Back to: Trading with Smart Money

How to Trade Bull Flag and Bear Flag Patterns in Trading

In this article, I will discuss How to Trade Bull Flag and Bear Flag Patterns in Trading. Please read our previous article discussing the Top 7 Chart Patterns in Trading Every Trader Needs to Know.

How to Trade Bull Flag and Bear Flag Patterns in Trading?

The bear flag pattern is a popular continuation price pattern used by technical traders within the financial markets to determine trend continuations. In this article, we will discuss bull flag trading opportunities and the topic we will cover:

- Definition of a bear flag pattern

- How does it work?

- How do you identify a bearish flag?

- Element of the flag pattern

- How to Trade Bull Flag Pattern?

- Bear flag vs bull flag.

- Bull flag vs. pennant

What is a Bullish Flag Pattern in Trading?

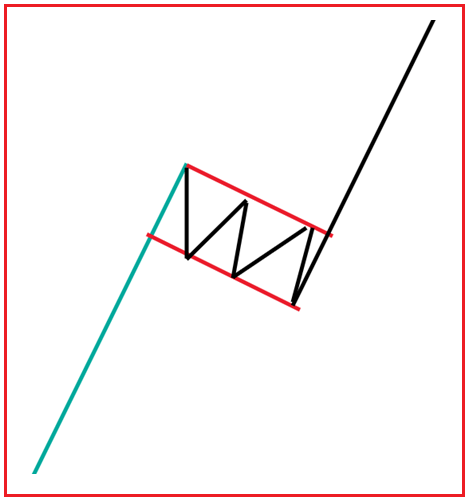

The Bullish Flag Pattern is a trend continuation chart pattern. A bull flag pattern is a chart pattern that occurs when a stock is in a sharp, strong uptrend. It is called a flag pattern because when you see it on a chart, it looks like a flag on a pole, and since we are in an uptrend, it is considered a bullish flag.

Pattern Structure

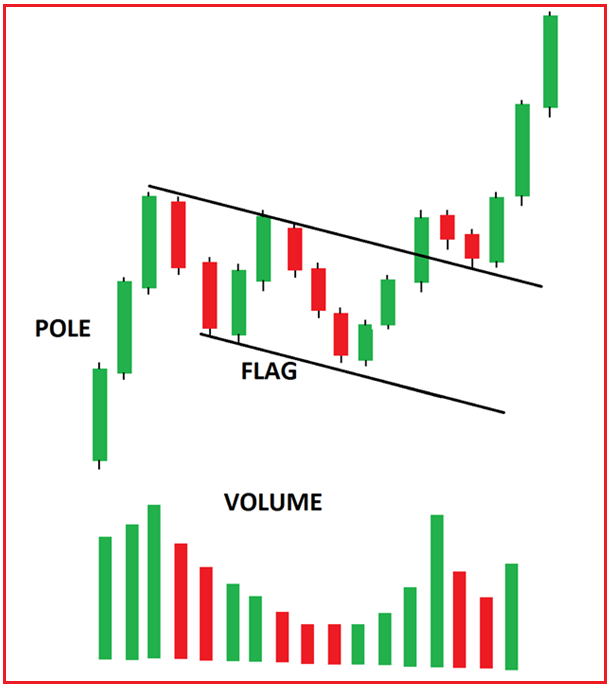

Defines a Flag pattern using two criteria: pole and flag

- Pole: Look for a sharp, strong, trending move. This means the range of the candles is more bullish than usual, and they tend to close near the highs. usually shown by large body candles. and strong volume in the same direction.

- Flag: weak pullback AFTER strong, sharp move, usually shown by small-bodied candles. The flag is made up of two parallel lines. The pullback should consist of smaller-range candles (compared to the earlier move). The “tighter” the range, the more likely the market will break out higher.

Logic

After the strong move higher, the market becomes overbought, so the market needs to take a “rest.” Here’s where you can expect a potential Bull Flag to form. A small break before the market continues moving in the same direction.

Volume Description

- Steep price advance preceding the formations on heavy volume.

- Dramatic drop-off inactivity as the consolidation patterns form. Volume should decrease as the Flag pattern forms.

- Then, the sudden high-volume activity on the upside breakout

Entry and Stop Loss

Trade the breakout of the flag in the direction of the pole. Stop-loss should be below the flag support in a bull flag breakout entry. Look for confluence factor-like 20ema or any sr line.

Target

Measuring technique: Measure the height of the flag pole. Then, extend it from the lowest point of a bullish flag.

How to Trade Bull Flag Pattern?

- Price is in sharp up move on high relative volume (ACT AS POLE)

- Prices consolidate at or near highs with a defined pullback pattern like flag, pennant, or tight range.

- Buy when prices break out above the consolidation pattern on high volume.

- Place stop orders below the bottom of the consolidation pattern.

- Targets should be at least 2:1 risk/reward

In the next article, I will discuss How to Become a Successful Trader. In this article, I explain How to Trade Bull and Bear Flag Patterns in Trading. I hope you enjoy this Bull Flag and Bear Flag pattern in the Trading article. Please join my Telegram Channel, YouTube Channel, and Facebook Group to learn more and clear your doubts.

Registration Open – Microservices with ASP.NET Core Web API

Session Time: 6:30 AM – 8:00 AM IST

Advance your career with our expert-led, hands-on live training program. Get complete course details, the syllabus, registration, and Zoom credentials for demo sessions via the links below.