Back to: Trading with Smart Money

Trading with Sideways Price Action Area

In this article, I will discuss the two approaches to Trading with a Sideways Price Action Area in detail. Please read our previous article, in which we discussed the Pin Bar Trading Strategy. As part of this article, we will discuss the following pointers.

- Two approaches to trading with a sideways price action area

- How enter?

- How to exit?

- Odd enhancer

How Do We Trade with SIDEWAYS Price Action Area Break Out?

A minimum of three candles are required for a sideways price action area break out.

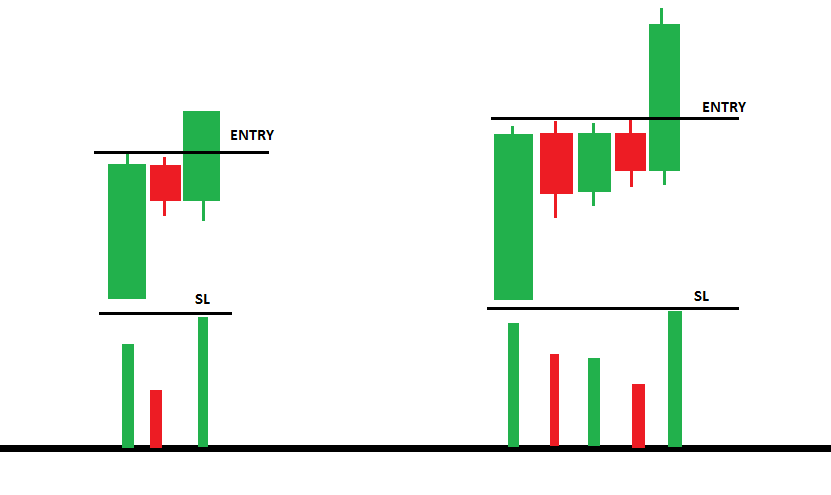

Here are two approaches to trading the breakout designed to minimize risk:

- Buy the initial breakout when the conditions are right

- Buy the retracement to the breakout when you need confirmation

Break Out Condition

Now that you know TWO tactical approaches to trade the breakout, let’s look at how to recognize which OR breakouts are the best to trade. Again, I’ve created a quick checklist for evaluating a stock’s price and volume action. Remember, these criteria are used to find stocks likely to lead to a successful breakout and to define good risk points based on the stock’s price and volume action.

- For bullish breakouts. look for a price to hug the top-of-the-range

- The quicker you enter a range breakout trade, the better.

- Trade with the trend. In a bear market, downward breakouts tend to make more money than upward breakouts in intraday trading. In bull markets, upward breakouts make more money.

- For upward breakouts, trade only those situations where the price most often closes above the middle of the opening range. Downward breakouts from the opening range do best when the price often resides below the range’s midpoint.

- There is no resistance above breakout of the bullish breakout

- Break out with volume

- After the breakout, the stock exhibited bullish price action for the up breakout.

Trade set up 1: For Opening Sideways Price Action Breakout

Logic: 1st candle of the day should be a heavy volume

Why heavy volume on the first candle of the day?

We are trying to identify the SM sentiment for the day. If Smart Money wants to buy stock, we would see that on the open with heavy volume and a strong directional move. The stock may gape at the opening, which shows that it may trend up the rest of the day.

Open = low of the first candle indicates SM is strongly bullish

1st candle having a lower wick indicates the price tray to move down, but Smart Money enters to drive the price higher

- 1st 5-minute candle should be a wide range candle with a low wick or no wick with volume

- Stock in an uptrend with price above new demand

- The next candle/candles should be inside candle be a doji or a shooting star or narrow-range candle with less volume

- The range stays within the top 2/3rd of 1st candle

Odd Enhancer

Avoid if

- Price extended from 20ma on entry time frame ( I am using 5 minutes)

- Sideways pa area volume is almost equal or more relative to the first candle

- Entry time frame not trading just above demand or supply on a higher time frame

- Less than a 3 to 1 reward-to-risk ratio to target on the chart

3 action steps:

➡ Buy 1-2 cents above the second candle, preferably a Doji or shooting star if playing long. The opposite of playing short.

➡ Upon entering your place, stop loss 2 cents below 1st candle or low of the last swing low

➡ Target is 2R

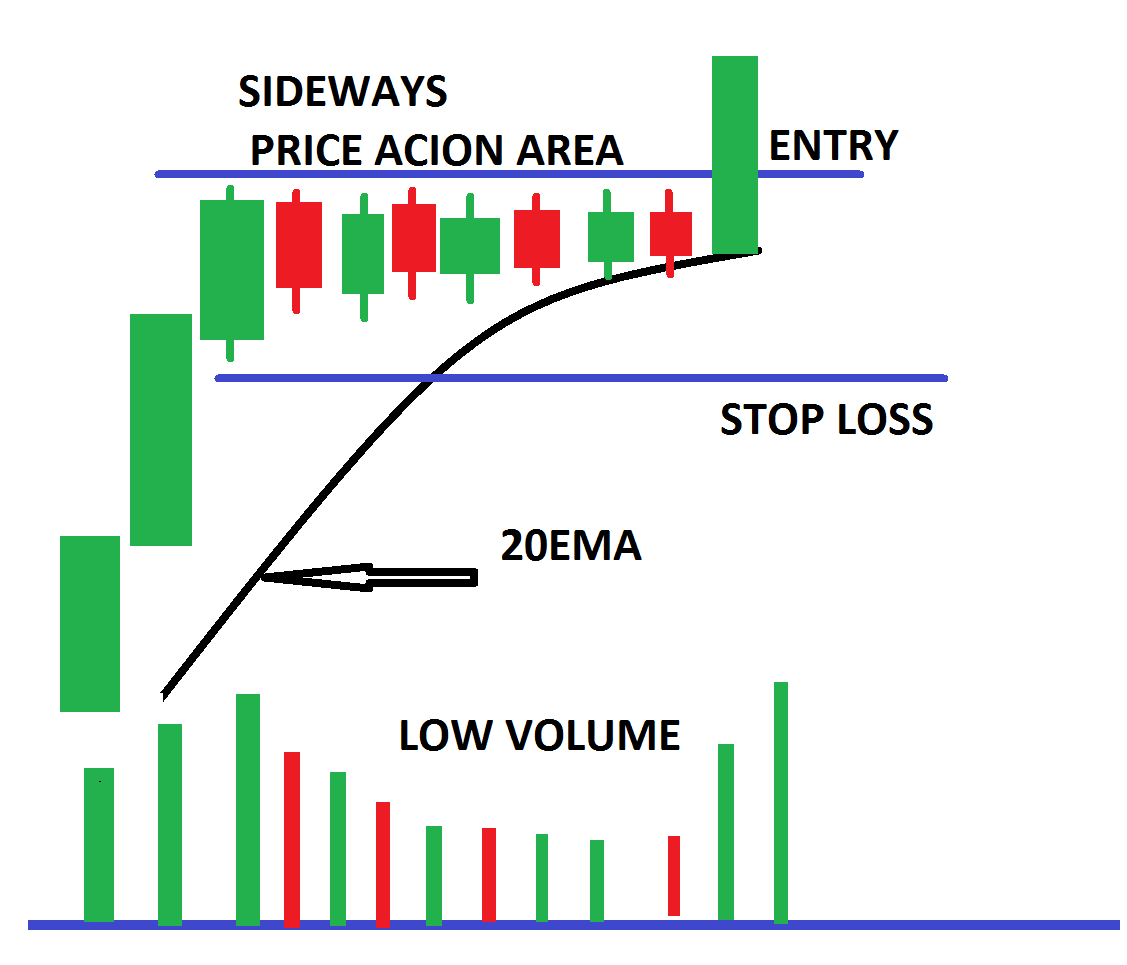

Trade set up 2: Pull back Break Out

SEE THE PULLBACK FOR CONFIRMATION

SMART MONEY ALWAYS BUYS FROM VWAP OR AROUND VWAP IF THEY WANT TO BUY

See the pullback to VWAP OR 20 EMA. If the price pullback to VWAP EMA but is unable to push and hold below VWAP, indicating that the buyer’s strength

Pullback condition

- Low volume

- Lower wick

- NARROW RANGE CANDLE

ODD ENHANCER

Avoid if

- Already traded to target on a bigger time frame

- Sideways pa area volume is equal or more relative to the first candle.

- Less than a 2 to 1 reward-to-risk ratio to target on the chart

Let’s do an example

Big picture

ON A DAILY TIME FRAME

On a daily the uptrend

HIGHER TIME FRAME ANALYSIS

ON 30MINUES OR HOURLY TIME FRAME

TRADING TIME FRAME

I am using entry-exit for a 5-minute time frame

Sideways markets can offer numerous trading opportunities due to the predictability of price bouncing between support and resistance. However, it’s important to recognize that ranges don’t last forever, and the market can break out in either direction. Hence, staying nimble and having clear rules for managing such transitions is critical. Always be aware of market news and events that can cause a range to end and a new trend to begin.

In the next article, I will discuss the Pullback Trading Strategy in detail. In this article, I explain the two approaches to Trading with Sideways Price Action Area in detail. I hope you enjoy this article. Please join my Telegram Channel, YouTube Channel, and Facebook Group to learn more and clear your doubts.

Registration Open – Microservices with ASP.NET Core Web API

Session Time: 6:30 AM – 8:00 AM IST

Advance your career with our expert-led, hands-on live training program. Get complete course details, the syllabus, registration, and Zoom credentials for demo sessions via the links below.

YOUR TEACHING IS VERY MUCH LUCID , PERFACT & COMPLETE IN ALL E.

I HAVE BEEN CHEATED IN COACHING , ON-LINE LEARNING .

BUT YOUR SITE PROVIDED ME ALL RELEVENT KNOWLEDGE.

I SHALL REMAIN THANKFULL TO YOU EVERYTIME .

IF YOU HAVE SLIDE ON P & F CHART OR ANY OTHER INFORMATION REGARDING TRADE ,

I SHALL LIKE TO STUDY THAT TOO.

ONCE AGAIN MANY MANY THANKS TO YOU . YOU HAVE SHAPED MY WRONG KNOWLEDGE TO PERFACT TRADER . BEFORE THIS I WAS GAMBLER.

MY MAIL. raviprakash4545@gmail.com

Thank you for your good knowledge share with us

Never seen such an excellent training whether in paid course or free. Kudos to Teacher for sharing

Very depth , perfect and complete knowledge . Even paid course dont give such knwoledge.

I will be very thankfull to you. Thank you so much sirji.

You give me direction.