Back to: Trading with Smart Money

Every Big Winner Leaves Footprints – How to Study Past Market Leaders for Future Success

Introduction: The Market Always Leaves Clues

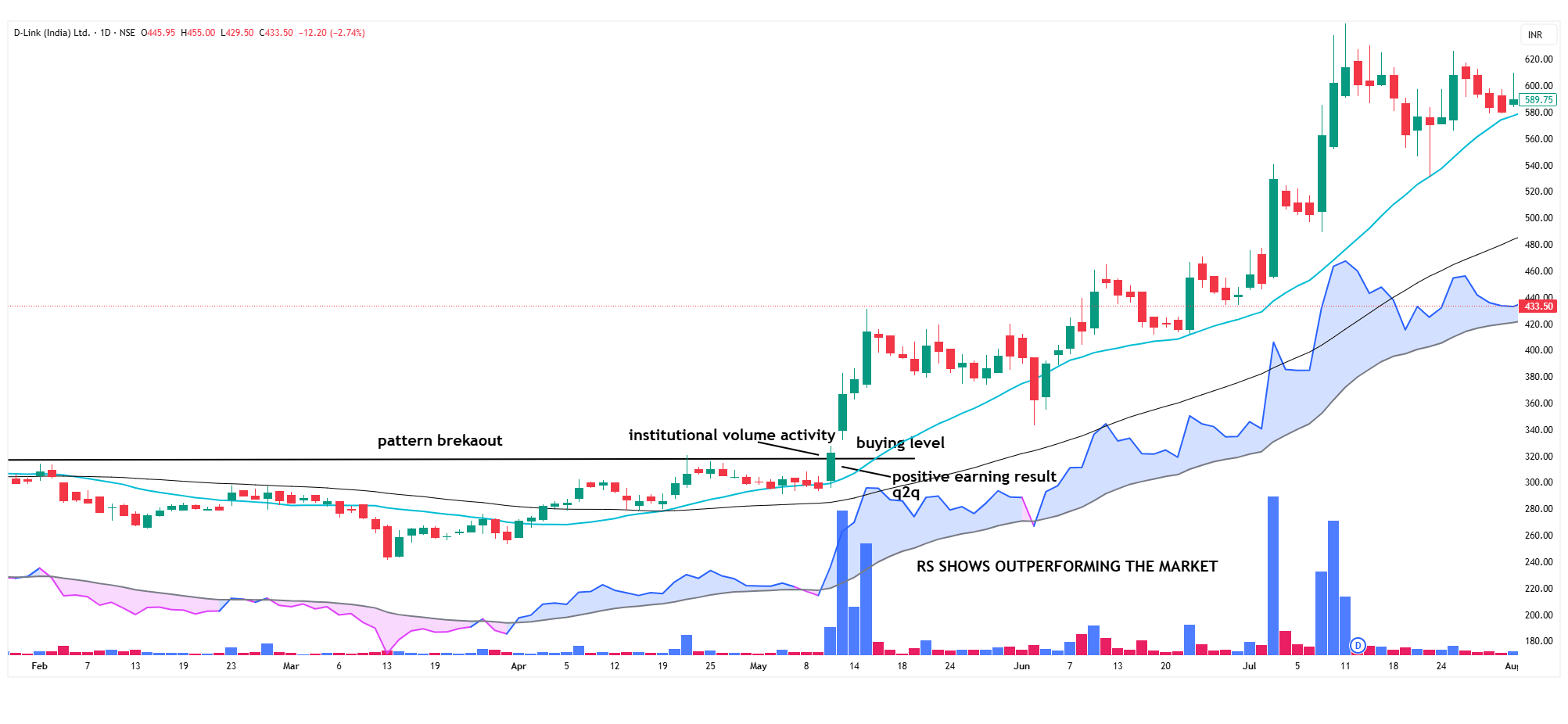

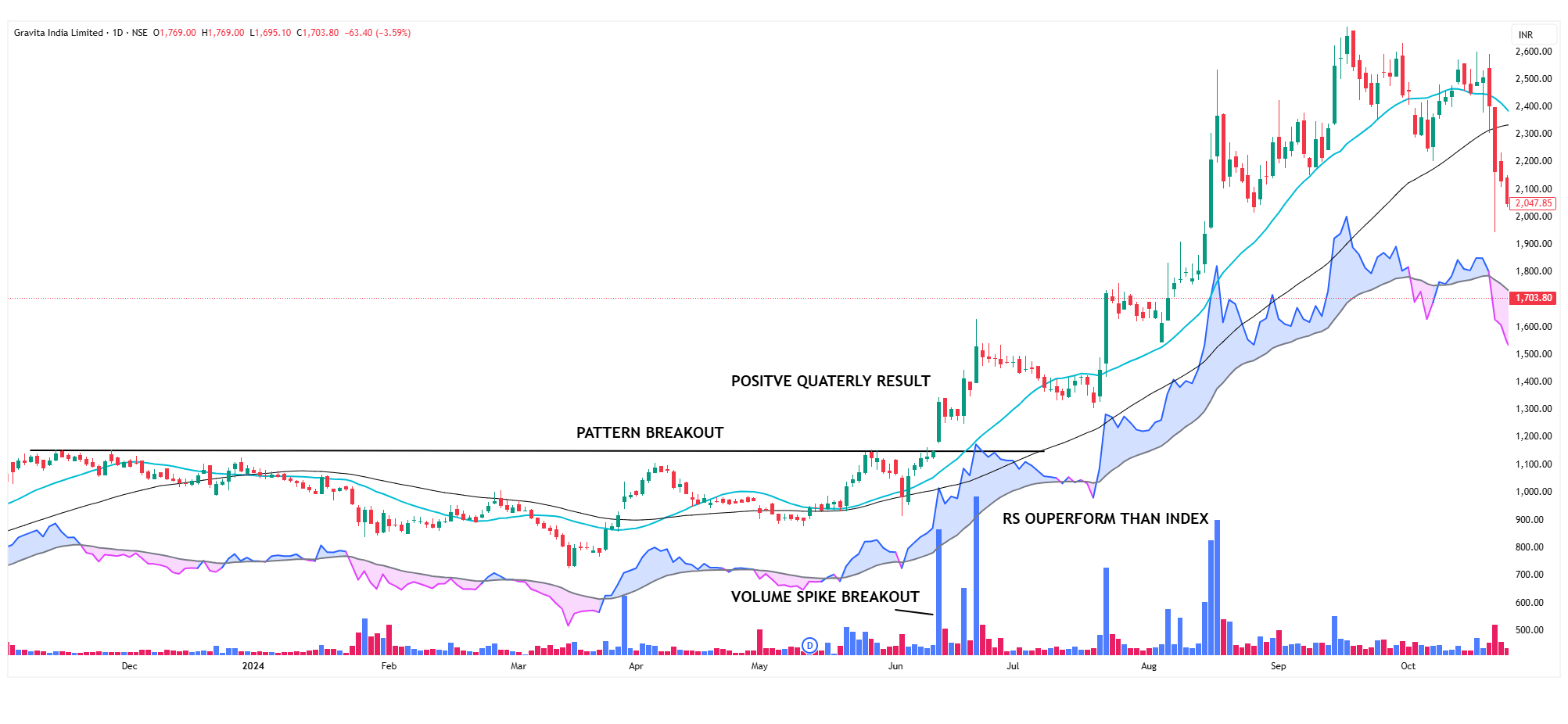

Every legendary stock move — from Infosys in the early 2000s to recent breakouts follows a familiar rhythm. If you study enough market history, you’ll realize something powerful: every big winner leaves behind footprints before its major run.

Those footprints are not random. They appear in the form of repeatable chart patterns, volume behavior, and price consolidations that signal where institutional money is flowing. Successful traders don’t predict — they recognize these recurring footprints and act with conviction.

1️⃣ Patterns Repeat — The Market Has a Memory

Just like human behavior, market behavior repeats because it’s driven by the same emotions: fear, greed, and accumulation by institutions.

When you study the charts of 100+ multibagger stocks, you’ll notice repeating formations:

- Cup and Handle

- Flat Base

- Double Bottom

- Ascending Triangle

- Stage 1 Breakouts

These aren’t coincidences. They are roadmaps left by smart money before major rallies. Each base tells a story of accumulation, shakeouts, and eventual breakout when demand overpowers supply. Your job as a trader is to read that story — not to guess it.

2️⃣ Timing Matters — Align with Index Cycles

Even the strongest stock struggles if the broader market trend is bearish. That’s why studying index timing is as crucial as studying stock patterns.

The Ideal Market Phase for Big Winners:

- Index Bottoms Out:

Nifty and sectoral indices stop making new lows. Market sentiment turns neutral from panic. - Early Stage Uptrend (Stage 2):

The index starts forming higher highs and higher lows. Stocks begin breaking out from long consolidations. - Rising Volume & Breadth Expansion:

Participation widens across sectors — you’ll see multiple stocks from themes like Defence, Power, or Semiconductors moving together. - Momentum Confirmation:

Once Nifty closes above key moving averages (21 EMA, 50 SMA) for several sessions, conviction builds — this is where real leaders emerge.

In short: Big winners rarely start in a downtrend. They start when the index quietly shifts from correction to recovery.

3️⃣ Conviction Builds from Evidence — Not Opinions

Every professional trader eventually realizes: conviction doesn’t come from opinions, tips, or Telegram channels.

It comes from evidence — seeing the same winning setups repeat over and over again.

When you’ve analyzed hundreds of past leaders:

- You start noticing that volume precedes price.

- You understand how pullbacks behave after breakouts.

- You can distinguish between healthy consolidation and distribution.

That’s when you stop guessing and start recognizing.

Your entries become more disciplined, your stops more logical, and your patience more powerful.

4️⃣ A Few Trades Can Change Your Year

In trading, you don’t need to be right all the time — you just need to catch the right ones.

Three to five exceptional trades a year — well-timed, high-conviction, and properly sized — can define your entire performance.

But the secret is: those “exceptional” trades never look magical at the start.

They emerge from boring, repeatable setups that most traders overlook because they seem “too slow.”

That’s why studying past big winners is so valuable — you train your eyes to spot the early stages of greatness.

How to Practice: Build Your Own Chart Library

Every serious trader should have a personal chart library — a visual database of past market winners.

Here’s how to build and use it:

- Collect Historical Charts

Download weekly and daily charts of India’s top performers (like Dixon Tech, IRCTC, RVNL, or Tata Elxsi during their breakout phases). - Mark the Key Phases

Highlight areas of base formation, breakout levels, and major volume spikes. - Study Context

What was the sector doing? What was the broader index trend? Was there a thematic catalyst like EV, AI, or defence? - Revisit Often

Review your chart library weekly. Over time, your brain starts recognizing patterns subconsciously.

This practice transforms you from a chart reader into a pattern recognizer — a skill that separates professionals from amateurs.

Conclusion: Learn from the Footprints of Greatness

Every great trader — from William O’Neil to Mark Minervini — built their success on one core truth: History doesn’t repeat exactly, but it rhymes.

The footprints of big winners are visible to anyone willing to study them. So start today: pick one past leader each week, analyze its journey from base to breakout, and mark the clues left behind. Because the next multibagger is already forming — and this time, you’ll recognize its footprints before the crowd does.

Key Takeaways

- The market rewards pattern recognition, not prediction.

- Big breakouts come from long, quiet consolidations.

- Conviction comes from studying evidence, not from opinions.

- Just a few powerful trades per year can redefine your portfolio.

- Build your own chart library — your personal roadmap to future winners.

Note:-

If you found the rules in this article useful, join my free webinar where I’ll teach this same system.

What you’ll get

- walkthrough of 2 setups (intraday + swing)

- How to scan leaders + sector filters (Chartink ready)

- Exact entry/stop/pyramid rules I use

- Q&A

Register here: https://forms.gle/bfwTFGBX4FAYqwLk9

For learning video can visit my YouTube channel: https://www.youtube.com/@LearnToTradeLTT

Registration Open – Angular Online Training

Session Time: 8:30 PM – 10:00 PM IST

Advance your career with our expert-led, hands-on live training program. Get complete course details, the syllabus, and Zoom credentials for demo sessions via the links below.