Back to: Trading with Smart Money

How to Trade with Support and Resistance

In this article, I will discuss how to Trade with Support and Resistance. Please read our previous article about Head and Shoulder Patterns in Trading. We will also discuss the following pointers in detail.

- What are Support and Resistance?

- How to Trade with Support and Resistance?

- The Psychology Behind Support and Resistance

- Support Resistance Level vs Zone.

- Types of Support and Resistance.

- Multiple Time Frame Support and Resistance.

- Where are Support and Resistance Formed?

- Strength of Support and Resistance

- When Do Support and Resistance Break?

What are SUPPORT AND RESISTANCE?

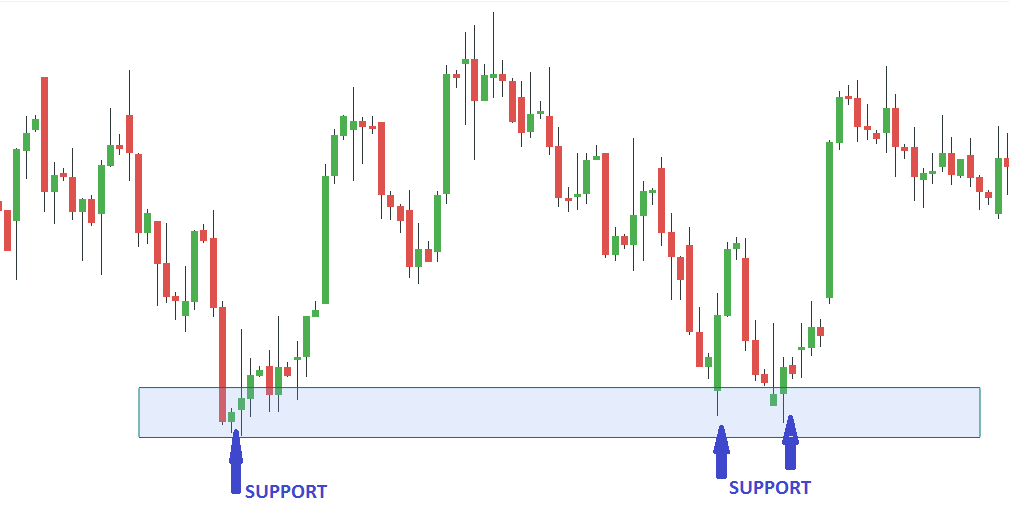

SUPPORT

Support, such as “buying, actual or potential, sufficient in DEMAND to halt a downtrend in prices for an appreciable period,” possibly reverse it and start prices moving up again. Fair price for buyers and risk to reward is more.

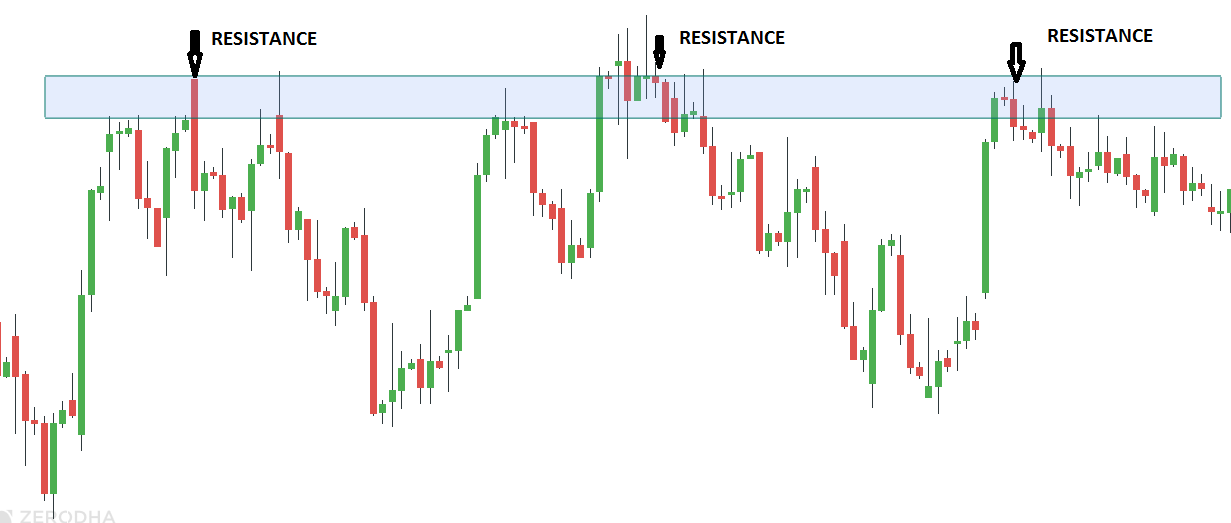

RESISTANCE

Resistance is the selling, actual or potential, insufficient supply to keep prices from rising for a time and possibly turn back its uptrend. Fair price for sellers and risk to reward is more.

FLIPPING

These price levels constantly switch their roles from support to resistance and from resistance to support. A former resistance, once it has been surpassed, becomes a support zone in a subsequent downtrend; and old support, once it has been penetrated, becomes our resistance zone in a later advancing phase.”

Why are Support and Resistance important?

These points are not random; the market creates them. They represent momentary changes in demand and supply forces. The bulls could not move the market above the swing high. This means that at that point in time, no one was willing to offer a price higher than the swing high, and traders saw no value above the swing high.

Hence, subsequently, when the price moves close to near or above a wing high, we must remember that traders saw no value in buying above that point previously. Assuming that most traders have not changed their opinions, prices are unlikely to move above the swing high. Effectively, the swing high marks a price area that prevents the market from moving up. This is what we call a resistance area. Reverse for support area.

Once the structure of the market know, then find which phase the market is currently in (accumulation or distribution or up or down)

The Psychology of Support and Resistance

To illustrate, let’s divide the market participants into three categories: the longs, the shorts, and the uncommitted. When the price comes to the support level/

- The longs are those traders who have already purchased contracts;

- The shorts are those who have already committed themselves to the sell-side;

- The uncommitted are those who have been out of the market or remain undecided about which side to enter.

Traders who fear missing out would enter their trades when the price comes close to Support to get at a low price. And if there’s enough buying pressure, the market would reverse at that location.

Let’s assume that a market starts to move higher from a support area where prices have been fluctuating OR accumulating for some time.

The longs are delighted but regret not having bought more. If the market retraced near that support area again, they could add to their long positions.

Now that they are on the wrong side of the market, the shorts are hoping (and praying) for a dip back to the area where they went short so they can exit the market where they got in (their break-even point).

The final uncommitted group now realizes that prices are increasing and resolves to enter the market on the long side on the next good buying opportunity.

All four groups are resolved to “buy the next dip.” They all have a “vested interest” in that support area under the market. If prices decline near support, renewed buying by all four groups will increase prices.

Now, let’s turn the tables and imagine that instead of moving higher, prices move lower. In the previous situation, because prices advanced, the combined reaction of the market participants caused each downside reaction to be met with additional buying (thereby creating new support). However, if prices drop and move below the previous support zone, the reaction becomes the opposite. All those who bought in the support zone now realize they made a mistake.

All of the factors that were supported by the three categories of participants—the longs, the shorts, and the uncommitted—will now function to put a ceiling over prices on subsequent rallies or bounces. Similarly, all previous buy orders under the market have become sell orders over the market. The support zone has become a resistance zone.

Support and Resistance Level and Zone

Support and Resistance Levels are more detailed, and the levels are different within the zone. The level is one line, and the Zone is a Zone. In practice, support and resistance and supply and demand zones are formed from the same origin.

Support and Resistance are areas and not lines

Why?

Because you’ll face these two problems:

- Price undershoot, and you miss the trade

- Price overshoot and you assume support and resistance are broken

Let me explain…

Price “undershoot,” and you missed the trade. This occurs when the market comes close to the support and resistance line but not close enough.

Then, it reverses back in the opposite direction. And you missed the trade because you were waiting for the market to test your SR level. This price reversal is also called 123 reversals. Or holding a higher level of support or lower level of resistance. THIS GENERALLY OCCURS DUE TO THE AGGRESSIVE BUYERS AND SELLERS.

An example: OF PRICE UNDERSHOOT

Price “overshoots” and assumes support and resistance are broken

This happens when the market breaks support and resistance levels, and you assume it’s broken. Thus, we trade the breakout but only to realize it’s a false breakout. THIS TYPE OF PRICE ACTION IS CALLED UPTHRUST AND SPRING

Let’s DO AN EXAMPLE OF PRICE OVERSHOOT

So, how do you solve these two problems?

Simple, Support, and Resistance are areas on the chart, not lines.

How to draw support and resistance zone

A two-step process to find SR ZONE

- Step 1: Switch to a line chart and mark the line with the rejections.

- Step 2: Again switch to the candlestick chart, mark the high or low of the candle near the marked line, and make the zone.

Let’s do an example of drawing an SR zone

TYPES OF SUPPORT AND RESISTANCE

- Horizontal

- Dynamic(moving average)

- Trend line

LET’S FIND ALL THE ABOVE SUPPORT AND RESISTANCE IN A SINGLE CHART

Timeframe SUPPORT AND RESISTANCE

- The power of support and resistance depends on the time frame we are considering. The longer the time frame, the higher the probability of it working.

- Through all the timeframe support and resistance work, the rewards grow the higher the timeframe is

- There is more noise in the lower time frame chart.

Using the higher time frame and top-down analysis, put more weight on the higher time frame SR level.

To focus on major support and resistance levels, first, find them on higher time frames before applying them to your trading time frame for analysis.

For example, you can note the support and resistance levels from the weekly chart. Then, plot them on the daily chart to find trading opportunities. This method keeps you focused on important support and resistance levels instead of flooding your chart with dozens of potential support and resistance levels.

WHERE SUPPORT AND RESISTANCE DEVELOPED?

- The first point of support in any time frame is the prior bar’s high

- The first point of resistance in any time frame is the prior bar’s low

- The second points of support and resistance are pivot points(swing high and swing low)

- Consolidation area

- Rejection from an area

- Previous has acted as both support and resistance

- Gap(invisible tail), EMOTIONAL POINT

- Fibo retracement

- Trend line and MA

Rejection from an area

THE LAST SWING IS HIGH, AND THE LAST SWING IS LOW

Swing highs and swing lows are market turning points. They are natural choices for projecting support and resistance zones.

CONGESTION AREAS

Smart money has spent a prolonged time in the congestion area, establishing actual trading interests within that price range. Hence, earlier market congestion areas are reliable support and resistance zones.

MA AND FIBO RETRACEMENT

You can also derive support and resistance from the moving average. They work best in trending markets.

Fibonacci retracement is a popular method for projecting support and resistance. We can easily mark out retracement levels. Hence, Identify major market swings and focus on the retracement of the move by a Fibonacci ratio. Generally, Fibonacci ratios include 23.6%, 38.2%, 50%, 61.8%, and 100%.

FLIPPING OF SUPPORT/RESISTANCE

Flipping acts as both support and resistance. Support can turn into resistance, or resistance can turn into support. When the price breaks through a resistance level, it shifts power from sellers to buyers, and the resistance level becomes support.

How strong support and resistance

Many factors should be considered in determining how significant or strong the support or resistance level will be. These factors are as follows:

- The number of occurrences. The first time retracing to the area is strong.

- Volume. The higher the relative volume is at a particular price level, the more likely it is that the price level will become significant support or resistance.

- How did the price leave the level? The stronger the price moves away from a zone, the more out-of-balance supply and demand are at that zone. Smart money places a heavy order.

- How much time did the price spend at the zone? The less time the price spends at a zone, the more out-of-balance supply and demand are at the price level. Smart money aggressively enters when prices retrace, and the level is tested in the future.

- How far did the price move away from the zone before returning back to the zone? The farther the price moves away from a zone before returning to that zone, the greater the reward to risk and probability.

When support and resistance break

And even when prices start to falter in the higher region of the chart, bulls are technically still in control as long as they manage to keep the market up at levels higher than or equal to a former significant low. However, the stronger the earlier dominance, the less likely the market will turn on any first reversal attempt.

- Support tends to break into a downtrend

- Resistance tends to break into an uptrend

- Support and Resistance tend to break when there is a tight range at the SR level.

- The more/frequent test of support resistance weakens this level and breaks the level.

The more times Support or Resistance (SR) is tested, the weaker it becomes and breaks the level.

Here’s why…

The market reverses at resistance because selling pressure pushes the price lower. The selling pressure could come from Institutions, banks, or smart money that trades in large orders.

Imagine this: If the market keeps re-testing resistance, these orders will eventually be filled. And when all the orders are filled, who’s left to sell?

It shows that participants are more aggressive in pushing/pulling the price to break the resistance/support. While the higher low toward resistance indicates aggressive by the buyers

LET’S DO AN EXAMPLE

Higher lows into Resistance usually result in a breakout (formed ascending triangle), and lower highs into Support usually result in a breakdown (formed descending triangle).

Resistance tends to break into an uptrend.

For an uptrend to continue, it has to break new highs consistently. So, shorting at resistance is a low-probability trade in an uptrend. Instead, going long at Support is a better trade or break out from the last high.

Support tends to break into a downtrend.

For a downtrend to continue, it has to break new lows consistently. So, going long at support isn’t a good idea in the downtrend. But going short at Resistance is a great idea, as well as a breakout from the last swing low.

Support and Resistance tend to break when there’s a tight range

Resistance is an area with potential selling pressure. So, the price should move up quickly.

Now… what if the price didn’t move down and instead consolidated at resistance?

What does it mean?

It was a sign of strength as the bears couldn’t lower the price. Perhaps there’s no selling pressure, or there is strong buying pressure. Either way, it doesn’t look good for the bears, and resistance will likely break. An example: the opposite of Resistance:

Trading with support and resistance is best done with other indicators and analysis techniques. Interpreting support and resistance levels accurately requires practice, and traders should always be prepared for the possibility that the market may not respect them.

In the next article, I will discuss Advanced Candlestick Analysis in Trading. In this article, I try to explain how to Trade with Support and Resistance in detail. I hope you enjoy this Trading with Support and Resistance article. Please join my Telegram Channel, YouTube Channel, and Facebook Group to learn more and clear your doubts.

Registration Open – Microservices with ASP.NET Core Web API

Session Time: 6:30 AM – 8:00 AM IST

Advance your career with our expert-led, hands-on live training program. Get complete course details, the syllabus, registration, and Zoom credentials for demo sessions via the links below.

thank you very much for good technical

Thank a lot for in depth analysis and in detail explanation….this article made my day…..Thanks

Waxaan rabaa inaan barto forex

Very well writtwn and covered all the points

Pls can you do your videos in English subtitles 🙏🙏.

Never seen such excellent training whether paid course or free. Kudos to Teacher

Good content ….it is useful to New traders

I believe this is the best box to understand and learn the pivot of stock markets, very well explained with very good examples.

Tha ks a ton for this learning content.