Back to: Trading with Smart Money

Top 3 Candlestick Patterns for Reversal Trades

By Pranaya Rout | June 8, 2025

In this post, I will explain the Top 3 Candlestick Patterns for Reversal Trades to predict price movements and maximize your trading profits effectively. Have you ever wished you could predict exactly when a trend is about to reverse? Imagine catching a trade right at the turning point, that’s where the biggest profits are! In today’s post, I will reveal the Top 3 Candlestick Patterns for Reversal Trades that every trader must know. Whether you are a beginner or a seasoned trader, learning how to spot the top reversal candlestick patterns will help you predict price movements and improve your trading strategy.

Table of Contents

- Introduction

- Why Reversal Candlestick Patterns Matter

- Understanding the Basics of Candlestick Patterns

- Top 3 Candlestick Patterns for Trend Reversals

- How to Trade Reversal Candlestick Patterns

- Using Volume to Confirm Reversal Patterns

- Common Mistakes to Avoid in Reversal Trading

- Pro Tips for Trading Candlestick Reversals Effectively

- Conclusion

- FAQs

Why Reversal Candlestick Patterns Matter

Reversal candlestick patterns provide early warning signs that the current trend is losing momentum and about to change direction. Reversal patterns are essential in predicting trend shifts. They help traders enter positions at the beginning of a new trend. They help you:

✔️Spot trend reversals before the crowd. Any indicator signalled after the price movement

✔️Enter trades at the best price for maximum gains.

✔️Minimize risk by identifying precise entry and exit points.

Master these patterns, and you’ll be able to catch reversals with confidence, avoiding the traps that most traders fall into.

Understanding the Basics of Candlestick Patterns

Before diving into the top reversal patterns, it’s crucial to understand candlestick anatomy:

The Anatomy of a Candlestick:

- Body: Represents the open and close prices.

- Wicks (Shadows): Show the highest and lowest price during the time period.

- Colour:

- Green/White: Indicates a bullish move (closing price is higher than the open).

- Red/Black: Indicates a bearish move (closing price is lower than the open).

Candlestick patterns reflect the battle between buyers and sellers at a specific moment in time, providing a glimpse into market psychology.

Top 3 Reversal Candlestick Patterns

Let’s jump into the top 3 most powerful candlestick patterns for reversal trades.

These are the top 3 candlestick patterns that signal potential bullish or bearish reversals. Recognizing them early can help you take advantage of market turning points.

1. The Hammer (Bullish Reversal Signal)

Structure: Small body (colour doesn’t matter), long lower wick doubles the body. Little or no upper wick. The candle range should be wider.

Meaning: A small body with a long lower wick showing rejection of lower prices or rejection of a price level. The hammer pattern reflects a shift in momentum from sellers to buyers, signaling a potential bullish reversal at the end of a downtrend, during a pullback in an uptrend, or at a demand zone. Pin bars with long wicks at key levels indicate price manipulation. The long wick indicates smart money testing liquidity before pushing the price in the opposite direction.

- ✅Rejection of Price Levels → Smart money stepping in.

- ✅Trend Reversal Signal → Strong rejection leads to the market turning.

- ✅False Breakout Warning → Price trapped traders before reversing.

Volume Tip: Higher volume boosts reliability.

Trading Strategy:

-

- Entry: Above the hammer’s high.

- Stop-loss: Below the hammer’s low.

Confirmation: high volume, at key level, or follow-through candle

A pin bar tells you that the market tried to move in one direction but failed, leaving a footprint of rejection—a powerful clue for reversal trades.

2. The Engulfing Pattern:

Structure: The 2nd candle closes above the first candle’s high (bullish engulfing pattern). Wide reversal candle pattern

Meaning: Buyers overwhelm sellers; a large green candle engulfs the previous red candle. It shows institutional buying. It signals a shift from bearish to bullish sentiment, indicating a potential reversal of the pullback or from the supply-demand zone or key level.

Volume Confirmation: High volume on the engulfing candle confirms strong buyer interest. The second candle should be accompanied by high volume, or volume expansion should be visible in any candle. Sudden volume spike confirms the buyer’s interest from a lower level

Trading Strategy:

-

- Entry: Above the engulfing candle’s high.

- Stop-loss: Below the engulfing candles’ low.

Confirmation: FOLLOWTHROUGH CANDLE

Trading Tip:

Powerful when appearing at key levels with volume confirmation

Pro Tip: If volume is lower, avoid the trade—smart money isn’t involved!

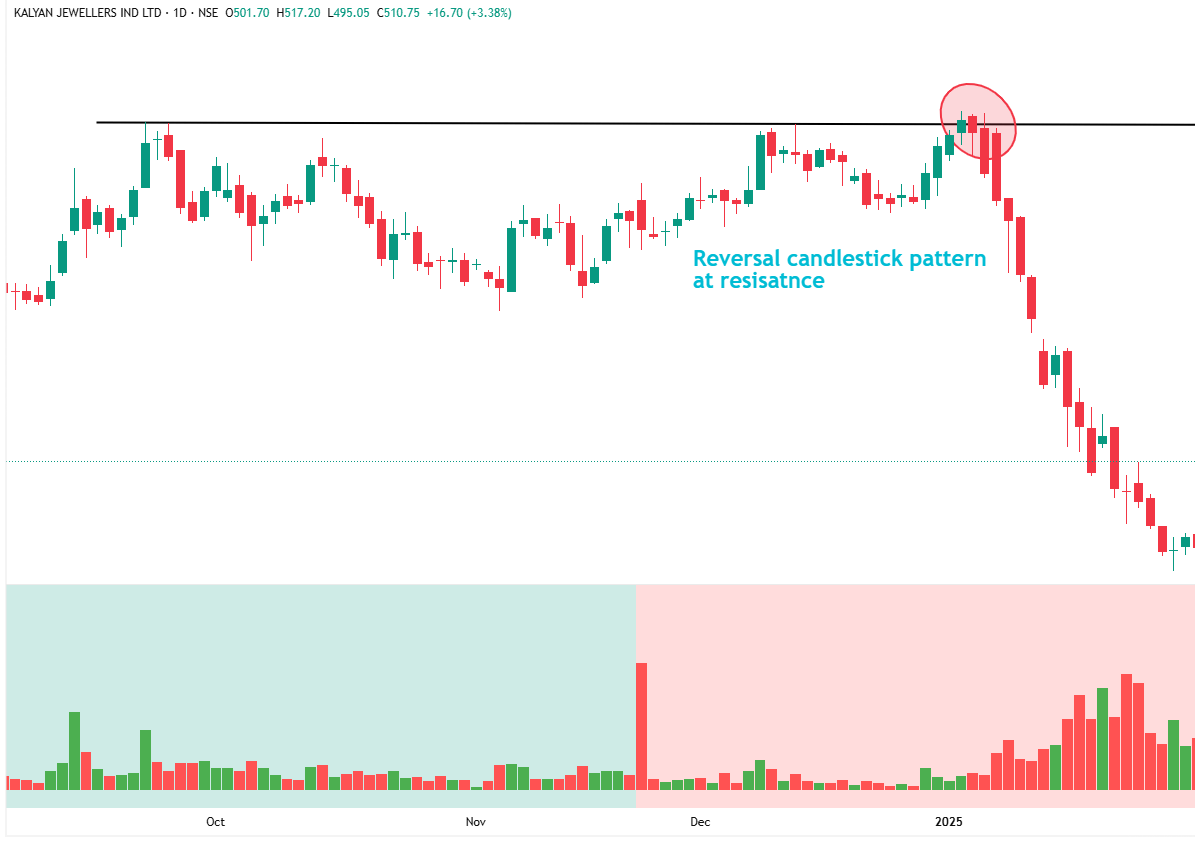

3. Candlestick Reversal Pattern

Bearish 3-Candlestick Reversal Pattern

The pattern consists of three candlesticks, which suggest a shift from bullish to bearish sentiment in the market.

- Meaning: Three-candle pattern showing trend reversal from bearish to bullish. Rejection of higher prices → Sellers gaining control. After a strong uptrend, this represents buyer exhaustion. Smart money begins to sell into the rally, preparing for a trend reversal.”

- Structure:

- green candle (uptrend) indicating the strength of the buyers,

- Small-bodied candle (indecision). Doji, inside candle, or narrow range candle

- Long red candle (bullish confirmation). Indicate momentum shift

Confirmation

- Bias changed with the momentum increase

- Volume confirmation. A spike in volume on the third bullish candle can support the validity of the reversal. Or volume increase

How to Confirm Reversal Patterns for Safer Trades

Spotting reversal patterns is just the first step—confirmation is key. Here’s how to confirm these trades for higher success rates.

- Key Market Levels: Support or resistance zones, trend lines, or moving averages.

- Volume spike reversal pattern: A high-volume spike during a reversal candlestick pattern indicates strong market participation, making the reversal more reliable. Checkmate/stopping /high volume

- Divergence: If the price is approaching a key level of support or resistance, but volume is declining, it may be a sign of weak momentum and potential reversal.

The more confirmations that align with your candlestick pattern, the higher your probability of success.

How to Trade Reversal Candlestick Patterns

Step-by-step:

- Identify areas where reversals are likely (support/resistance/trendline/ma).

- Watch for one of the top 3 candlestick patterns to form.

- Confirm with volume, momentum, or price action.

- Plan entry, stop-loss, and take-profit levels.

- Discuss risk-reward ratios and trade management strategies.

Notice how the bearish engulfing candle aligns perfectly with the key resistance zone and a volume spike? That’s a high-probability reversal trade right there.

Pro Tips for Reversal Trading Success

Before we wrap up, here are some pro tips to help you master reversal trading like a pro.

✅ “Always wait for candle close confirmation—don’t anticipate moves.”

✅ “Combine reversal patterns with trendline breaks for extra validation.”

✅ “Use tight stop-losses—reversals can fail without proper confirmation.”

✅ “Be patient—the best reversals take time to form.”

🚫Common Mistakes to Avoid in Reversal Trading

❌Ignoring Market Context: Always consider the overall trend and support/resistance levels.

❌Trading Without Volume Confirmation: Volume is essential for confirming the strength of the reversal.

❌Rushing into Trades: Wait for a confirmation candle before entering any trades.

❌Overtrading Minor Patterns: Stick to the most reliable patterns at key levels.

FAQs

What are the most reliable candlestick patterns for reversals?

The Bullish Engulfing, Bearish Engulfing, Hammer, Shooting Star, and Doji are considered some of the most reliable candlestick reversal patterns.

How do I confirm candlestick reversal patterns?

Volume confirmation is key. A high-volume spike during the reversal pattern increases the probability of a successful trade. Always wait for a confirmation candle before entering.

Can candlestick reversal patterns be used for long-term trends?

Yes! Candlestick patterns are effective on any timeframe, from intraday to long-term charts. For long-term trends, focus on multi-timeframe analysis and strong patterns at key levels.

How can I improve my accuracy in reversal trading?

Combine candlestick patterns with volume analysis, trend analysis, and risk management strategies for improved accuracy and consistency in your trades.

Conclusion

Candlestick patterns are powerful tools for predicting market reversals. By mastering the top 3 reversal patterns, you’ll be able to:

- Identify market turning points before the crowd.

- Confirm trends with volume for higher accuracy.

- Execute high-probability trades at optimal entry points.

In this article, I explain the Top 3 Candlestick Patterns for Reversal Trades to predict price movements and maximize your trading profits effectively. I hope you enjoy this article and gain a better understanding of the Top 3 Candlestick Patterns for Reversal Trades. Please join my Telegram Channel, YouTube Channel, and Facebook Group to learn more and clear your doubts.

Registration Open – Mastering Design Patterns, Principles, and Architectures using .NET

Session Time: 6:30 AM – 08:00 AM IST

Advance your career with our expert-led, hands-on live training program. Get complete course details, the syllabus, and Zoom credentials for demo sessions via the links below.

- View Course Details & Get Demo Credentials

- Registration Form

- Join Telegram Group

- Join WhatsApp Group

sir I have seen you giving importance to the 3 candlestick reversal pattern. like in many videos u hv said for egs after breakout candle if the next two candles closes below breakout candle than its a failed BO or can be a reversal. So do we hv to give more imp to 3 candle reversal pattern than the other two ?