Back to: Trading with Smart Money

How to Select Stocks for Intraday Trading

In this article, I will discuss Stock Selection for Intraday Trading, i.e., How to Select Stocks for Intraday Trading, in detail. Please read our previous article, where we discussed how to make your own day trading scanner step by step. As part of this article, we will discuss the following pointers in detail related to intraday stock selection.

- Rules for Stock Selection

- 3 Stock Selection Methods

- With Live Example

Why do most traders fail to pick the right stock?

- They pick randomly on tips from social media or news

- They don’t prepare before the market open

Rules for Stock Selection in Intraday Trading

Price Structure = Trend (avoid ranging market)

Trade active stock=high volume and high open interest build up (smart money active on these stocks)

The momentum of the stock = Strength & Continuity of the move (previous day candle)

Stock Selection for Intraday Trading Types

- Breakout trading

- Momentum trading

- Pullback reversal trading

How Do We Select Stocks for Intraday Trading?

Generally, three methods of stock selection for intraday trading

- Aftermarket closed

- Live market stock selection

- News or result-based stock selection

Aftermarket closed

Aftermarket closed stock selection

- Based on the end of the day (EOD) data

- Based on breakout

Based on EOD data

Here, we have to select stocks based on

- High volume

- High Open interest

- Top gainer and top looser

Step to find high volume, high open interest, or top gainer/loser stock

Step 1: We have to find a stock that shows an increase in open interest with increasing volume at the end of the day (EOD). Suppose we find some 10 stocks with both bullish and bearish data from our scanner

How to Make Your Own Day Trading Scanner

Step 2: then we check where the action is happening in the chart

Step 3: If price action indicates bullish or bearish behaviors, we keep it on our watch list. If the index and sector indicate positive. we prefer only bullish stock

Step 4: aftermarket open if our system tells us to buy, then we will go long in that stock

Let’s do this with an example

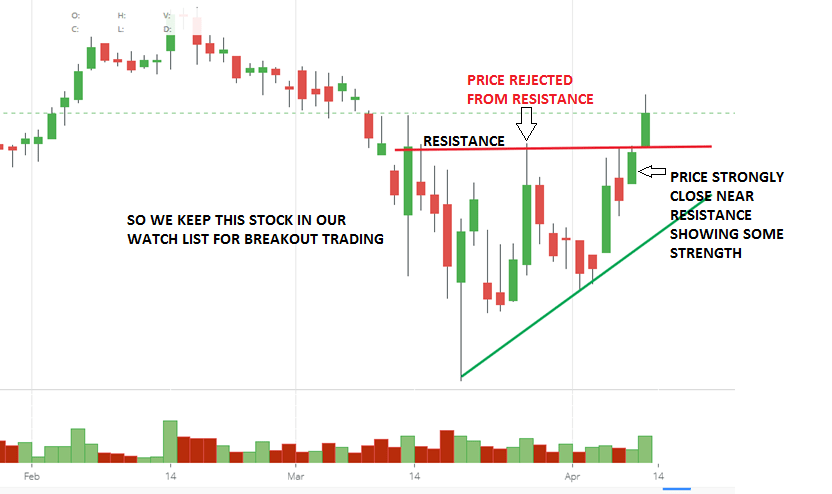

Based on breakout

Time frame hourly or daily

The breakout means a price breakout from any

- Support or resistance

- Trend line

- Chart pattern

This method takes time. As we have to find out manually in our chart

Chart Patterns like

- Rectangle

- Wedge

- Triangle

- Flag

- Cup & Handle

- Tight trading range

Live market Stock Selection For Intraday Trading

There are two methods to select stocks from the live market

- Pre-market stock selection for intraday trading

- After 15 of the market open

Premarket Stock Selection For Intraday Trading

- First, select FO stock

- Check market sentiment(Check advance-decline ratio )

- Generally, I trade only gap-up or gap-down stock from pre-market stock selection

- Pick a stock and check-in chart

Let’s do it with an example

Live Market Stock Selection

After 15 market opens, find

Step 1: Find the Top gainer /looser from the NSE site

Step 2: Check the premarket volume

Step 3: See the activity for the last 2/3 days and draw the support and resistance line.

Step 4: Wait for the pullback to entry(pullback entry strategy)

News-based/result-based (no technical analysis work)

We get the news from the MONEY CONTROL APP

- WHAT CHANGES WHILE YOU ARE SLEEPING

- STOCK IN NEWS

In this article, I explain How to Select Stocks for Intraday Trading with examples. I hope you enjoy this article on stock selection for intraday trading. Please join my Telegram Channel, YouTube Channel, and Facebook Group to learn more and clear your doubts.

Please I did not understand your video on Google scanner

Sir good evening. . Sharemarket started 2014 till now .not confidence buy or sell the trades. Not profits only loses.can you help me sir please.

Need Intraday tips Sir.

M : 96012 73838

Thanks

thank you sir.

Superior teaching . keep it up

How to get in touch with you

Nicely explained with pictorial view. Great work. Keep it up.