Back to: Trading with Smart Money

5 Candlestick Patterns Every Trader Should Know

In this article, I will discuss 5 Candlestick Patterns Every Trader Should Know. Please read our previous article discussing WRB Trading Strategy.

How to Read Candlestick Pattern?

In trading, reading candlestick patterns involves recognizing specific patterns that suggest possible trends or reversals in the market. Traders can use these candlestick patterns to pinpoint trends, entry and exit points, and possible market reversals. Candlestick patterns come in a variety of forms, but the following are some of the more popular ones and their interpretations:

Important Points to Remember

- Context is essential: Depending on where it appears on the chart, a candlestick pattern has several meanings. For example, a strong candle appears at the bottom trend or resistance breakout or end of the momentum

- Support and resistance levels: typically, reversal candlestick patterns that form close to important levels of support or resistance are more reliable.

- Confirmation: Before acting on a pattern, always wait for a confirmation candle. For instance, a second bullish candle can validate a bullish pattern that emerges.

- Volume: A pattern’s significance can be confirmed by higher trading volumes that accompany it. A bullish engulfing pattern with large volume, for example, can indicate a more robust upward trend.

Candlestick Pattern 1: Bullish Reversal Patterns

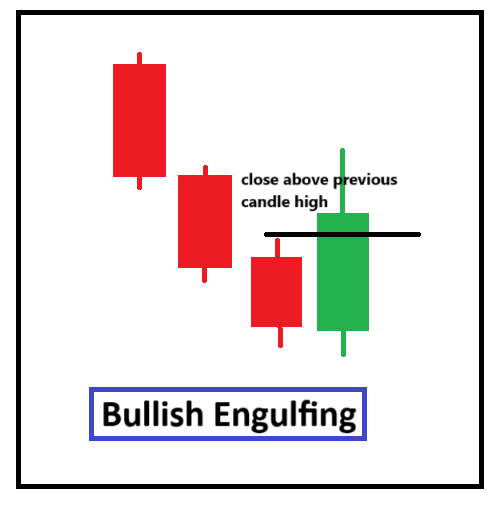

Bullish Engulfing Pattern Description: A big bullish (green) candle that fully “engulfs” the body of the previous small bearish (red) candle. A Bullish Engulfing candlestick pattern is a two-candle reversal pattern that occurs at the bottom of a downtrend or at support, indicating a possible change of momentum from bearish to bullish

The pattern consists of:

- The first candle: A small bearish candle

- The second candle: A wider bullish candle that completely engulfs the body of the first bearish candle. Bullish candle Close above bearish candle high

Logic of Buyer and Sellers:

- First Bearish Candle: The sellers remain in control, continuing the downtrend or bearish momentum. The small body indicates that the strength of selling pressure is decreasing.

- Second Candle (Bullish): Buyers step in strongly at a lower level and push the price significantly higher, overtaking the previous day’s high and engulfing the bearish candle completely. This indicates that buyers are now in full control over sellers, and buyers are dominating sellers.

Interpretation:

The Bullish Engulfing candlestick pattern reflects a shift in market sentiment from bearish to bullish:

First sellers dominate buyers and continue with the bearish momentum.

First, sellers take the lead, extending the downward trend. On the other hand, buyers become more confident at lower levels, enter the market with power, and drive prices higher, often resulting in a possible bullish reversal. The strength of the shift in momentum is proportional to the size of the bullish candle.

A bearish engulfing indicates a reversal in an uptrend, whereas a bullish engulfing points to a significant reversal in a downward trend.

Confirmation:

Volume: The bullish candle volume is Higher-than-average trading volume, and the previous candle volume strengthens the bullish reversal signal.

Next Candles: To confirm a trend reversal, traders frequently wait for a third bullish candle (which follows the engulfing pattern) or a break above significant resistance levels.

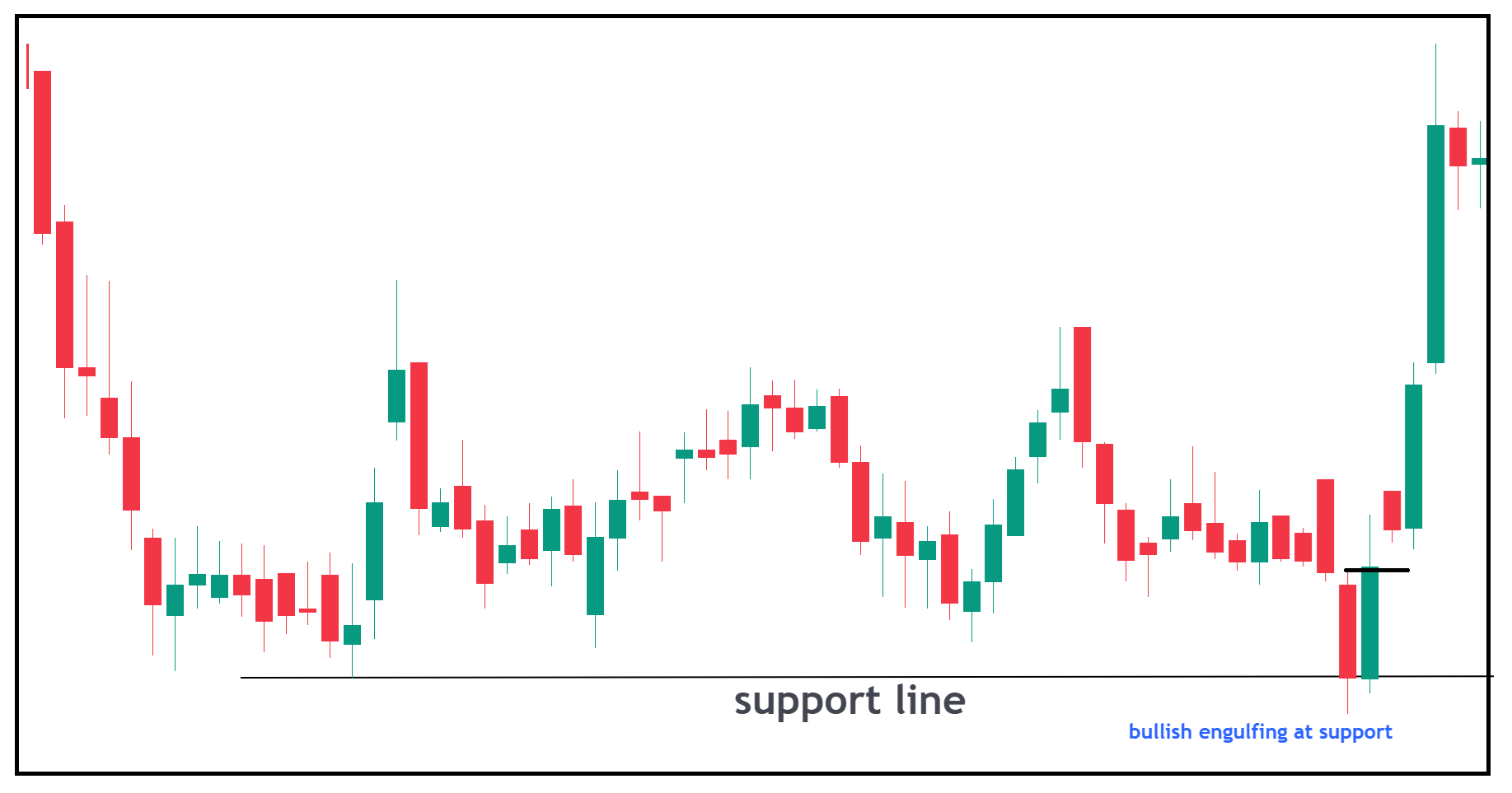

Support Zones: If the engulfing pattern forms at a strong support level or demand zone, it adds weight to the bullish sentiment.

How are we going to trade it? Breakout and reversal

1. To ensure an uptrend continuation during a bull trend, buy above the bullish Engulfing pattern.

2. To ensure a bearish continuance in a bear trend, sell below the bearish Engulfing pattern.

Identify the pattern: Look for a clear Bullish Engulfing pattern at the bottom of a downtrend or at support in an uptrend or demand zone.

Confirmation: Wait for confirmation of the reversal, such as:

- A breakout above resistance levels or volume in the engulfing pattern or price reverse from strong support or demand zone in an uptrend.

- A third bullish candle or increased buying volume.

Entry Point: After confirmation, consider entering a buy position.

Stop Loss: Place a stop loss below the low of the engulfing candle to manage risk.

Note any reversal pattern must have the wide candle and volume confirmation

Candlestick Pattern 2: Doji

Doji Candlestick Pattern Description: With long wicks, the open and close are nearly identical, forming an extremely little or non-existent body. When the opening and closing prices of an asset are nearly equal or very close, a candle with little to no real body is formed; the length of the wicks or shadows can vary, but the small body is the key characteristic.

The appearance of a Doji indicates that the market’s buyers and sellers are in a state of equilibrium, and neither has control over the price by the end of the trading session. A Doji can occur after both bullish and bearish trends, signaling potential reversals or a continuation, depending on its context.

Types of Doji Candlestick Patterns:

- Standard Doji: The opening and closing prices are nearly the same, with upper and lower shadows of varying lengths.

- Long-Legged Doji: Shows long upper and lower shadows, indicating high volatility and indecision.

- Dragonfly Doji: Has a long lower shadow and little or no upper shadow, suggesting a potential bullish reversal after a downtrend.

- Gravestone Doji: Has a long upper shadow and little or no lower shadow, indicating a possible bearish reversal after an uptrend.

The logic of Buyers and Sellers: it represents market indecision.

Buyers try to push the price higher, and sellers try to push it lower during a Doji formation. Since neither group has taken the lead by the time the period ends, the open and close prices are almost equal. The Doji may signal that buyers are losing momentum and that sellers are getting ready to step in if it appears following a significant rally.

Pattern Interpretation:

Indecision: The primary meaning of a Doji is indecision or uncertainty. The market has tested both higher and lower price levels but has closed very close to where it opened.

Possible Reversal: A doji at the top or bottom of a trend may indicate a change in direction. However, a doji cannot confirm the reversal by itself. It suggests that the present trend is losing momentum.

Continuation: In some cases, a Doji can also signify a pause in the trend, implying that the market may first consolidate before moving upward again in the same direction.

Confirmation of the Doji Pattern:

Support and Resistance Levels: A Doji near key support or resistance levels provides more reliable signals. For example, following a decline, a Doji may form close to a significant support level, indicating a possible turnaround.

Volume: A higher volume than average and the previous candle during the formation of a Doji can provide additional weight to its significance. Higher volume suggests that the indecision may lead to a strong move once the market decides the direction.

Next Candles: To confirm whether the Doji signals a reversal or continuance, traders frequently watch for the next candles. For instance, a bullish reversal is confirmed if a strong bullish candle emerges after a bullish Doji. A bearish reversal is confirmed if a strong bearish candle appears after a bearish Doji.

How to Trade the Doji Candlestick:

Identify Context: Before taking a trade based on the Doji candle , assess the overall trend (bullish or bearish) key support (in an uptrend) and resistance(in downtrend) levels, or supply and demand zone levels

Look for Confirmation: Wait for the next one or two candlesticks to confirm the Doji’s reversal or continuation with the trend. As an indication of hesitation, the Doji should not be used as the only basis for trading decisions.

Reversal Strategy:

If a Doji candle occurs at the top of an uptrend or at resistance, wait for a bearish candle for confirmation of Doji reversal and consider entering a short position below the confirmation candle.

Candlestick Pattern 3: Hammer

Description of the Hammer Candlestick Pattern: The hammer is a bullish reversal candlestick pattern that forms at the bottom of a downtrend or the support or demand zone. It has a small body (body color does not matter) near the top of the candlestick and a long lower wick at least twice the size of the candle’s body. It suggests that sellers drive the price lower, but by the close of the candle, buyers regained control and drive the price back up toward the opening price, even close above the opening price.

Characteristics of hammer candle:

- Small real body (maybe green or red).

- Long lower wick at least twice the size of the real body.

- Little or no upper wick.

Logic of Buyers and Sellers:

The Hammer pattern traps the traders who sell in the lower region of the candlestick, then when prices recover and close upper or at high, forcing them to cover their shorts. As a result, they combine produce buying pressure of short covering and new buying,

The hammer pattern reflects a shift in momentum from sellers to buyers:

- Sellers dominate early in the session, driving the price down (creating a long lower shadow).

- Buyers step in later at the lower level, absorbing the selling pressure and driving the price back up towards opening, closing near the opening price. This shows buyers are becoming stronger than sellers. The long lower wick suggests that sellers pushed the price down, but buyers regained control over sellers.

Pattern Interpretation:

A hammer pattern signals a potential bullish reversal at the end of a downtrend or during a pullback in an uptrend or at a demand zone. It suggests that the market may have found a bottom as buyers regain control.

Bullish Reversal: If the pattern appears after a prolonged downtrend, it indicates that the selling may be exhausted, and the market could start moving upwards.

Bearish Weakness: It shows that despite sellers trying to push the price lower, they were overpowered by buyers who pushed the price back up.

Confirmation:

The hammer candlestick pattern should be confirmed before taking a long trade:

- Next Candle Confirmation: Look for a bullish candlestick that closes higher than the hammer. This suggests that the buyers strength increasing.

- Volume increase: If there is a volume increase during the confirmation candle or during the hammer creation, the reversal confirmation is stronger.

- Support Levels: To increase the hammer’s reliability as a reversal signal, see if it forms close to a support zone or key level.

How to Trade the Hammer Pattern:

Look for a clear Bullish Engulfing pattern at the bottom of a downtrend or at support in an uptrend or demand zone

Entry:

- Conservative Approach: Enter the long trade after a confirmation candle closes above the hammer’s candle high. This confirms that the reversal signal is valid.

- Aggressive Approach: Enter a long position immediately after the hammer candle forms, but this approach carries more risk due to the lack of confirmation of the hammer candle.

Stop Loss:

Put a stop loss below the low of the hammer. This ensures you are protected in case the trend reversal doesn’t happen and the market keeps moving downwards.

Candlestick Pattern 4: Morning Star:

The Morning Star candlestick pattern is a bullish reversal candlestick pattern that appears at the end of a downtrend, at support or demand zones, or at the end of a pullback. It signals the possible beginning of an upward price movement. The pattern consists of three candlesticks, which suggest a shift from bearish to bullish sentiment in the market.

Pattern Description: A three-candle pattern.

- The first candle is a large bearish candle, indicating the strength of the sellers,

- followed by a small-bodied candle (either bullish or bearish), indicating market indecision, and

- then a large bullish candle. Indicate momentum shift

Logic of Buyers and Sellers:

- The first candlestick in the Morning Star pattern shows the bears in full control. This indicates that the downtrend is still intact, and bears are dominating over bulls.

- Then, the doji candle indicates a transition to a neutral/indecision market. The market reaches a point of indecision/neutral, where neither bulls nor bears are in clear control. This reflects uncertainty in the market.

- Finally, the strength of the last bullish candlestick confirms the bullishness. Buyers take over and drive the price higher, often confirming the end of the downtrend or bearish momentum. The strong bullish movement indicates that buying pressure is overcoming selling pressure, and sentiment is shifting in Favor of the bulls.

Pattern Interpretation: It suggests a reversal from a downtrend to an uptrend.

Confirmation

- The third wide, clean, bullish candle should ideally close above the midpoint of the first bearish candle and 2nd candle high.

- Volume confirmation. A spike in volume on the third bullish candle can support the validity of the reversal.

- Confirmation can come with a bullish price movement in the upcoming few sessions, such as a higher high or higher close bullish candle.

How to Trade the Morning Star Pattern

Here’s a step-by-step guide to trading the Morning Star pattern:

- Entry Point: buy above the morning star pattern. More conservative traders might wait for further confirmation.

- Stop Loss: Place the stop loss below the low of the morning star pattern to protect against a potential false reversal.

Candlestick Pattern 5: Marubozu

Pattern Description: A long, solid bullish (green or white) candle with few or no shadows (wicks) is the distinctive characteristic of a bullish marubozu candlestick pattern. The candle indicates strong buying pressure throughout the entire period because it opens at the day’s low and closes at its high.

- No Upper Shadow (Wick): When the price closes at the peak of the trading session, it indicates that buyers held control throughout the trading session

- No Lower Shadow (Wick): There was no selling pressure at the open, as evidenced by the price opening at the lowest point of the session.

Buyer and Seller Logic:

- Buyers: In a bullish Marubozu, the buyers take control right away in the trading session. Throughout the session, they raise the price without allowing the sellers an opportunity to lower it. Wicks are not present, indicating that buyers are in complete control and that the price is rising gradually with little to no resistance.

- Sellers: Throughout the session, sellers are either completely absent or incredibly weak. The absence of shadows implies that sellers were never able to put on enough pressure to push the price lower.

Pattern Interpretation:

- Continuation of an Uptrend: The Bullish Marubozu indicates that buyers are confident in pushing the price higher and that the momentum is likely to keep going if it appears within an already-existing uptrend.

- Reversal at a Support Level: The Bullish Marubozu may indicate a possible reversal if it appears to follow a downward trend and shows that buyers are entering the market with power.

Confirmation:

In an Uptrend: For confirmation of the Bullish Marubozu in an uptrend, look for continued bullish candles in next candle , with prices closing above the high of the Marubozu. if Volume increase, indicating strong buying interest.

How to Trade the Bullish Marubozu:

In an Uptrend:

- Entry Point: As soon as the market rises over the Bullish Marubozu candle’s peak, place a long trade.

- Stop Loss: Position the stop loss just below the Bullish Marubozu’s low.

In the next article, I will discuss the VWAP Trading Strategy in Detail. In this article, I explain 5 Candlestick Patterns Every Trader Should Know. I hope you enjoy this 5 Candlestick Patterns Every Trader Should Know article. Please join my Telegram Channel, YouTube Channel, and Facebook Group to learn more and clear your doubts.