Back to: Trading with Smart Money

Spring and Upthrust Trading Strategy

In this article, I will discuss one volume trading strategy: the Spring and Upthrust Trading Strategy. Please read our previous article, Finding Entry Opportunity using Volume Spread Analysis, for a better understanding of this article. I will also discuss the following pointers in detail.

1. What is Spring?

2. Logic Behind Spring

3. Some Elements for determining spring

Spring and trend

Spring and volume

Spring and follow-through

5. When should avoid trading spring

6. My trading setup using spring

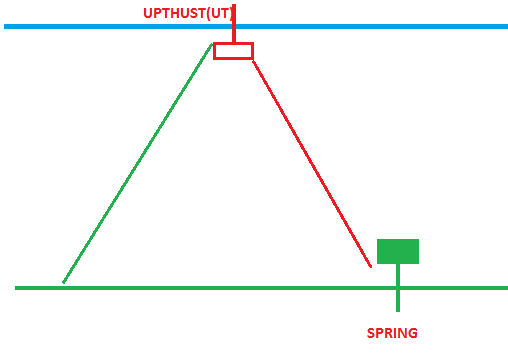

Spring (Opposite Upthrust(UT))

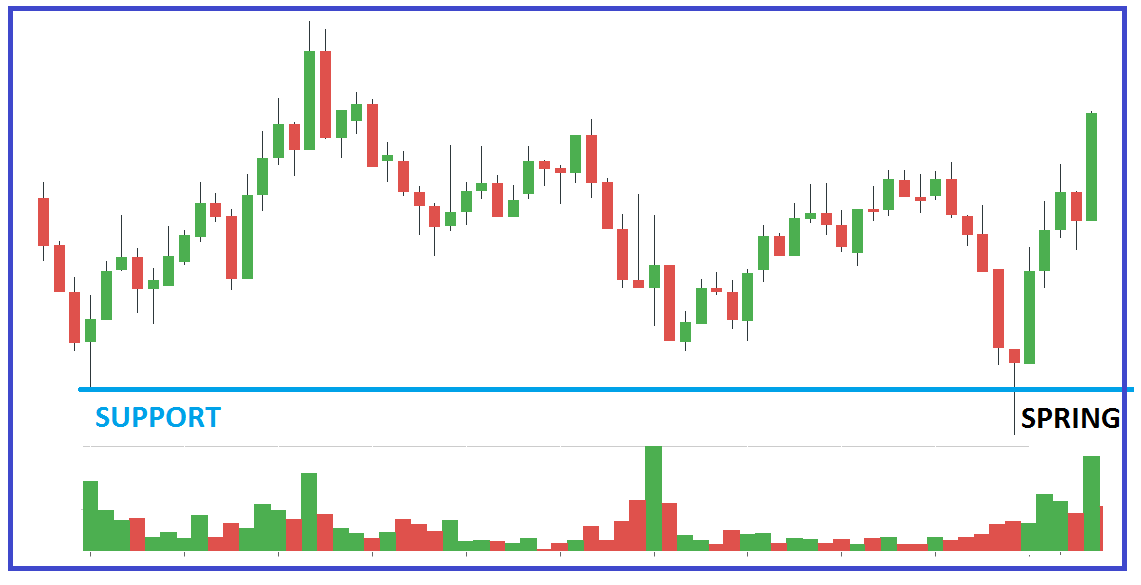

- Price dips below support and rallies to close on or near its high and back above support, so there should be a clear minor or major support zone.

- Failure to follow through after breaking below support or recent swing low.

- All bullish pin bars are not spring, but spring is a bullish pin bar.

Logic

Spring is an example of a “bear trap.” WHY? The price drop below support appears to signal the resumption of the downtrend. But in reality, the drop marks the end of the downtrend, thus “trapping” the late sellers or bears.

The depth of the price drive to new lows below the support and the relative level of volume on that penetration can judge the strength of the sellers.

A spring involves penetrating a well-defined support level on low or moderate volume. If a stock is going to break the support, it must break with high volume. The spring action shows that the stock is trying to break down and has failed. It is an important sign of strength.

Spring and Trend

During an uptrend

Pullback

- They will work best in trending conditions. During an uptrend, when the bullish signal appears, we go long.

- A retracement to a prior resistance support area is a typically excellent trade.

- Fibonacci retracement level also worked well

During a downtrend

When a spring signal appears during a downtrend, we need a retest of that spring before we can go long.

Condition

- Be sure that prior trends are over

- Background: The background is extremely important. You should see strength in the background with stopping volume, a selling climax, or the end of a falling market.

- Then appears spring, and Spring is Tested

Spring and Volume

Low volume spring

Volume should be lower than the original anchor(where support first occurred ). The candle at support, when the price retraced the first time to support the candle, should have a lower volume than the anchor candle. The shallow price penetration and low volume indicate sellers are exhausted. springs should be bought immediately.

High volume spring

High volume indicates demand coming in. As we trade with the trend, springs should be bought immediately if we want to trade for trend reversal. High volume indicates the presence of sellers more likely to test immediately or after some rally. To justify buying on the spring test, two criteria must be met.

- First of all, the volume on the test must be lower than on the spring itself. If it is not, nothing is proven, and no buyer should be done.

- Secondly, the price should hold at a higher level on the test than in the spring. It is especially positive if the price supports at or above the support level on the test.

If these two criteria are met, the stock can be bought on the test of the spring. Immediately after the test, the stock should begin a rally.

Spring and Follow-through

WHAT PRICE ACTION SHOULD HAPPEN AFTER SPRING? If a spring fails to rally away from the SUPPORT and the price hangs near the Spring low, Something is likely wrong.

WHEN SHOULD AVOID TRADING SPRING

Context or background move

Supply dominated

In a Downtrend where supply is dominated. The swing down to spring has supplied more supply (price decreasing and volume increasing) than the demand swing. The odds of success are low.

Momentum should be lost when approaching support, and the spring indicates strength. This is a good context. If momentum increases when approaching support and the next is a spring, the context is not showing strength, and the spring should be seen in the suspect.

Last demand swing

Shortening of thrust. Thrust Refers to the distance between the current swing high and a previous swing high (in an uptrend) or swing low (in a downtrend). Increased thrust is a sign of potential trend strength. The shortening of Thrust is a sign of potential trend weakness. If the last swing high is characterized by diminishing demand(price increasing and volume decreasing ), the odds of success are lower.

My SPRING SETUP(opposite for upthrust)

Trend continuous setup

ELEMENT REQUIRED

- SPRING

- WELL DEFINED SUPPORT

- VWAP

Support

- The last swing low or resistance turned into support

- Fibonacci retracement level (50-61.8%)

Time frame:

- 5 minutes

Applicable

- Both stock and index

Context or background

- Market in a defined uptrend

- Cleared support level

- Low volume when approaching support level

Set up condition

- Price retrace towards support on low-volume

- Spring at the confluence of support plus VWAP (strong signal) or spring at support

Entry

- Buy above the spring

- Or Test of spring

Stop loss

- Below the spring

Target

- Next resistance

- Or any bearish reversal price action

In the next article, I will discuss the VSA (Volume Spread Analysis) Trading Strategy in detail. In this article, I explain the Spring and upthrust Trading Strategy. I hope you enjoy this Spring and upthrust Trading Strategy article. Please join my Telegram Channel, YouTube Channel, and Facebook Group to learn more and clear your doubts.

Registration Open – Microservices with ASP.NET Core Web API

Session Time: 6:30 AM – 8:00 AM IST

Advance your career with our expert-led, hands-on live training program. Get complete course details, the syllabus, registration, and Zoom credentials for demo sessions via the links below.

Sir hats off to your work.please give some set of rules which trader should follow before taking a trade.because execution is very important thing in tradaing so please provide us some tips on rules.

Thankyou

Hi,

Usually you say resistance and support is a zone and not a single price level. In all of your above charts you have drawn them as levels. So what is the criteria to draw such lines and not consider then as zones. Because only then we can identify spring and uprhrust and not confuse them as only pinbars ( you did mention all springs are pin bars but all pin bars are not springs )

Regards

Sona

Do read support and resistance article. Mentioned about level and zone

Can we use this for both intraday and for swing trading .?

Also I think we can add one more check to make it a high probability trade, when the same stock makes and upthrust or buying climax and there is a failed test followed later, high volume testing , so this provides an additional confirmation when the price makes a selling climax with spring , shows sign of strength to go bullish ….kindly confirm

Yes I am discussed trend continous setup .trend reversal set up is good for swing trading. Intraday trading is about trend trading .go with momentum. Will discuss more about swing trading

Sir ji can we use intraday and for swing trading

and pls add more intrday example trade with marking in uptrend and downtrend

and sir ji we also check volume ?

Thank you sir

God bless

Never seen such an excellent training in paid courses also. Kudos to Teacher

Hi!

I enjoyed reading your article about the spring and upthrust candlesticks. I saw that when I was analysing my price movements. But, I kept wondering what to call a candle wick, which breaks above resistance, and below support lines respectively. Now I know that they are called upthrust and spring respectively.

Thanks

Very nicely explained, news concepts learned today. 1 question can we use options chain to determine strength and weakness of the the trend

I have been looking really hard for these kinds of lessons – Wyckoff and SM related trading strategies.

And now here they are well explained and for free.

Thank you so much for your generosity, these are gold!

please Sir can you give us vwap indicator