Back to: Trading with Smart Money

Market Structure in Trading

In this article, I will discuss Market Structure in Trading. It is the second part of Technical Analysis. Please read our previous article, where we discussed Technical Analysis Part 1. At the end of this article, you will understand the following pointers.

- What is the Market Structure in Trading?

- Principles of Market Structure

- Elements of the Market Structure

What is Market Structure in Trading?

- Market structure gives us bias for trading opportunities. In the bull market, we always look to buy dips.

- Range market we look for buy low sell high

Principles of Market Structure

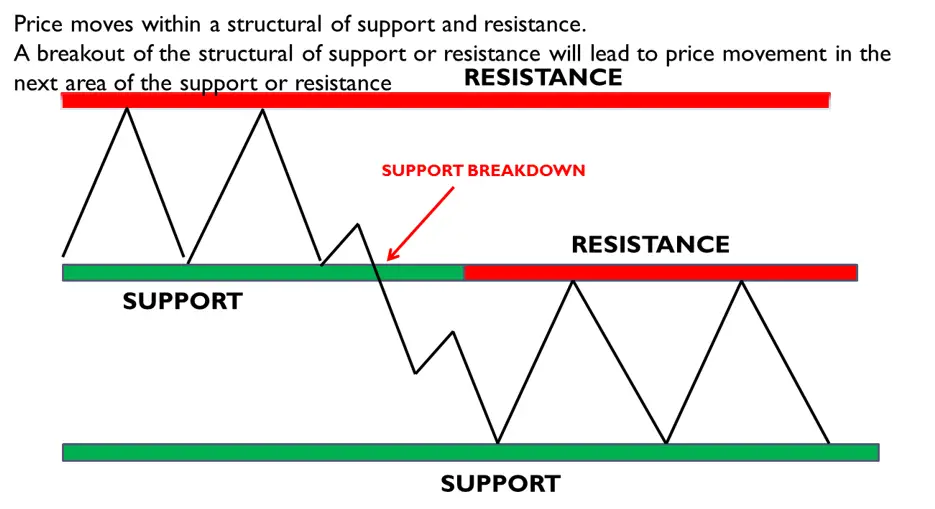

- Price moves within a structural of support and resistance.

- A breakout of the structural of support or resistance will lead to price movement in the next area of the support or resistance.

Elements of the Market Structure

The market structure consists of

- Phases

- Trend

Phases

How does the market really work?

All financial markets work on the universal law of Supply and Demand.

Law of Demand– The higher the price of an item, the fewer the demand (buyers don’t want to buy at a higher price), and lower the price, higher the demand (buyers want to buy at a low price)

Law of Supply– The higher the price of an item, the higher the supply (sellers want to sell at a higher price), and lower the price, lower the supply (sellers don’t want to supply at a lower price

So prices go up to find sellers and then go down to find buyers

Let’s think from the perspective of smart money

What is smart money?

- Smart money is nothing but professional money, big hedge funds, and institution’s

- If you want to be a successful trader, you have to understand where these smart money place themselves and where their orders are

- If you don’t know this, you might get trapped by smart money

The price goes through 4 Phases

- ACCUMULATION

- UPTREND

- DISTRIBUTION

- DOWNTREND

ACCUMULATION

- Accumulation means removed from the floating supply of stock by buying

- Demand coming in to gradually overcome and absorb the supply and to support the stock at this level

How smart money do that? they buy as much of the stock as possible without significantly putting the price up against their own buying until there are few or no more shares available at the price level they have been buying at

Accumulation generally takes place within a well-defined congestion area, where the stock appears to have no interest in either moving up or moving down. The smart money ensures that the stock is contained below a certain upper level which is the supply area. At the same time, the smart money also supports the prices above a certain lower line, which is the support area.

How does trend change?

- Stopping action(stopping the downtrend)

- Change of character(strength of trend change from bearish to bullish)

- Testing of supply(testing supply whether present or not)

- Mark up(if no supply is found in testing action )

We will discuss this in depth in later sections. There are many other patterns that signify accumulation. Some of them are

- rounding bottoms,

- reverse head and shoulder

- double bottoms patterns

- triple bottom pattern

UPTREND

Once the supply observes by smart money. When general market conditions appear favorable, Smart Money can then mark up the price of the stock at some point in the future.

First, the market breaks out from the end of the accumulation phase, moving steadily higher with average volume. There is no rush as the insiders have bought at wholesale prices and now want to maximize profits by building bullish momentum slowly, as the bulk of the distribution phase will be done at the top of the trend, and at the highest prices possible. Again, given the chance, we would do the same.

DISTRIBUTION

Smart money will take advantage of the higher prices obtained in the rally to take profits by beginning to sell the stock back to the uninformed traders/investors.

Opposite of the accumulation process

DOWNTREND

Once the distribution completed. the Smart Money can then mark down the price of the stock At some time in the future. Let’s combine all phase

So, let’s try to put the above phases with nifty 50

This is all the smart money is doing, they are simply playing on the emotions of the markets which are driven by just two. Fear and greed. That’s it. Create enough fear and people will sell. Create enough greed and people will buy. It’s all very simple and logical

This cycle of accumulation and distribution is then repeated endlessly, and across all the time frames. Some may be major moves, and others minor, but they happen every day and in every market

Trends:

Let us first understand what is a trend. In a healthy bull trend, the upswing generally exceeds the downswing in length and makes a higher high and higher low, the reverse is true for the bear market.

WHY Trend Analysis for Trading?

- Trading against the trend, without a trend, or poor quality trends are one of the most common reasons traders fail.

- The quality or strong trends have more predictable success (edge)

- Controlled arrangement of price bars and pullbacks provide greater certainty that reverses at supply and demand happen

- Poor or weak trends have lower predictability

- An uncontrolled arrangement of price bars and pullbacks into supply and demand lessens the chances of a reversal.

Determining the market trend

According to Dow Theory, the market has three trends

Primary trend: In Dow Theory, the primary trend is also considered as a major trend in the market. It has a long-term impact

Secondary trend: Dow calls a correction in the primary trend as a secondary trend. In a bullish market, the secondary trend will be a downward movement and in a bearish market, it will be a rally.

SHORT TERM trend: The Minor Trend is a corrective move within the secondary trend

Which time frame trend is best?

- It depends on what time frame you are looking at.

- Larger Timeframes establish and dominate the trend.

- If we are looking at the daily time frame and the price is making higher highs and higher lows, we are in the bull market.

- But if we are looking at a retracement of that bull move in 30 minutes time frame we might be a short-term bear market even though overall market is bullish.

Let’s do an example

The Ultimate objective of technical analysis is to find the location of trend and trade according to the trend

Some of the tools that are used for technical analysis are

- Swing(the building block of trend)

- Support and resistance

- supply and demand zone

- trend line

- pattern

- gaps

- volume

- open interest

- signal candle for entry

Please watch the following video to better understand the Market Structure in Trading concept.

In the next article, I will discuss Market Structure Through Swing. Here, in this article, I try to explain Market Structure in technical Analysis. I hope you enjoy this Market Structure in the technical Analysis article. Please join my Telegram Channel and YouTube Channel as well as my Facebook Group to learn more and clear your doubts.

Registration Open – Mastering Design Patterns, Principles, and Architectures using .NET

Session Time: 6:30 AM – 08:00 AM IST

Advance your career with our expert-led, hands-on live training program. Get complete course details, the syllabus, and Zoom credentials for demo sessions via the links below.

- View Course Details & Get Demo Credentials

- Registration Form

- Join Telegram Group

- Join WhatsApp Group

Very nice 👌👌 explain ed

Thanks

Good book I would love to have it

Just wow

In Mapping out maket structure, if Market breaks the protected low in a downtrend and immediatly enters back, should we consider it as a CHOCH or should we continue with the uptrend until a full candle with it’s high and low clear below the low to confirm a proper change of character?