Back to: Trading with Smart Money

Top 7 Chart Patterns in Trading Every Trader Needs to Know

In this article, I will discuss the Top 7 Chart Patterns in Trading Every Trader Needs to Know. Please read our previous article, where we discussed Supply and Demand Trading.

What are Chart Patterns?

Chart patterns are the basis of price action analysis and technical analysis and require a trader to know exactly what they are looking at in chart pattern and what they are looking for in chart pattern.

- Chart patterns are collective human behavior. Human behavior in the market creates some patterns type on the charts. Chart pattern trading is really about understanding the psychological human behavior of the market using those patterns.

- Price patterns form the structure of the market. You can’t predict with 100% accuracy where the market will go next but Price patterns. Chart Patterns Can help reduce uncertainty and show you the probable next move of the market.

Types of Chart Patterns in Trading

The changes in trend usually require a period of transition. The problem is that these transition periods do not always signal a trend reversal. Sometimes, these transition periods indicate a pause or consolidation in the existing trend, after which the original trend is resumed.

Chart patterns are divided into three types: continuation patterns, reversal patterns, and bilateral patterns.

- A continuation chart pattern signals that an ongoing trend will continue

- Reversal price patterns signal that a trend may be about to change direction

- Bilateral chart patterns signal that the price could move either way, meaning the market is highly volatile

Best Chart Patterns in Trading

Here are 7 chart patterns every trader needs to know.

- Head and shoulders

- Double top and Double bottom

- Rounding bottom

- Cup and handle

- Wedges

- Pennant or flags

- Ascending Triangle and Descending triangle and Symmetrical triangle

Elements of Price Pattern

- Trend and bias

- Pattern Description:

- Price action characteristics

- Logic

- Time

- Supply and demand (volume)relation

- Entry

- Stop loss

- Target

Let’s discuss all the above points in detail in each chart pattern

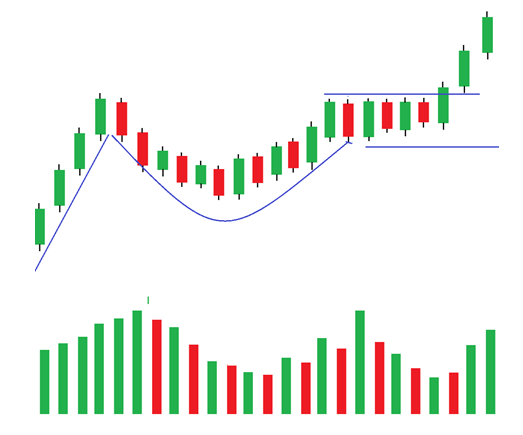

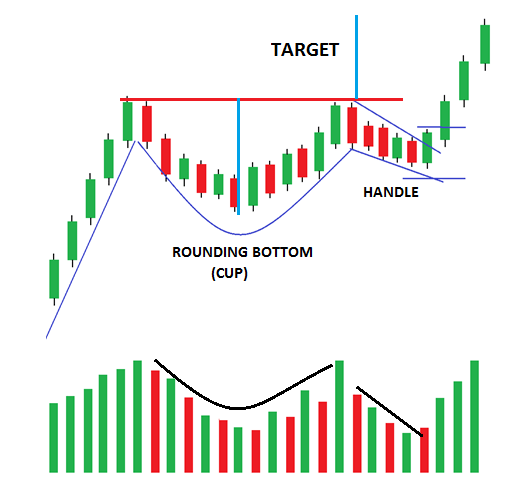

Cup and Handle Chart Pattern

- Directional Bias: Bullish

- Pattern Type: Continuation pattern

- Price Action Characteristics: This pattern occurs within the context of an uptrend. the price forms a U-shaped cup (rounding bottom) with a short handle on the right like a flag pattern

- Logic: The last retracement (handle) is the last bearish move. When the price falls, we expect the market to rise. Like a bullish flag pattern

- Volume behavior: Volume will typically follow the shape of the cup (or rounding boom), with high volume as the left lip forms, falling volume as the bottom of the cup forms, and rising volume toward the right lip, and again, volume decrease on last bearish push

- Entry: The conservative entry for the Cup and handle chart pattern is to buy on break-out of the cup’s high. The aggressive entry can take place once the handle breaks out.

- Breakout Confirmation: A strong candle close above the upper trend line drawn across the handle with above-average volume

- Target /Measuring Technique: The price target is obtained by measuring the start of the cup to the bottom of the cup and then adding to the price level of the cup

Ascending Triangle Chart Pattern

- Directional Bias: Bullish

- Pattern Type: Continuation

- Price Action Characteristics: This pattern occurs within an uptrend and consists of equal highs and rising lows, forming a triangle

- Logic: A relatively strong horizontal upper resistance line was holding the price from going higher. Each time the price hits the resistance line, it drops. However, each time it drops, the fall weakens. Thus, it starts making higher lows. From a smart money psychology point of view, this seems to suggest a large sell order placed at a fixed price (where the horizontal upper resistance line is located). Each time the buyers push the price to that level, the price is rejected from the resistance line and drops as part of the order gets triggered. This process continued for a while until the entire order was cleared from the resistance line, and once there weren’t any more sellers, the price was pushed higher by strong buyers.

- Volume behavior: The volume declines throughout the triangle formation

- Entry: In a bull trend, buy on break-out above an Ascending Triangle

- Breakout Confirmation: The confirmation for this pattern is a strong candle close above the highs on above-average volume.

- Measuring Technique: Subtract the height of the pattern’s highs and lowest lows and add this amount to the breakout level.

In the next article, I will discuss How to Trade Bull Flag and Bear Flag Patterns in Trading. In this article, I explain the Top 7 Chart Patterns in Trading That Every Trader Needs to Know. I hope you enjoy this article. Please join my Telegram Channel, YouTube Channel, and Facebook Group to learn more and clear your doubts.

Today I found cup & handle pattern in nifty & same time you had sent this pattern in telegram..but today it did not work bullishly …

Sir plz provide whats app no your email id is not working I have open account from your link in Upstox and want to join course

Plz drop the WhatsApp no