Back to: Trading with Smart Money

Supply and Demand Trading

In this article, I will discuss Supply and Demand Trading. Please read our previous article, in which we discussed Market Structure through Swing. At the end of this article, you will understand the following pointers.

- What are the Supply and Demand Zones?

- Why are supply and demand zones in our chart?

- Why does the market return to the supply and demand zone?

- Why trade from the supply and demand zone?

What are the Supply and Demand Zones?

Supply-demand is nothing but the border area of support or resistance

Why are the supply and demand zones in our chart?

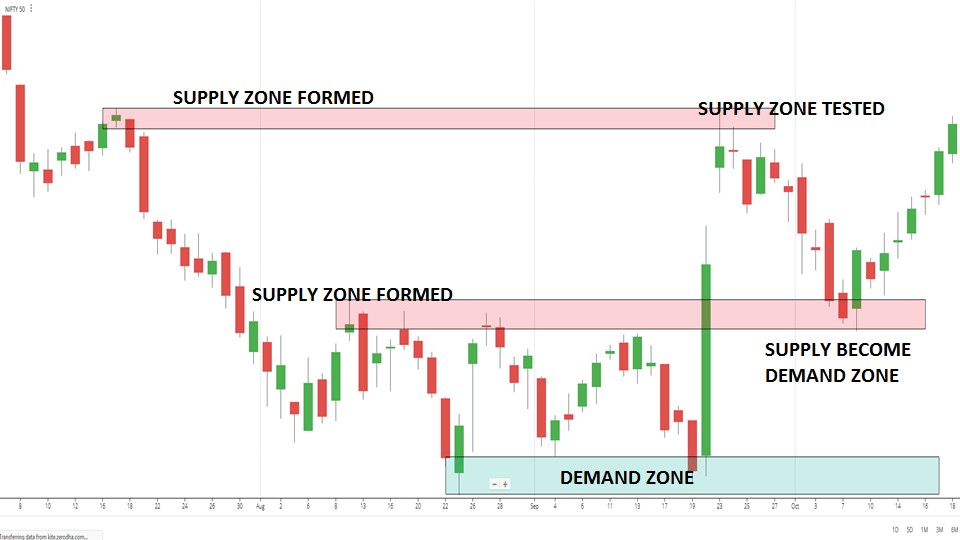

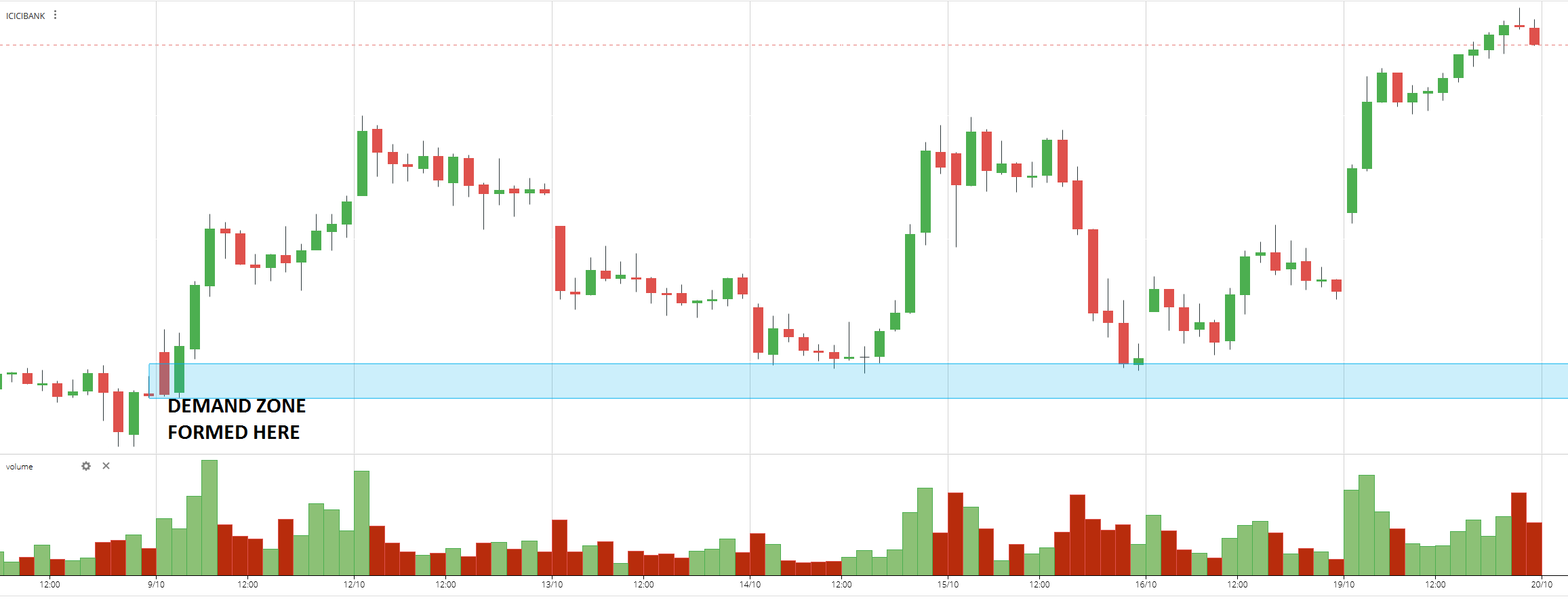

- The supply zone was formed due to the smart money that placed the sell trades. We can confirm this to be a fact because the market continued to fall after the zone formed (opposite of the demand zone)

- If you are aggressive, you want to buy or sell NOW. In other words, you place a MARKET ORDER to buy or sell immediately at the best available current price.

- Because your position is pretty big, it won’t be filled all at once. It will get filled quickly, and you will be able to enter the whole position, but the position will get split as the price moves quickly. The aggressive market participants drive the price aggressively up or down with their market orders.

- So, the supply and demand zone can only be seen once the price speeds away from the zone. It indicates that there was smart money buying or selling interest at the origin of that move.

Why does the Market return to Supply and Demand Zones?

- Due to a Pending Block order

- Because the smart money position is pretty big, it won’t be filled all at once. Smart money could not get all their trades placed when the zone formed. If they rush into the market, the price goes along with them. This action will make them buy higher and sell lower. They resolve this issue by leaving blocks of orders on the books.

- To get their remaining trades placed, the banks leave pending orders at the zones so that when the market returns to the zone, the trades they were unable to get placed initially are executed, and the market moves back in the direction in which the zone was created.

WHY TRADE FROM THE SUPPLY AND DEMAND ZONE?

- Low-risk high reward

- You are with the smart money.

In this article, I try to explain supply and demand trading. I hope you enjoy this Supply and Demand Trading article. Please join my Telegram Channel, YouTube Channel, and Facebook Group to learn more and clear your doubts.

can you please clear the concept of Level-I, Level-II and Level-III data in trading and on that basis how to take a trade

yes i also want