Back to: Trading with Smart Money

Order Block Trading Strategy with Examples

In this article, I will discuss the Order Block Trading Strategy with Examples. Order Block Trading Strategy is a method that involves identifying and trading off significant price levels on a price chart. Traders using this method look for areas where large buying or selling activity has occurred in the past, potentially acting as areas of support or resistance in the future.

Order blocks can be found in any timeframe, from minutes to weeks, and can be used in any market, including stocks, futures, forex, and cryptocurrencies. Order block trading can be combined with other technical analysis methods, such as trend lines, moving averages, and oscillators, to confirm trades or to identify a potential trade setup.

Here are the general steps involved in using the order block trading method:

- Identify a price chart showing clear areas of buying or selling activity, typically a consecutive candle.

- Locate the most significant areas of buying or selling activity, often called order blocks.

- Determine whether the price will likely respect or break through the order block. This can be done by looking at the price action around the block.

- If the price is likely to respect the block, consider entering a long or short trade near the block, with a stop loss order placed just below or above the block, respectively.

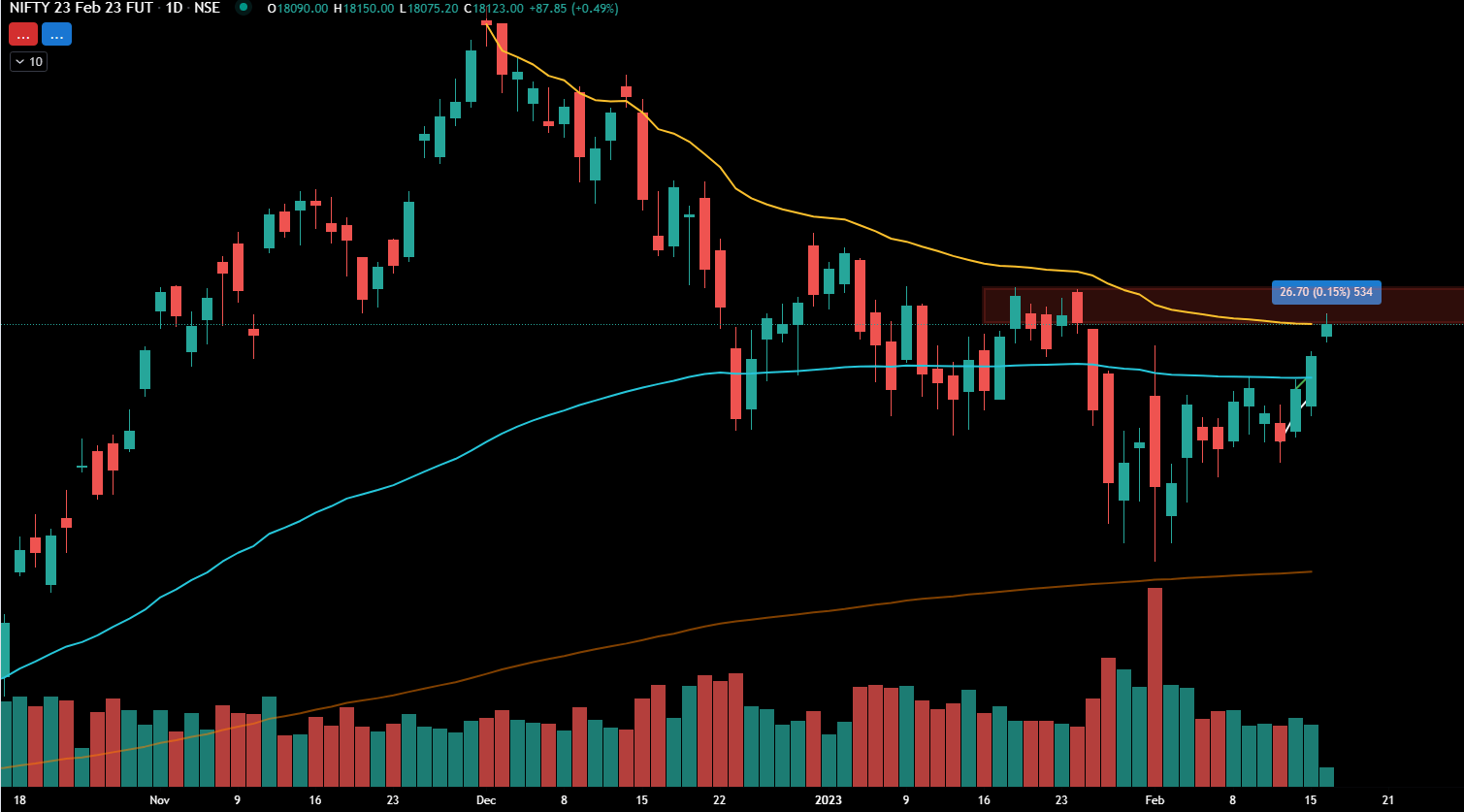

Below is an example of a Nifty 50

I took this chart during the day. Here, I used a VWAP indicator along with the order block. Price reach confluence of order block and VWAP ZONE

NOW CHECK THE BELOW CHART. PRICE TURNED GREEN TO RED THAT DAY AND STARTED FALLING FROM THE TESTED ORDER BLOCK ZONE

Core Concept of Smart Money Trading Method

This concept is divided into 3 parts

SMART MONEY CONCEPT

- Supply and demand

- order block

SMART MONEY MARKET STRUCTURE

- SD FLIP

- CHoCH

- BOS

SMART MONEY ENTRY TECHNIQUE

- Liquidity hunting

- Inducement

Order Block Trading Strategy System

What is an Order Block in Trading?

Order Blocks are footprints left by the market when an impulsive move occurs. Order Block (OB) is the last opposite candle before the strong move that creates an imbalance in the market. Price will likely return to those zones before it triggers another impulse move to continue his trend.

Why Order Block Zone in Our Chart?

- The market continued to decline after the bearish order block zone formed, which is proof that smart money was placing sell transactions when it formed (opposite of the bullish order block zone)

- Aggressive people want to buy or sell right away. To put it another way, you place a MARKET ORDER to buy or sell anything right now at the best price currently offered.

- Your post will not be filled simultaneously because it is so large. The position will be split as the price rises quickly, but it will fill quickly, and you can enter the entire position. The price is aggressively driven up or down by aggressive market participants using their market orders.

- So, the order block zone can only be seen once the price speeds away from the zone. It indicates that there was smart money buying or selling interest at the origin of that move.

Why Does the Market Return to Untested Order Block Zones?

- The smart money position will not be filled simultaneously because it is large.

- When the order block zone was created, the smart money could not execute all its trades. If they enter the market quickly, the price moves with them. Doing this will force them to buy higher and sell lower. By keeping order blocks on the books, they find a solution to this problem.

- The smart money leaves pending orders at the order block zones so that when the market returns to the order block zone, the initial trades they were unable to complete are executed. The market moves back in the direction in which the order block zone was created. This allows the smart money to get their remaining trades placed.

- Due to a Pending Block order.

Criteria For Valid Order Block Zone Trading

- A valid demand/supply zone is where prices rapidly move away with wide candles (imbalance) and beaks of structure or character changes. So, three important factors to study to find a valid zone

- Liquidity hunting at order block zone. IN THE FORM OF Stop Hunt Candle / Fake out/candle trap OR PSY

- Imbalances move or sharp move in a short time SRC/AR CANDLE MUST (MOVE AFTRE ORDERBLOCK).

- beaks of structure/ changes of character (form 1 of 3 market structure)

- untested order block zone FOR entry

Liquidity hunting at order block zone. IN THE FORM OF Stop Hunt Candle / Fake out/candle trap. I will cover this concept in more detail later.

Imbalance moves after the order block zone.

An imbalance is a significant difference between the number of buy orders and sale orders for a particular security or asset. This can occur when there is a large amount of buying or selling pressure in the market, which can cause the security price to move rapidly in one direction.

- Momentum should increase. suggest an imbalance in price

- Order block zone should not test the next 3 candles, and also, in a bullish order block, the previous candle low should not breach in the next 3 candle

The above example shows price imbalance with 3 consecutive candles making a higher high and higher low. Now check the below example of price in balance. Here, after 2 candle prices form a balanced structure.

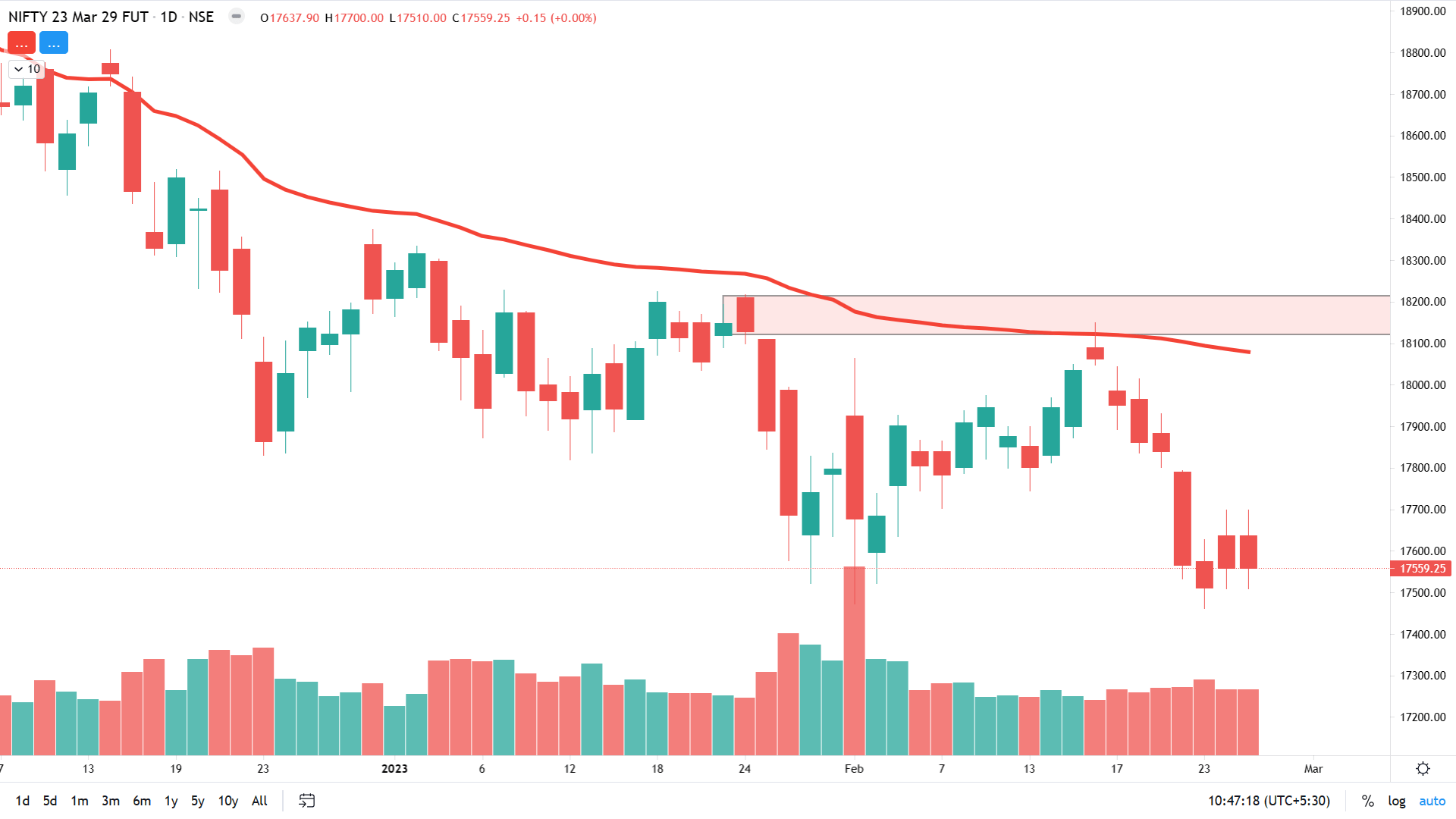

BELOW IS AN EXAMPLE OF THE NIFTY 50 CHART

Volume in Order Block Zone Trading Strategy

A higher volume at a particular level could indicate stronger support or resistance.

- Either high-volume block candle and follow-through

- Or follow-through volume increasing after block candle formed

In the first example, the high volume order block candle wands in 2nd example low volume order block, but the volume increases. Both cases are valid to order block.

BELOW IS THE CHART OF THE SAME NIFTY50 WITH THE VOLUME

Order Block move should Break the Market Structure

BEFORE going forward, understand valid breakout vs invalid breakout

Untested order block for entry

Prefer only untested OB zone

In the next article, I will discuss the Smart Money Market Structure Trading Strategy. In this article, I try to explain the Order Block Trading Strategy with Examples. I hope you enjoy this Order Block Trading Strategy article. Please join my Telegram Channel. YouTube Channel and Facebook Group to learn more and clear your doubts. Please watch the following video to learn and understand this concept better.

Registration Open – Microservices with ASP.NET Core Web API

Session Time: 6:30 AM – 8:00 AM IST

Advance your career with our expert-led, hands-on live training program. Get complete course details, the syllabus, registration, and Zoom credentials for demo sessions via the links below.

Hi! What does SRC/AR Candle mean?

Your concept and knowledge is absolutely amazing.