Back to: Trading with Smart Money

How to Make Your Own Day Trading Scanner

In this article, I am going to discuss how to make your own day trading scanner step by step. Please read our previous article where we discussed 3 Techniques for Risk Management in Trading. Here, you will learn how to get the stock market data, such as price, volume, and open interest data, using a Google Spreadsheet and how to analyze it. After reading this, you will be able to:

- Analyze the End of Data

- How do you create your own Google spreadsheet for data analysis?

- How do you use this sheet?

What is the end of data in stock?

This means what the price did on that day. It shows open, close, high, low, open interest, option chain data, etc.

Where to get this data?

After the market closed. NSEINDIA published this report in bhavcopy file

What to download?

Download the capital market bhavcopy file and the Derivatives market bhavcopy file. The link is given below

https://www1.nseindia.com/products/content/all_daily_reports.htm

How do you make your own Google spreadsheet scanner?

All the steps are described in the below video.

Use of scanner

- Can we predict the stock trend by analyzing the end of the data?

- Can we find stock for the next day?

What is contained in this sheet?

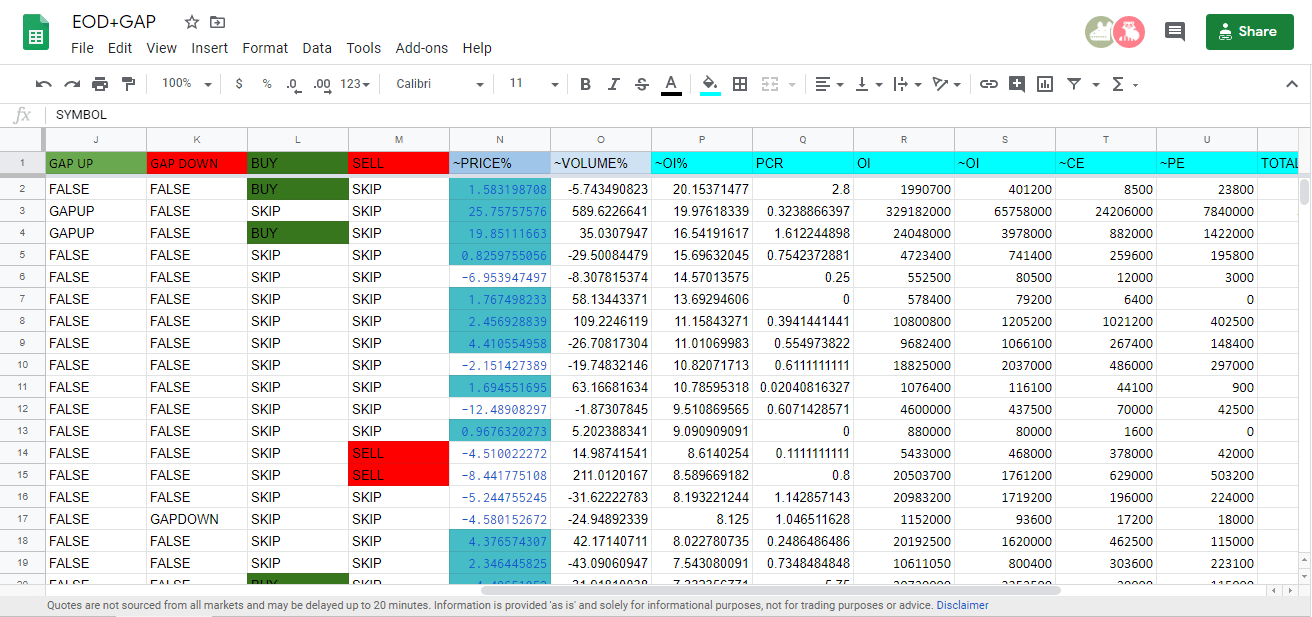

Buy/sell column

So, for long stock, it should have high volume, high OI, and PCR>1. So, we make our buy column by giving the above condition

Change in Volume and Change in the open interest column

If ultra-high volume, we find. Then something unusual happened. By checking the chart, we can determine whether the stock for tradable or not. Whether it breaks out from any support or resistance level with high volume. then we must keep it on our watch list

Change in price

Here, we will find the top gainer or top loser stock. Check the chart to see why the top gainer is a top loser.

Change in PCR column

Gap up and gap down the column

This column updates aftermarket open. Have a look at this sheet

How do I use this scanner?

Let me tell you some basic information.

For trading purposes, stocks with lower volumes and lower open interest should be avoided.

Why?

The analogy of volume and open interest in the market is like that of fuel to a fire. If the fuels are removed from a fire, the fire will go out. If fuel (volume and open interest) is removed from a price trend, the trend will change or move will stop. When open interest and volume decline, fuel is removed, and the prevailing price trend is running on borrowed time. For a healthy, strong price trend (either up or down) to continue, open interest and volume ideally should increase, or at least not decline.

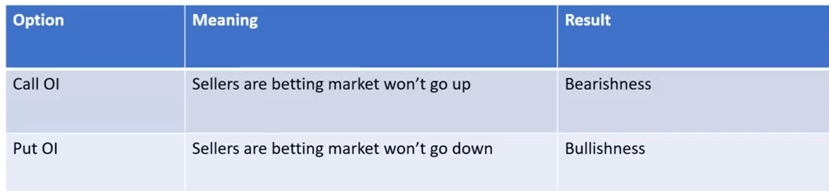

Option chain analysis

PCR=put to call ratio

Buy Rule: 1. Change in PCR(OI) is positive.

Sell Rule: 1. Change PCR(OI) is negative.

In the video, I explain live how to select stock for the next day based on day data analysis. Here is the list of stock that shows buy condition

Even our scanner shows buy condition. After the market opens, if our trading setup doesn’t tell, then I am happy to avoid trading.

Tips: If the index and sector are bullish, trade with strong stock on the bullish side.

In the next article, I will discuss How to Select Stocks for Intraday Trading with live examples. In this article, I try to explain how to make your own day trading scanner, and I hope you enjoy this article. Please join my Telegram Channel, YouTube Channel, and Facebook Group to learn more and clear your doubts.

Registration Open – Microservices with ASP.NET Core Web API

Session Time: 6:30 AM – 8:00 AM IST

Advance your career with our expert-led, hands-on live training program. Get complete course details, the syllabus, registration, and Zoom credentials for demo sessions via the links below.

i required Google spread sheet scanner (Excel Format) with formula so that i can find right stock for the day trading

please send it to my mail id praveen_npn@rediffmail.com

i required Google spread sheet scanner (Excel Format) with formula so that i can find right stock for the day trading

please send it to my mail id

Hi Sir,

What a wonderful explanation. It was easier to understand. However can you share the spreadsheet and formula to get live price against symbol in the spreadsheet?

Could you please share the spreadsheet scanner

HI

I am not able to get buy signal from the scanner rest all is fine can u mail me if possible the codes at cubenter@gmail.com

sir….could you please share spread sheet scanner @

ksridhara37@gmail.com

8884677516-watsup

i required Google spread sheet scanner (Excel Format) with formula so that i can find right stock for the day trading

please send it to my mail id connectmukesh1984@gmail.com

please share spread sheet scanner dsjack09@gmail.com

Dear sir share with me spread sheed (exal format) with Goole formula

Please share this Google sheet

Sir plz share Goole sheet

Sir plz share Goole sheet

rkp5532@gmail.com

i required Google spread sheet scanner (Excel Format) with formula so that i can find right stock for the day trading

please send it to my mail id kostastrader@gmail.com

Hello Sir, Pls send me Google spread sheet scanner

please send it to my mail id mooncadprojects@gmail.com

Hello sir please find out the Google Scanner video some problem please resolve as soon as possible thanks and regards Samrat Banerjee I am big fan of you

hi sir can you please share me this excel sheet ?

gmchiluka@gmail.com

Hi Sir

Appreciate if you could pl mail me spreadsheet at your leisure.. My email is

mac4nan@gmail.com

Thank you again. Kind Regards

Macnan

hi sir can you please share me this excel sheet ?

devsunil20@gmail.com

hi sir plz send excel sheet.. babuvinod895@gmail.com

required Google spread sheet scanner (Excel Format) with formula so that i can find right stock for the day trading

please send it to my mail id gyaderla.suresh.trade@gmail.com

Sir where to get Google spreadsheet some of the video is black near this

i required Google spread sheet scanner (Excel Format) with formula so that i can find right stock for the day trading

please send it to my mail id

jaylipsasamal@gmail.com

If Possible Pls share Google sheet to suri97775@gmail.com

Thanks & Regards

Photsn2014@gmail.com

Cam you send me this excel file on biplabn27@gmail.com

Hi sir, Could you send me the excel file to jivaro888@yahoo.es

Thanks a lot

sir please send me the spreadsheet scanner my email- majhi.rajat13@gmail.com

thankyou sir

Sir,Can you share spreadsheet?

You are extraordinary person which provide knowledge so openly.

Thanks

If you can share excel file, then please send it on the email.

Are you taking training and classes on market analysis?

Hello sir, how to i get this spreadsheet.

Hi sir please send excell sheet to vbnshares@gmail.com

Thanks for helping people like me

Request you to please share latest excel scanner to me with below columns. As i dont know if any formula is used in this column that could affect any result in scanner.

DBPDO

DBPDH

DBPDL

DBPDC

sir….could you please share spread sheet scanner @

hiren.suthar102@gmail.com

sir….could you please share spread sheet scanner

Thank you

Hi sir,

Please share scanner excel sheet…mukarrampharm@gmail.com

Appreciate…

i required Google spread sheet scanner (Excel Format) with formula so that i can find right stock for the day trading

please send it to my mail id : rheelgraphics@gmail.com

i required Google spread sheet scanner (Excel Format) with formula so that i can find right stock for the day trading

please send it to my email gillibene@gmail.com

Sir,

i required Google spread sheet scanner (Excel Format) with formula so that i can find right stock for the day trading

please send it to my mail id.

Regards

Hii sir,

Can you please provide me spread sheet, it will be your great help.

Hi sir, Could you send me the excel file to

sachin.apexint@gmail.com

Thanks .

i required Google spread sheet scanner (Excel Format) with formula so that i can find right stock for the day trading

please send it to my mail id dksonara@gmail.com

Sir

Kindly send intraday stock scanner spreadsheet which contain formulas inorder to select the right stocks for intraday trading to the following email I’d.

rajeevkumar.443@gmail.com

Thanks in advance sir.

Shoyonag.2015@ gmail

Kindly send intraday stock scanner spreadsheet which contain formulas inorder to select the right stocks for intraday trading to the following email