Back to: Trading with Smart Money

How to Predict Market Trends with Candlestick and Volume Analysis

By Pranaya Rout | June 8, 2025

In this post, I will explain how to predict market trends using candlesticks and Volume Analysis for successful trading outcomes. Imagine being able to predict market moves before they happen. Sounds powerful, right? In today’s guide, I will show you exactly how to predict market trends using the perfect combination of candlestick patterns and volume analysis. These two tools, when combined, can help you spot market reversals, confirm breakouts, and avoid false signals.

Table of Contents

- Introduction

- The Importance of Predicting Market Trends

- Understanding Candlestick Patterns

- Role of Volume in Market Analysis

- How Candlestick and Volume Analysis Work Together

- Key Candlestick Patterns for Trend Prediction

- Bullish Engulfing

- Bearish Engulfing

- Hammer

- Shooting Star

- Doji

- Volume Analysis Techniques for Market Trends

- Volume Spikes at Key Levels

- Low Volume Pullbacks

- Climax Volume for Reversals

- Combining Candlestick and Volume Analysis for Accurate Predictions

- Common Mistakes and How to Avoid Them

- Pro Tips for Better Market Trend Predictions

- Conclusion

- FAQs

By mastering these techniques, you’ll spot trend reversals, breakouts, and continuations before the crowd.

The Importance of Predicting Market Trends

Predicting market trends allows traders to:

- Enter trades early in a trend for maximum profits.

- Avoid false breakouts and market traps.

- Set better stop-losses and profit targets.

Why Combine Candlestick and Volume Analysis?

Candlesticks show us who’s in control, buyers or sellers. But here’s the catch: Candlesticks alone don’t tell us how strong the move is. Volume analysis fills this gap by revealing the underlying strength behind price movements.

✔️Candlesticks = Market Sentiment

✔️Volume = Strength Behind Moves

✔️Together = High-Accuracy Predictions

Think of it like this: Candlesticks are the words, and volume is the tone of the market’s language. You need both for a complete story.

Understanding Key Candlestick Patterns

Before we combine them, let’s quickly cover the most powerful candlestick patterns that signal market trends.

Candlestick patterns tell the story of price action during a given period. They reflect trader psychology and highlight key moments like reversals, breakouts, and continuations.

Why Candlesticks Matter in Trend Prediction:

- Bullish patterns indicate strong buying pressure.

- Bearish patterns signal rising selling pressure.

- Indecision patterns (like Doji) hint at potential reversals.

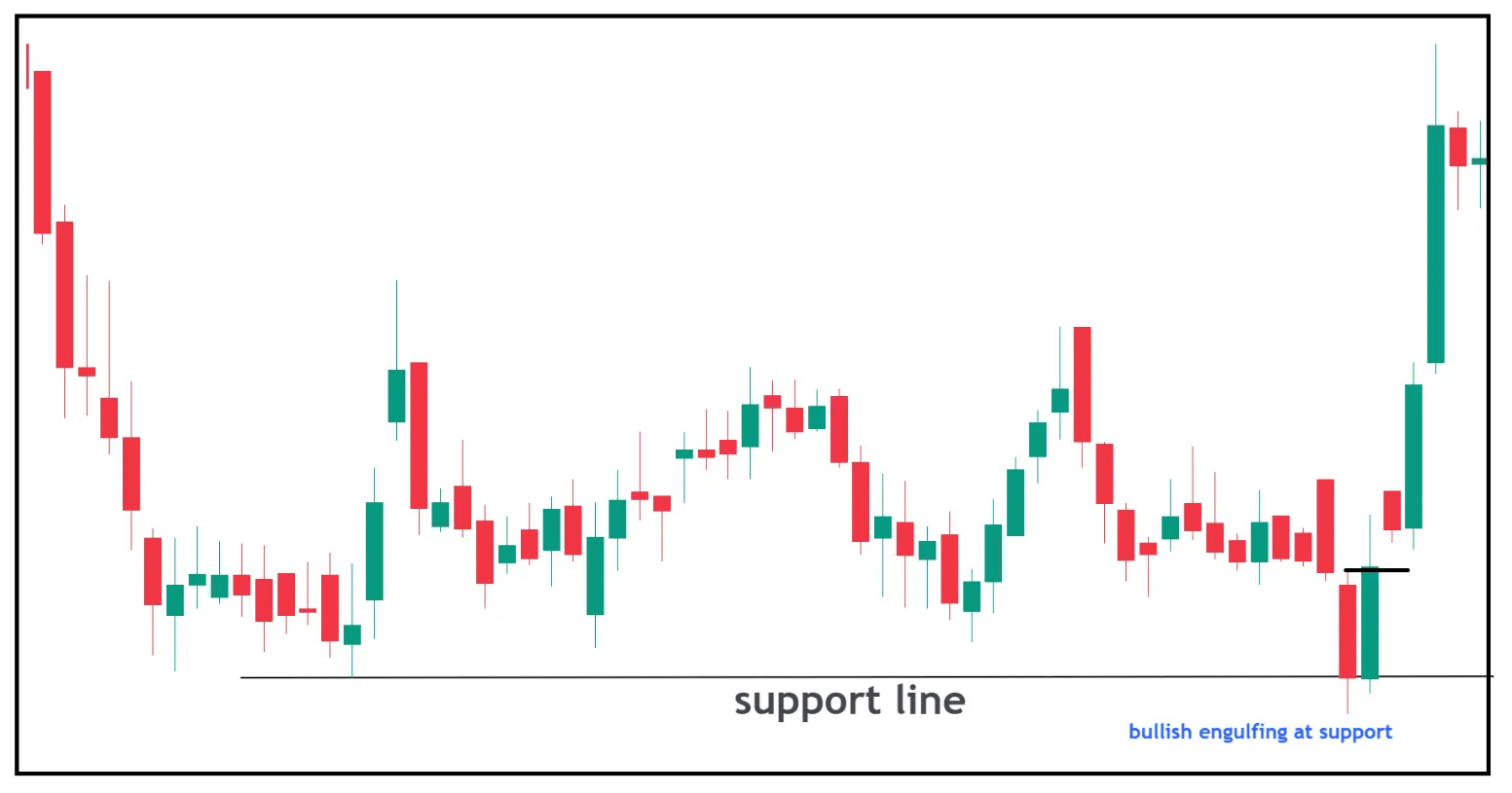

1. Bullish Engulfing (Reversal Signal)

Structure: The 2nd candle closes above the first candle’s high (bullish engulfing pattern). Wide reversal candle pattern

Meaning: Buyers overwhelm sellers; a large green candle engulfs the previous red candle. It shows institutional buying. It signals a shift from bearish to bullish sentiment, indicating a potential reversal of the pullback or from the supply-demand zone or key level.

Volume Confirmation: High volume on the engulfing candle confirms strong buyer interest. The second candle should be accompanied by high volume, or volume expansion should be visible in any candle. Sudden volume spike confirms the buyer’s interest from a lower level

Trading Strategy:

-

- Entry: Above the engulfing candle’s high.

- Stop-loss: Below the engulfing candles low.

Confirmation: FOLLOWTHROUGH CANDLE

Trading Tip:

Powerful when appearing at key levels with volume confirmation

Pro Tip: If volume is lower, avoid the trade, smart money isn’t involved!

2. Bearish Engulfing (Reversal Signal)

A large red candle engulfs the previous green candle, indicating that sellers have taken control—a strong bearish reversal signal at the resistance level.

- Meaning: Sellers take control—bearish reversal.

- Best Location: At resistance zones or after an uptrend.

- Volume Confirmation: High volume confirms the bearish reversal.

3. Hammer & Shooting Star (Trend Reversal Clues)

Structure: Small body(colour doesn’t matter), long lower wick double the body, little or no upper wick. The candle range should be wider.

Meaning: A small body with a long lower wick showing rejection of lower prices or which shows rejection of a price level. The hammer pattern reflects a shift in momentum from sellers to buyers, signaling a potential bullish reversal at the end of a downtrend, during a pullback in an uptrend, or at a demand zone. Pin bars with long wicks at key levels indicate price manipulation. The long wick indicates that smart money is testing liquidity before pushing the price in the other direction.

- ✅Rejection of Price Levels → Smart money stepping in.

- ✅Trend Reversal Signal → Strong rejection leads to the market turning.

- ✅False Breakout Warning → Price trapped traders before reversing.

Volume Tip: Higher volume boosts reliability.

Trading Strategy:

-

- Entry: Above the hammer’s high.

- Stop-loss: Below the hammer’s low.

Confirmation: high volume, at key level, or follow-through candle

A pin bar tells you that the market tried to move in one direction but failed, leaving a footprint of rejection—a powerful clue for reversal trades.”

4. Doji Candles (Indecision Signal)

A Doji represents indecision in the market. Combined with volume, it can indicate potential reversals, especially after a strong trend.

Meaning: Market indecision—potential reversal if confirmed by volume and trend context.

Volume Tip: High volume following a Doji indicates a strong directional move is coming.

Marubozu Candlestick

A Marubozu candlestick pattern is a single-candle formation in technical analysis that signifies strong market momentum.

- Bullish Marubozu

- Structure: Opens at the low and closes at the high of the session.

- Appearance: Typically displayed as a green or white candle.

- Implication: Indicates strong buying pressure; often suggests a continuation of an uptrend or a potential reversal from a downtrend.

- Bearish Marubozu

- Structure: Opens at the high and closes at the low of the session.

- Appearance: Typically displayed as a red or black candle.

- Implication: Indicates strong selling pressure; often suggests a continuation of a downtrend or a potential reversal from an uptrend.

Trading Strategies Using Marubozu

- Trend Confirmation: A Marubozu appearing in the direction of the prevailing trend can confirm its strength.

- Reversal Signals: When a Marubozu appears after a prolonged trend, it may signal a potential reversal.

- Volume Analysis: High trading volume accompanying a Marubozu enhances the reliability of the signal.

Volume Analysis Basics

Now, let’s break down how volume works and why it’s essential.

1. Volume Analysis Techniques for Market Trends

Volume confirms price direction. High volume means the market has conviction. Low volume? Expect indecision or false breakouts.

✔️Rising Price + Rising Volume = Strong Trend

✔️Rising Price + Falling Volume = Weak Trend (Possible Reversal)

✔️Falling Price + Rising Volume = Strong Downtrend

✔️Falling Price + Falling Volume = Weak Downtrend

2. Volume Spikes at Key Levels

Scenario: High volume near support or resistance = potential breakout or reversal.

Pro Tip: Confirm direction with candlestick patterns.

3. Low Volume Pullbacks

Scenario: In an uptrend, low-volume pullbacks suggest trend continuation.

Pro Tip: Look for bullish reversal candles at pullback lows.

4. Climax Volume for Reversals

Extreme volume after a prolonged trend may indicate trend exhaustion.

Pro Tip: Combine with patterns like Doji or Shooting Star for confirmation.

Combining Candlestick Patterns with Volume

Now comes the real magic—combining candlesticks with volume for accurate trend predictions.

When candlestick patterns and volume behaviour align, they create high-probability trade setups.

Example:

- Bullish Engulfing + Rising Volume = Strong Uptrend

- Shooting Star + Volume Spike = Potential Reversal

Always look for volume confirmation to validate candlestick signals.

1. Breakout Confirmation

Price action identifies the breakout zone. A strong, wide-range breakout candle or engulfing candle confirms the breakout.

- Watch for a wide-range bullish candle breaking resistance.

- Volume: Must accompany the breakout for validation. Very high volume

- Entry: On the breakout candle close.

- Stop-loss: Below the breakout candle’s low.

2. Trend Continuation Setup

- Setup: Identify an uptrend characterized by higher highs and lower lows.

- Volume: Decreasing during pullbacks, increasing during rallies.

- Entry: On the formation of a bullish engulfing or hammer after the pullback to a key level.

3. Reversal Prediction Strategy

- Setup: for reversal candlestick patterns at key support/resistance levels.

- Volume: A spike in volume on a reversal candle indicates smart money shifting direction.

- Entry: On confirmation candle after the reversal pattern.

4. Extra False Breakout Detection

If a breakout candle forms with low volume, be cautious. The move might be false.”

Key Insight: “True breakouts are accompanied by volume surges.”

5. Continuation Pattern Confirmation

- For continuation patterns like flags and pennants, rising volume on breakout candles confirms trend continuation.”

- Example: Flag breakout with volume spike confirmation.

6. Exhaustion and Trend Reversal

Setup: After a long-extended trend, look for reversal candlestick patterns WITH VOLUME SPIKE

Pro Tips for Trend Prediction Success

Before we wrap up, here are a few pro tips for mastering trend predictions:

✅ “Always wait for volume confirmation before entering trades.”

✅ “Context matters—check higher time frames for trend confirmation.”

✅ “Be patient—don’t chase moves without confirmation.”

✅ “Combine volume analysis with key support/resistance levels.”

Common Mistakes and How to Avoid Them

❌Ignoring Volume Confirmation: Always align price action with volume behavior.

❌Overtrading Minor Patterns: Focus on high-quality patterns at key levels.

❌Not Considering Market Context: Patterns are more reliable within a trend or at key support and resistance levels.

❌Trading Without Risk Management: Always define risk and reward, and set stop-losses.

FAQs

How can candlestick patterns help in predicting market trends?

Candlestick patterns reveal market sentiment and price action behaviour, helping traders spot reversals, breakouts, and continuations.

Why is volume analysis important in trading?

Volume confirms the strength behind price moves. High volume during a breakout indicates smart money participation, making the move more reliable.

What are the best candlestick patterns for trend prediction?

Top patterns include the Bullish Engulfing, Bearish Engulfing, Hammer, Shooting Star, and Doji, especially when confirmed by volume analysis.

How can I effectively combine volume and candlestick analysis for more informed trading?

- Look for candlestick patterns at key levels.

- Confirm the pattern with a volume spike for strong conviction.

- Enter trades on confirmation candles with risk-managed stops.

Recap & Final Thoughts

Let’s recap today’s key lessons:

- Candlestick patterns reveal market sentiment. Volume indicates the underlying strength behind price movements.

- Combining them leads to high-probability trades. Always confirm breakouts and reversals with volume.

Mastering this combination takes time, but trust me, once you do, you’ll start predicting market moves with unbelievable accuracy.

In this article, I explain how to Predict Market Trends with Candlestick and Volume Analysis. I hope you enjoy this article and gain a better understanding of how to Predict Market Trends with Candlestick and Volume Analysis. Please join my Telegram Channel, YouTube Channel, and Facebook Group to learn more and clear your doubts.

Registration Open – Mastering Design Patterns, Principles, and Architectures using .NET

Session Time: 6:30 AM – 08:00 AM IST

Advance your career with our expert-led, hands-on live training program. Get complete course details, the syllabus, and Zoom credentials for demo sessions via the links below.

- View Course Details & Get Demo Credentials

- Registration Form

- Join Telegram Group

- Join WhatsApp Group

Analzi is good