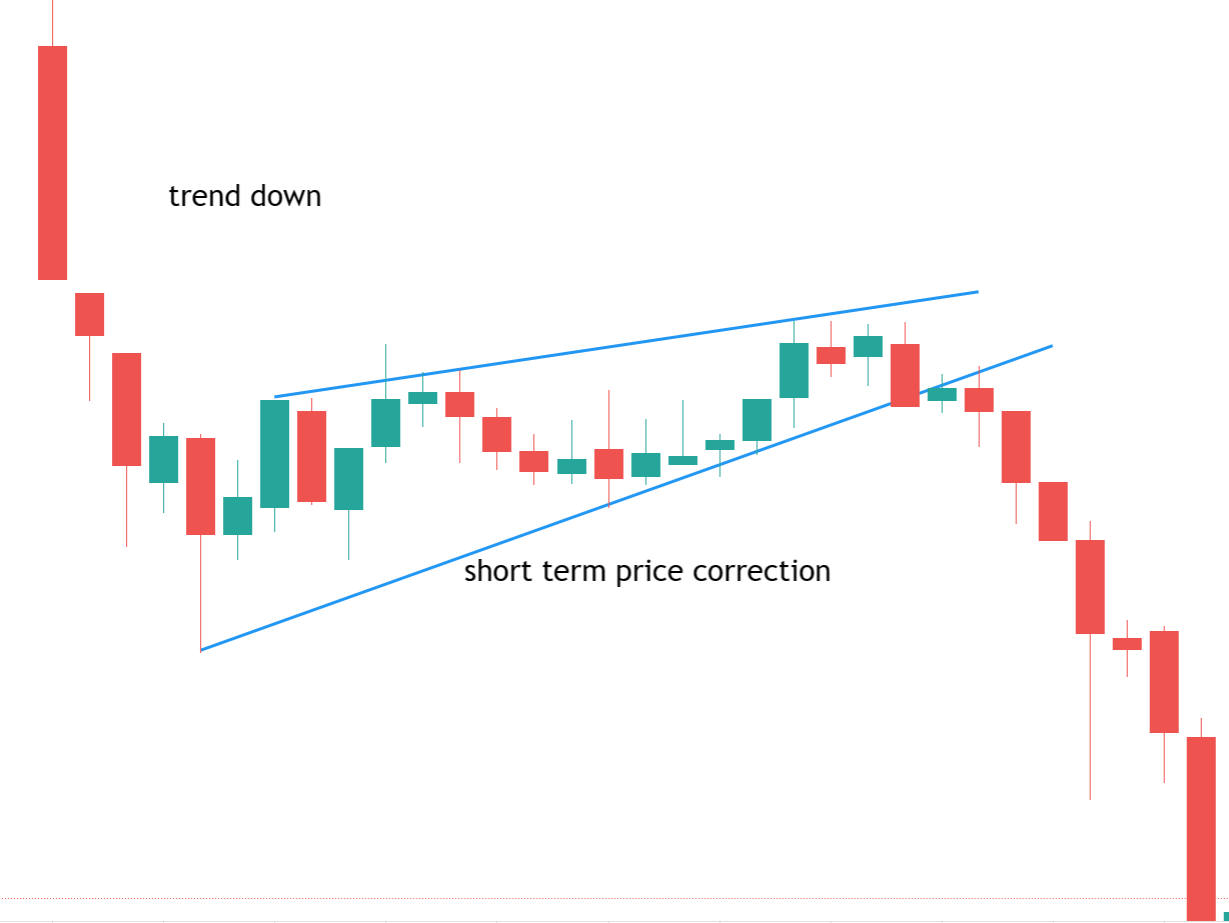

Take a look at an example of a retracement on the nifty daily chart below:

With price trading in a bearish trend, you can see each pullback was a short-term price movement that moves against the current dominant trend, and later it resumes back into the main dominant market direction. Each pullback on the chart was a temporary move and didn’t signal a change in the overall trend from bearish to bullish.

Different Types of Pullbacks in Trend

Can divide all pullbacks into two categories

- Time Correction

- Price Correction

Time Correction:

A time correction, often referred to as a horizontal or sideways correction, is a period in which price movement is relatively stable or consolidates within a trading range. A time correction is characterized by a lack of major directional movement in the market and price reversals within a narrow band. Before continuing the trend, this consolidation phase allows the market to digest the previous price advance or decline before resuming the trend.

Characteristics

- Prior to the pattern creation, the stock must be in a stage 2 uptrend or stage 4 downtrend and have reached an overbought or oversold region.

- There must be a period of price consolidation

- Volume needs to drop off as the pattern moves from left to right.

- Breakout with lots of traffic

Why High Volume in Breakout Candles?

- Breakout buyers are jumping on the breakout days themselves.

- At the same time, shorts have to cover their trade if a valid breakout

- These 2 bullish forces create a huge breakout volume

Three points should be mentioned about the volume

- Volume should diminish as the price swings narrow within the consolidation

- An increase in volume is essential to the resumption of an uptrend in all consolidation patterns.

- Breakout with high volume

Different types of time correction patterns are

- Tight base

- Rectangle or Sideways Range

- Triangle Patterns

Tight base

Characteristics Of Weak Pullback

- The stock must be in a stage 2 uptrend or stage 4 downtrend and reach an overbought or oversold region before the pattern formation. Impulse moves with volume and candle size increasing

- A period of price consolidation takes place between the anchor candle (in an uptrend between a bullish candle high and low) Doesn’t close follow-through beyond the anchor candle

- Volume and volatility must decline as the pattern progress from left to right. A great mix of red and green candles with light volume. It usually comprises a mixture of doji and small-bodied bars.

- more the candle better the base minimum 3 candle

- Breakout with high volume

- Buy breakout

- Stop loss recent swing high or low

Look for Evidence of Smart Money Demand through the Pattern.

- Lack of downward follow‐through after a threatening price bar (breakout failure at resistance). The failure to respond to threatening price action at highs (UPTHRUST) and Springs at lows are the best indications of ACCUMULATION.

- Breakout with high volume

BELOW IS MORE example of Nifty 17 May 2023

Price in the downtrend. price consolidation takes place between anchor candle high and low Breakout with high volume

Below is an example of a bullish trend

Price is an up trend. price consolidation takes place between anchor candle high and low Breakout with high volume

Rectangle or Sideways Range

This type of time correction occurs when prices move within a horizontal range, forming a rectangle pattern. It indicates a period of consolidation where the market lacks a clear directional bias. Remember that it is important to have at least two price touches on both the top and bottom respectively to define the boundary of the rectangle or sideways. Without that two-point touch confirmation, the pullback could have even ended up as a wedge or a flag pullback instead.

The simultaneous occurrence of breakout failure of both support and resistance creates a consolidation/congestion zone. We draw a horizontal line as a sign of strength to mark the support of consolidation. We draw a horizontal line at a sign of weakness to mark the resistance of consolidation. The area bounded by this support and resistance line is known as consolidation one.

We can trade the breakout of the consolidation zone. The breakout candle of the consolidation zone must increase in spreads compared to the previous candle and volume.

Characteristics of Sideways Pullback in Uptrend

Characteristics of Sideways Pullback in Uptrend

- The stock must be in a stage 2 uptrend or stage 4 downtrend and reach an overbought or oversold region before the pattern formation. Impulse moves with volume and candle size increasing

- A period of price consolidation takes place between predefined ranges.

- Look for evidence of smart money activity in the pattern before the breakout like trap or volume increasing

- Reaction volume remains low and volume increases at support (for accumulation)

- Lack of downward follow‐through after a threatening price bar (breakout failure at resistance). The failure to respond to threatening price action at highs (UPTHRUST) and Springs at lows are the best indications of ACCUMULATION.

- Failure of price to break support after basing above it

- Stronger BULL candles in terms of range

- Final volume increasing breakout or Breakout with high volume

- Buy breakout

- Stop loss recent swing high or low

Look for Evidence of Smart Money Demand through the Pattern. Example of a bullish range breakout

- Consecutive volume increases on the upside. Look for a series of candles where price and volume increase.

- Trapping in base low (downside breakout failure). shakeout days help to eliminate weak holders.

- Higher low before the breakout.

- Reaction volume remains low and volume increases at support (for accumulation)

- Lack of downward follow‐through after a threatening price bar (breakout failure at resistance). The failure to respond to threatening price action at highs(UPTHRUST) and Springs at lows are the best indications of ACCUMULATION.

Ascending /descending Triangle Patterns

Another type of time correction characterized by convergent trend lines is the triangle. Triangles can be symmetrical (where both trend lines converge), ascending (where the upper trend line is horizontal and the lower trend line is ascending), or descending (where the lower trend line is horizontal and the upper trend line is descending). Triangles frequently precede strong breakouts or trend continuations and indicate a reduction in price volatility.

Characteristics

- Before the pattern forms, the stock must be in a stage 2 uptrend or stage 4 downtrend and have reached an overbought or oversold region. Increased volume and candle size during an impulse move

- There is a period of price consolidation within the defined range.

- A series of smaller contractions must occur in order for the price to correct. price was tightly ranged from high to low, with a higher low prior to the breakthrough. As more weak investors are absorbed, each pullback from a high should be smaller than the one before it. HIGHER IS BETTER THAN LOWER PRIOR TO BREAKOUT. Watch for at least two pullbacks from the top. BETTER IS MORE. The pullbacks themselves result from supply and demand and exhibit the mindset of smart money.

- Volume decreases as the pattern progress. As the volatility contraction pattern progress, the right volume should start to decrease. this indicates that the available supply of the stock is being absorbed and once eliminated the stock can resume its uptrend.

- Final volume increasing breakout

- Breakout with high volume

- Buy breakout

- Stop loss recent swing high or low

Look for Evidence of Smart Money Demand through the Pattern.

- Consecutive volume increases on the upside. Look for a series of days where price and volume increase. This represents an institutional accumulation shakeout. Trapping in base low (downside breakout failure). shakeout days help to eliminate weak holders.

- Higher low before the breakout.

- Reaction volume remains low and volume increases at support (for accumulation)

- Lack of downward follow‐through after a threatening price bar (breakout failure at resistance). The failure to respond to threatening price action at highs (UPTHRUST) and Springs at lows are the best indications of ACCUMULATION.

In the next article, we will discuss different types of price correction in trends. Here, in this article, I try to explain 2 Pullback Trading Strategies You Must Know. I hope you enjoy this 2 Pullback Trading Strategies You Must Know article. Please join my Telegram Channel and YouTube Channel as well as my Facebook Group to learn more and clear your doubts.