Back to: Trading with Smart Money

How to Study Candlestick in Trading

In this article, I will discuss how to study candlesticks in trading and the following three important pointers related to Candlesticks in Trading.

- What is a candlestick?

- How to Study Candlestick?

- The six principles for analyzing candlestick

What is a Candlestick?

The candlesticks reflect what buyers and sellers are doing. To what extent do they move the price and the strength behind the move over a specific period? CANDLES TELL YOU WHO IS IN CONTROL, but do not tell you about the strength of buyers or sellers behind the move; a candle with volume shows that.

Technical analysis frequently uses candlestick charts to evaluate possible price trends and patterns in stocks, cryptocurrency, forex, and other financial markets.

Candlestick patterns can be used to forecast future price changes based on past performance. “Doji,” “Hammer,” “Engulfing,” and “Shooting Star” are a few common patterns that offer insights into upcoming market reversals or trends. Each candlestick provides six key pieces of information about the asset during a given time frame.

The Open:

Open price tells us the balance between buyers and sellers at the opening of that period. The opening value is the first trade of the day. After the traders have time to review the markets overnight, the open represents the desired position of investors to begin the day. The change from the previous close to the open reflects new sentiments. Also, institutions looking to accumulate (or distribute) positions often place orders at the open because the open trade is often the largest, most liquid trade of the day. In this way, the opening might be one of the best times to accumulate/ distribute a large stock volume while minimizing the impact on the stock’s price.

The High:

The high is the highest point the stock traded during the session. It is the furthest point the bulls were able to push the stock higher before sellers regained control and pushed the stock back down. The high represents a stronghold for sellers and a resistance area for buyers. There is one exception: when the stock closes on the high, it does not encounter any real resistance from the sellers. The buyers just ran out of time.

The Low:

The low is the lowest point the stock traded during the session. It is the furthest point the bears were able to force down the stock before buyers regained control and pushed the stock up. The low represents an area where enough demand exists to prevent the price from lowering. The exception is when the security closes on the low. When the stock closed at the low, it did not encounter buying support. Instead, the bulls were saved by the closing bell of the session.

The Close:

Close price tells us where the balance point was at the end of the period. The close is the last price agreed upon between buyers and sellers, ending the trading session. The close is the market’s final evaluation. A lot can happen between one close and the next close. The close represents investors’ sentiments and convictions of investors at the end of the day. It is the position investors desire to hold after-hours when investors cannot trade with liquidity until the next session opens. The closing price is the first (often the only) price most investors desire to know.

The Change:

The change is the difference between close and close. The difference in the closing value one day versus the closing value the next. When this difference is positive, it tells us that demand outweighs supply. When this difference is negative, it tells us that supply is increasing beyond demand. The change is perhaps the most sought-after piece of financial data.

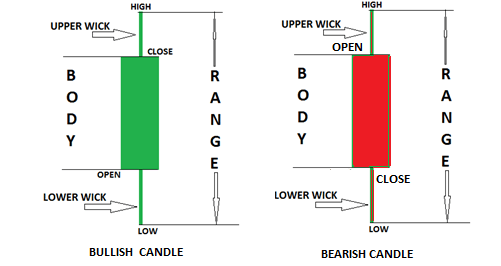

The Range:

The range is the spread of values within which the stock trades throughout the day. The range spans between the bar’s highest point and the same bar’s lowest point. It is measured from the top of the bar, where resistance is low and support comes in. The size of the range gives us important information about how easily demand can move the s took up or supply forces the price down. The wider the range, the easier it is for the forces of supply and demand to move the stock price.

The body:

The area of the candlestick that is wider and symbolizes the range of prices between the opening and closing values.

- The body is usually colored green or white if the closing price exceeds the opening price, signifying bullish momentum (an increase in the asset’s price).

- The body is colored black or red, signifying bearish momentum (the asset’s price dropped) if the closing price is lower than the opening price.

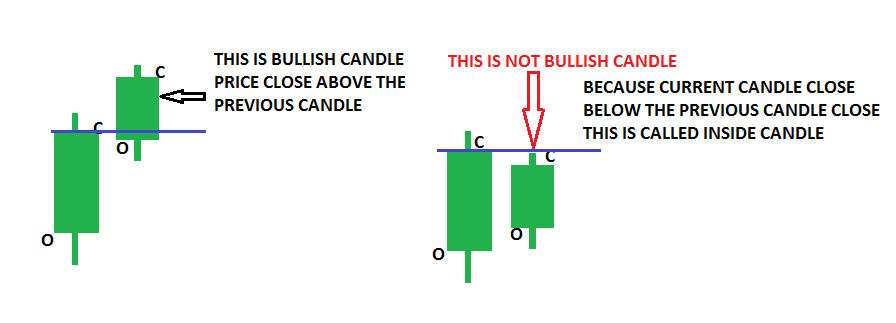

Bullish CANDLESTICK

This is nothing, but when the CURRENT CANDLE closes, it is ABOVE the previous candle’s high.

Bearish CANDLESTICK

When the CURRENT close is BELOW the previous candle low

With the proper understanding of CANDLESTICK, you can predict what is about to happen in the near future

#Pro Tips: we (retailers) can’t move the market, so every candle shows what smart money is trying to show. So, their move trap or genuine is only validated by volume

#Pro Tips: CANDLESTICK shows half of the information, and the volume shows the other half of the information

Example

WHAT IS TELLING US?

SENIMATE = BULLISH, two consecutive higher close candles. Let’s add volume to this candle

2nd candle range is smaller than 1st candle

2nd candle volume greater than 1st candle

Think why the volume is greater than 1st candle.

Let me explain to you. NARROW SPREAD CANDLE WITH HIGH VOLUME. Two possible explanations

If the volume had represented buying, how could the spread be narrow?

- Either the professional money is selling into the buying, the possible reversal in the near future

- There is a trading range to the left, and the professional money is prepared to absorb the selling from traders locked into this old trading range. I mean, break out may happen.

Let’s understand the chart.

If the next bar is down, closing near its lows, this confirms the professional selling

A low volume down candle close to the middle or top shows that smart money testing supply and no more supply available 2nd candle was the buyer’s volume if the next candle closes above the current candle

6 PRINCIPLES FOR CANDLESTICK ANALYSIS IN TRADING

- Principle Number One: The length of any wick, either to the top or bottom of the candle, is ALWAYS the first point of focus because it instantly shows strength, weakness, and indecision, and most importantly, where SMART-MONEY enters.

- Principle Number Two: If no wick is created, this signals strong market sentiment toward the closing price. SMART-MONEY active there

- Principle Number Three: A wide body represents strong market sentiment, and a narrow body presents weak market sentiment. A Narrow body with a heavy volume of either Smart Money observing for the continuous move or Smart Money entering in the opposite direction

- Principle Number Four: A candle of the same type will have a completely different meaning depending on where it appears in a price trend. Start of the trend or middle of the trend, end of the trend, at support or resistance, or in the consolidation phase. Candlestick should analyze the context of the move. You should never try to read the market by looking at one day’s action in isolation. Read the market phase-by-phase and then read the latest day’s action into the phase.

- Principle Number Five: Volume validates price. First, see what CANDLESTICK is telling you, then validate by volume. Is it validating or not with the CANDLESTICK price action?

- Principle Number SIX: When a particular timeframe doesn’t make sense, move to the next higher time frame for the big picture or lower timeframe for the microstructure of the move.

Important Points to Remember

Context is essential: A candlestick pattern has several meanings depending on where it appears on the chart. For example, a strong candle appears at the bottom trend, resistance breakout, or end of the momentum.

Support and resistance levels: typically, reversal candlestick patterns that form close to important support or resistance levels are more reliable.

Confirmation: Always wait for a confirmation candle before acting on a pattern. For instance, a second bullish candle can validate a bullish pattern that emerges.

Volume: A pattern’s significance can be confirmed by higher trading volumes that accompany it. For example, a bullish engulfing pattern with a large volume can indicate a more robust upward trend.

In the next article, I will discuss Candlestick Analysis in Trading. In this article, I explain how to study candlesticks in trading. I hope you enjoy this article. Please join my Telegram Channel, YouTube Channel, and Facebook Group to learn more and clear your doubts.

What is professional selling?

At market top when retailers buying , professional selling to retailers.exaample Retailers buying for breakout of previous high professional simple selling and false break out at top forming M pattern, just an example of M pattern

DID YOU START YOUR 16TH DATE COURSE FOR ACCOUNT OPENERS IN ZERODHA, UPSTOX, ANGEL, FYERS ?

Sir hindi

DID YOU START YOUR 16TH DATE COURSE FOR ACCOUNT OPENERS with your links?

Great articles…. How to ask doubts on Telegram???

https://t.me/tradingwithsmartmoney

no option to comment on telegram. then how to ask ?

Please send me the basic to advance study material on trading technicals and training

Thanks for the article, i would like to ask a question: for a narrow body candle with higher volume compared with prior candle, if smart money is not active, what could have been responsible for higher volume and can volume be used in forex?

One reason for higher volume can also be due to position unwinding.

You mention that we can ask doubts on Telegram channel. I have joined your telegram channel. However it seems to allow you to broadcast message to entire group only and members cannot reply back or ask anything. Please Let us know if there is any other way to reach out to you.

i have no words to explain how useful knowledgeable article this one

thanks a lots guru ji

i want to chat talk with u either phone or any social networking site with.

please accept my request .

Thanks & Regards

Abhisekh

8828238395

9838976758

Thanks a Lot

great article with solid depth pf knowledge

may be basic question, what is smart money meant for?

awesome ,unique knowledge…..

great work…hats off to you sir…

DID YOU START YOUR 16TH DATE COURSE FOR ACCOUNT OPENERS IN ZERODHA, UPSTOX, ANGEL, FYERS ?

very useful knowledgeable

thanks a lot sir

sir can i get the physical copy or book from any stores

Thanks & Regards

manoj shah

9029687757

HI Friend

Oh man that is soOOOo great my friend. You should publish

Big love and appreciation from france

Hi

Ma Karachi sa hon or ap ki videos dekh ma ne kafi trading ko improve kia ha ap ki har video unique Hoti ha or Jis topic or contest par ap video banatey hain you tube channel par ap ki videos ka koi competition ni ha or na hoga.

In Sha Allah

Qazi Toseef

From Karachi, Pakistan

Thanks a lot it helps a lot, i have learned from your tutorials and getting profit every day.

Thank you for such a great insight …..

🙏🙏🙏what a content sir