Back to: Trading with Smart Money

Breaker Block Trading Strategy:

In this article, I will discuss the Breaker Block Trading Strategy with Real-time Examples. In the smart money trading concept, it is called breaker block trading, and in the price action concept, it is called breakout test. The idea behind a breakout test or breaker block is that if the market can successfully retest the breakout level and continue in the same direction, it confirms the breakout’s validity and suggests that the market will likely continue moving in that direction.

- A breaker block strategy or breakout test involves looking for key support or resistance levels on a price chart that may cause a significant change in price direction when broken. When an SR/SD level is breached, it is considered a significant signal that the price may continue to move in that direction.

- Then, please wait for the price to return to the breakout level to confirm that it has become a new support or resistance level. Once the level has been confirmed, traders can enter a trade toward the breakout.

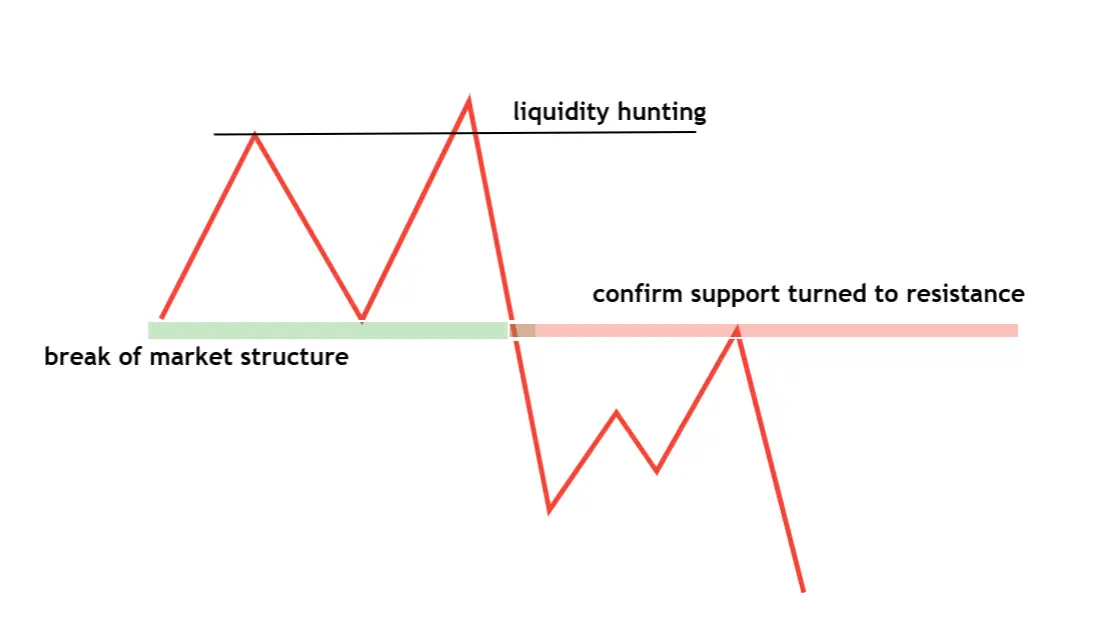

Below is the basic idea about breaker block trading or breakout test trading strategy

Breaker Block Trading Strategy step by step

Step 1: Identify the key support or resistance levels in the range (accumulation/distribution)

Step 2: Watch for a price breakout above or below these levels, signaling a potential trend reversal or continuation.

Step 3: Confirm the breakout by looking at the trading volume and candle to see if the move is supported by market activity.

Step 4: Wait for the price to return to the breakout level and confirm that it has become a new support or resistance level. Look for the price to touch or bounce off the breakout level, indicating that it is holding at a new level of support or resistance.

Step 5: Enter a trade toward the breakout, using stop-loss orders to manage risk. If it was a bullish breakout test or bullish breaker block, enter a long trade and place a stop-loss order below the breakout level and recent swing low.

Step 6: Monitor the trade closely and adjust stop-loss orders or exit the trade if the market moves against your position.

BREAKOUT CONDITION

- liquidity hunting and break of market structure

- Valid breakout

- HIGHEST CLEAN VOLUME OR WIDEST CANDLE (VOLUME SPIKE). The greater the volume and size of the candle, the stronger the breaker block.

- Should not break and follow through of the breakout candle

U can trade trend continuation or trend reversal. Here is the basic idea behind the valid breaker block entry method

Below is an example of a breaker-block trading strategy

Order Block Trading Strategy

The order block strategy identifies areas where significant buying or selling activity has occurred on a price chart. When the price returns to an order block, traders look for confirmation that the level is holding before entering a trade in the same direction as the previous buying or selling activity. 3 types of order block entries. In Order Block Trading, or SMART MONEY MARKET STRUCTURE

- SD FLIP

- CHoCH

- BOS

Step 1: Look for areas on the price chart where significant buying or selling activity has occurred, creating order blocks.

Step 2: Watch for the price to return to the order block area, which can signal a potential trading opportunity.

Step 3: Wait for confirmation that the order block is holding by looking for price action or trading volume.

Step 4: Enter a trade from the previous buying or selling activity, using stop-loss orders to manage risk.

Step 5: Monitor the trade closely and adjust stop-loss orders or exit the trade if the market moves against your position.

Break of Market Structure and Order Block Trading Strategy

Supply Demand Flip and Order block trading strategy

Change of Character and Order block trading strategy

Pullback Trading Strategy:

The pullback strategy involves looking for temporary retracements in an instrument’s price before it continues to move in its previous direction. Traders look for areas of support or resistance (using any confluence factor) where the price may retrace before continuing in its original direction.

Here are the basic ideas behind the pullback trading strategy

- After an impulse move formed. wait for any trend continuation Chart Patterns like the flag, pennant, wedge channel, etc

Below is the basic idea behind the confluence of fibo retracement +flip zone with pullback trading

Pullback Trading Strategy Step-By-Step Process

Step 1: Identify the instrument’s trend by analyzing the price chart using the supply-demand zone or market structure. Wait for a valid breakout to continue or reverse the trend.

Step 2: Look for areas of support or resistance that the price may retrace before continuing in its original direction.

Step 3: Then look for temporary, weak retracements to any areas of support or resistance (using any confluence factor) where the price may retrace before continuing in its original direction. Wait for the price to pull back to the identified support or resistance level. Confluence zone (Flip zone /sd zone/fibo/trendline/ma/vwap/avwap)

- Look for continuation chart patterns like flag, pennant, wedge, channel, double top or double bottom, etc.

Step 4: Confirm the retracement zone by looking at price action or trading volume.

Step 5: Enter a trade in the direction of the original trend, using stop-loss orders to manage risk.

Step 6: Monitor the trade closely and adjust stop-loss orders or exit the trade if the market moves against your position.

Differences Between Breaker Block Trading, Order Block Trading, and Pullback Trading:

The key difference between these strategies is how they identify potential trading opportunities.

- The breaker block strategy focuses on identifying significant support or resistance levels,

- Order block strategy focuses on identifying areas where significant buying or selling activity has taken place,

- The pullback strategy focuses on identifying temporary retracements in the price of an asset.

Each strategy has advantages and disadvantages, and traders should choose the one that best fits their trading style, risk tolerance, and goals. To implement these strategies effectively, traders should also understand technical analysis tools and market dynamics.

In the next article, I will discuss What is Liquidity Hunting or Stop Hunting in Trading with Real-time Examples. In this article, I try to explain the Breaker Block Trading Strategy with Real-time Examples. I hope you enjoy this Breaker Block Trading Strategy article. Please join my Telegram Channel, YouTube Channel, and Facebook Group to learn more and clear your doubts.

Hamari jasi blind trader ki tum God ho sir. Really sir this type valueable lesson ka liya God bless you.

Great lesson

This is so good