Back to: Trading with Smart Money

A Comprehensive Guide to General Market Analysis in Trading

In this article, I will give a Comprehensive Guide to General Market Analysis in Trading. In the dynamic world of finance, mastering the art of market analysis is paramount for investors seeking to make informed decisions. Whether you’re a seasoned trader or a novice investor, understanding general market analysis and index analysis is essential. This article aims to provide a comprehensive guide, shedding light on the importance of market analysis, how to conduct it effectively, and the key factors to consider.

Content

- Why Study?

- How to Study?

- Merits and Demerits of Market Analysis:

- What is the current trend in the market, and how does it influence trading strategies?

- How does market sentiment play a role in determining market direction, and how can it be measured?

- What key technical indicators do you use for analyzing market trends, and how do you interpret them?

- concept of market breadth and its significance in market analysis?

- How do you identify potential trend reversals in the market, and what signals do you look for?

- What role do major news events and earnings reports play in shaping market trends?

- How do you adjust your trading strategy in different market conditions, such as bull, bear, or sideways markets?

- What potential risks are associated with relying solely on technical analysis for market predictions?

- How do you incorporate global factors and geopolitical events into your market analysis?

Definition of Index analysis:

Index analysis, or general market analysis, involves assessing the performance and trends of financial market indices to gain insights into the overall health and direction of the broader market. It includes evaluating various factors such as price movements, trading volumes, and the composition of the index.

Why Study General Market

1. General Market Direction:

Why should we know about general market direction?

Understanding market indices provides a macroscopic view of market conditions. It helps investors identify trends, anticipate market movements, and align their strategies with the prevailing direction. probability of success depends on open general market direction

What factors influence the stock price movement?

50% index and reaming sector and stocks own strength

- Knowing the general market direction is critically important. The bottom line is that most stocks follow the market’s general direction.

- What you need to know is that in a bull cycle, breakouts work with a very high probability. Breakouts can still work in bear cycles, but the probability of success is much lower.

- It doesn’t matter how good a stock’s fundamentals are or how well it has accumulated over the last several months. If the index falls, the majority of stocks follow the index. A great case in point would be corona pandemic, even though the fundamentals never changed.

- Buying breakouts can be riskier when the market is in a bear cycle or correction. Generally speaking, in a bear cycle, you want to be very careful, keeping positions smaller and stopping loss orders tighter.

Different setups work in different market trends.

You will get different results if you do the same things repeatedly. Do you know why? Because the general market condition is constantly changing. This is the big secret of financial markets. Nothing works all the time. Different setups work in different general market conditions. Everyone makes money in a bull market. Not everyone makes money when the market goes into pullback or a range-bound, choppy mode. A skilled trader is able to adapt to changing general market conditions.

- One of the primary objectives of market analysis is to identify the prevailing market direction. Understanding whether the market is in a bull, bear, or sideways phase empowers investors to align their strategies accordingly.

- Adjusting your trading strategy based on market conditions is crucial for adapting to different environments and maximizing the probability of successful trades.

How each type of general market trend influences swing trading

1. Bull Market:

- Strategy: Focus on buying opportunities with stocks exhibiting strong upward momentum.

- Adjustments:

-

- Consider trend-following strategies like buying breakouts or pullbacks.

- Look for fundamentally sound stocks with positive growth potential.

- Employ trailing stops to capture profits while allowing room for the trend to continue.

2. Bear Market:

- Strategy: Shift towards defensive strategies, such as short-selling or holding cash.

- Adjustments:

-

- Consider short-selling stocks or using inverse ETFs to profit from declining prices.

- Focus on high-quality defensive stocks, such as those in healthcare or utilities.

- Implement strict risk management with tight stop-loss orders to protect against sudden market rebounds.

3. Sideways (Range-Bound) Market:

- Strategy: Adapt to price oscillations within a defined range.

- Adjustments:

-

- Implement range-bound strategies, buying near support levels and selling near resistance levels.

- Utilize technical indicators like RSI to identify overbought or oversold conditions within the range.

- Consider options strategies, such as selling covered calls or cash-secured puts.

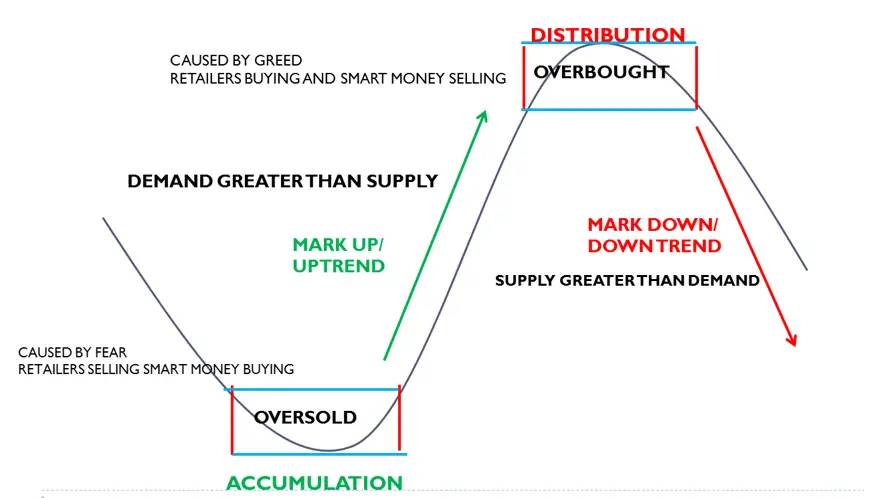

4. Trend Reversals: early market cycle

- Strategy: Be cautious during potential trend reversal points.

- Adjustments:

-

- Confirm reversal signals with multiple indicators or patterns.

- Consider reducing position sizes until the reversal is confirmed.

- Shift from trend-following to range-bound strategies until a new trend is established.

Remember that market conditions can change rapidly, and flexibility is key. Regularly reassess your strategy based on the evolving market environment, and be willing to adapt to new trends and developments.

2. Risk Management:

Market analysis plays a pivotal role in assessing overall market risk. It allows investors to diversify portfolios, set realistic expectations, and implement effective risk management strategies to safeguard their investments. How?

- Position sizing is highest in favorable market conditions and lowest in unfavorable market conditions

- Reducing position sizing in late/extended market moves (after 3 base)

So, knowing when the market conditions are good or bad for your style of trading is a great strategy

3. Timing of Trades:

Successful trading is about what to buy and when to buy. Market analysis aids in timing entry and exit points, ensuring that investors capitalize on favorable market conditions while avoiding potential downturns.

- You can avoid a fresh buying position if you expect a bearish pb/reversal.

- Consider reducing position sizes until the bullish reversal is confirmed

- If confirmed, the uptrend can take a long position

How to Study:

Using

- technical analysis

- sentiment analysis (heartbeat of the market)

1. Technical Analysis:

Technical analysis involves studying historical price and volume data to predict future price movements. Key indicators include moving averages, RSI, MACD, and chart patterns. Technical analysis is particularly useful for short to medium-term traders. For technical analysis, check the respective topics:

- technical analysis series

- volume analysis

- price action analysis course

- chart pattern analysis

- supply and demand analysis

- Order block trading system

Let’s find the trend of the general market (trend identification)

Trend identification using swing

Stage analysis is an approach to market analysis that involves identifying different stages in a financial instrument’s price movements and trends. This analysis helps traders and investors make informed decisions based on the current stage of the market cycle. Combining stage analysis with swing structure analysis enhances the precision of market entry and exit points. Here’s a guide on using stage analysis with a swing structure:

For complete details, check this article: Market Structure

- What is the Market Structure in Trading?

- Principles of Market Structure

- Elements of the Market Structure

Trend identification using moving average

- 20dma for short-term trend

- 50dma for midterm trend or 10wma

- 200dma for long-term trend or 40wma

Break Follow-through of key moving average changed the respective trend

The above example shows a change in the trend from bullish to bearish.

Summary

Some say that discipline and risk management are the solutions to all trading challenges, but they will not help you if you trade a setup without an edge in the current market.

- Informed Decision-Making: Market analysis equips investors with the knowledge needed to make informed decisions.

- Risk Mitigation: Understanding overall market conditions allows for better risk management.

- Timing Advantage: Investors gain a timing advantage by aligning strategies with the prevailing market trend.

Conclusion:

In conclusion, general market analysis is the compass that guides investors through the intricate landscape of financial markets. Whether you are a swing trader, a long-term investor, or a market enthusiast, mastering the art of market analysis is a continuous journey. Stay informed, adapt to changing conditions, and use market analysis as a tool to navigate the complexities of the financial world. Happy investing!

The one major thing that can drastically improve your trading edge is learning to recognize changes in general market conditions and adapt to them quickly. Different setups work in different market conditions. Knowing what works and what doesn’t work in each general market condition is 80% of the battle.

FAQ

Certainly! Here are answers to some frequently asked questions (FAQs) related to general market analysis:

What is the primary goal of market analysis?

The primary goal of market analysis is to gain insights into market trends, direction, and conditions. It helps investors and traders decide when to enter or exit positions and manage risks effectively.

Why is it important to consider both technical and fundamental analysis in market analysis?

Technical analysis provides insights into price movements and trends, while fundamental analysis assesses the underlying financial health of assets. Combining both approaches offers a more comprehensive view, helping investors make well-rounded decisions.

How often should I conduct market analysis?

The frequency of market analysis depends on your trading or investment strategy. Active traders may perform daily analyses, while long-term investors might do so less frequently. Regular reviews, especially during significant market events, are essential.

What role do economic indicators play in market analysis?

Economic indicators provide crucial information about the health of an economy. Investors analyze indicators like GDP growth, employment rates, and inflation to understand broader economic trends, which can impact financial markets.

How can I stay updated on global factors influencing the market?

Stay informed through reputable financial news sources, follow central bank announcements, and monitor international economic reports. Social media and financial websites can also provide real-time updates on global events.

Can market analysis help identify potential investment opportunities?

Yes, market analysis is instrumental in identifying potential investment opportunities. By understanding market trends, investor sentiment, and economic conditions, you can spot assets with growth potential and favorable risk-reward profiles.

How does market analysis contribute to risk management?

Market analysis helps assess overall market risk, allowing investors to diversify portfolios and set risk-appropriate position sizes. It also aids in identifying potential market reversals, enabling timely adjustments to mitigate losses.

Can market analysis be applied to different trading styles, such as day trading and long-term investing?

Yes, market analysis is versatile and can be adapted to different trading styles. Day traders may focus on short-term trends, while long-term investors use analysis to identify fundamentally sound investments.

How can I mitigate emotional decision-making in market analysis?

Develop a disciplined approach by sticking to a predetermined trading plan, setting realistic goals, and using risk management techniques. Having a clear strategy and staying informed can help reduce emotional decision-making.

In this article, I try to explain A Comprehensive Guide to General Market Analysis. I hope you enjoy this A Comprehensive Guide to General Market Analysis article. Please join my Telegram Channel, YouTube Channel, and Facebook Group to learn more and clear up your doubts. Please watch the following video on my YouTube Channel for a better understanding.